MUFG Establishes “Security Token Research Consortium”

MUFG today announced that, on November 6, consolidated subsidiary Mitsubishi UFJ Trust and Banking Corporation (“the Trust Bank”), together with Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (“MUMSS”), MUFG Bank, Ltd. (“MUFG Bank”), and 21 partner companies established a ST (Security Token) Research Consortium (“SRC”) with the aim of offering infrastructure that enables seamless automatic securities settlement and fund settlement, as well as the protection of investors’ rights, based on blockchain technology (“the Service”).

The Trust Bank has also applied for a patent in Japan for technology supporting the Service.

Background

As information technology advances there is an ongoing diversification in financial transaction methods, including expanded circulation of crypto-assets and the rise of ICOs*1. Meanwhile, with the aim of enhancing trust in financial functions and protecting users, Japan enacted a new law in May 2019 and is working to revise regulations related to crypto-assets and clarify the legal basis of security tokens.

In this environment, the Trust Bank has conducted research on infrastructure related to custody, clearing and escrow of digital assets, including crypto-assets, and has also applied for a patent in Japan and considering infrastructure and organizational structure for the appropriate management of security tokens.

About the ST Research Consortium

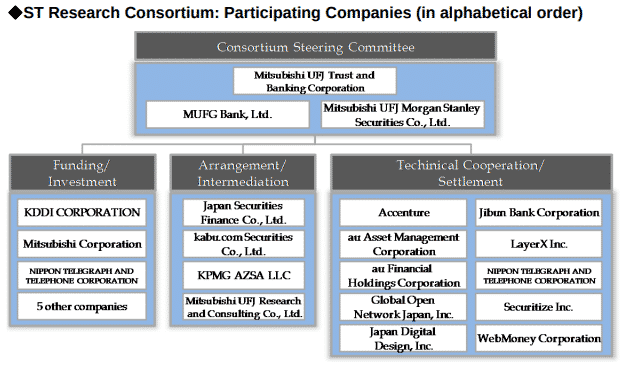

SRC was established on November 6 with the cooperation of all 21 partner companies in order to share knowledge and conduct research from the perspectives of funding/investment, arrangement/intermediation and technical cooperation/settlement studies, with the aim of rapidly introducing the Service.

The Consortium Steering Committee is managed by the Trust Bank, who provides the Service, in cooperation with MUMSS and MUFG Bank. MUMSS and MUFG Bank provide essential knowledge for the development of the Service by participating in the network as an intermediary focusing on corporations, and by considering future product composition utilizing the Service, respectively.

Overview of the Service

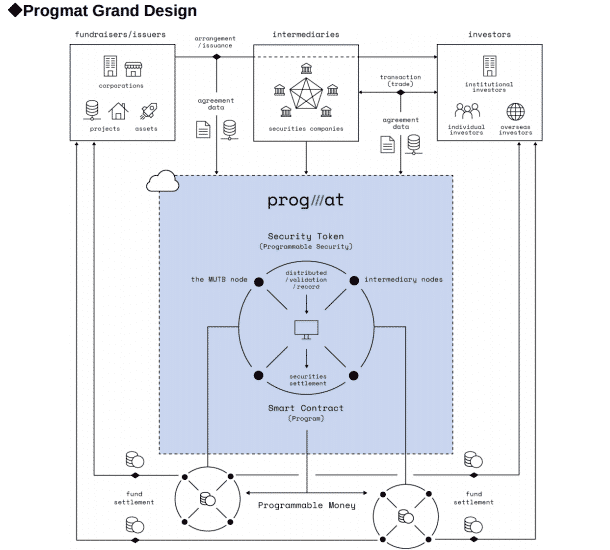

By combining security token and smart contract2 technology, as well as collaborating with external programmable money3, which is expected to be adopted in the future, the Service will enable efficient financial transactions on our program base with the aim of making it possible to do fundraising and management on one platform, managing a “variety of financial products” (bonds, securitized products, etc.) “anytime” (24 hours a day, 365 days a year), “anywhere” (accessible without an exclusive terminal), and with “anyone” (including individual retail investors and overseas investors).

Additionally, we will construct a structure that protects investors’ rights by combining blockchain infrastructure with a trust function to minimize counterparty risk, which is currently an issue for fundraising through tokenization.

Specifically, by putting the ledger information of rightsholders who have existing bonds and/or trust beneficiary securities related to underlying assets on blockchain, each time rights are transferred the information will be automatically updated, with the rights legally claimable. Information about each security will be programmed at the time of issue and fund transfers associated with interest payments and redemption will be implemented automatically. Through the exchange of tokens on different blockchains without third party mediation, the Service aims to settle funds automatically and simultaneously upon the transfer of rights to securities.

The Service is called “Progmat” and it will provide a “simple,” “speedy,” and “secure” platform that can facilitate a revolution in the financial system.

Overview of Technology Verification

While developing the Service the following technology verification processes for bond usage cases were performed between July and October 2019:

- Comparative verification of multiple blockchain infrastructures.

- Prototype development based on business process workflows such as issuance, buying/selling (transferring rights) and interest payment/redemption.

- Prototype development based on smart contracts that enables real-time settlement of securities and funds using virtual programmable money and centralized automatic processing of interest payments and redemptions.

MUFG will continue to actively utilize technology to support the resolution of various social issues.

*1 Initial Coin Offering: A general term for funding activities in fiat money and crypto-assets that issues electronic tokens.

*2 A blockchain program that automatically confirms contract terms and contract execution without the use of a third party.

*3 A blockchain fund settlement method designed to have a stable value so that it can be easily used as a settlement system.

Photo by Jezael Melgoza on Unsplash

More Articles:

Real Estate Tokenization for Dummies

Use the Blockchain and token-economics to fix privatizations