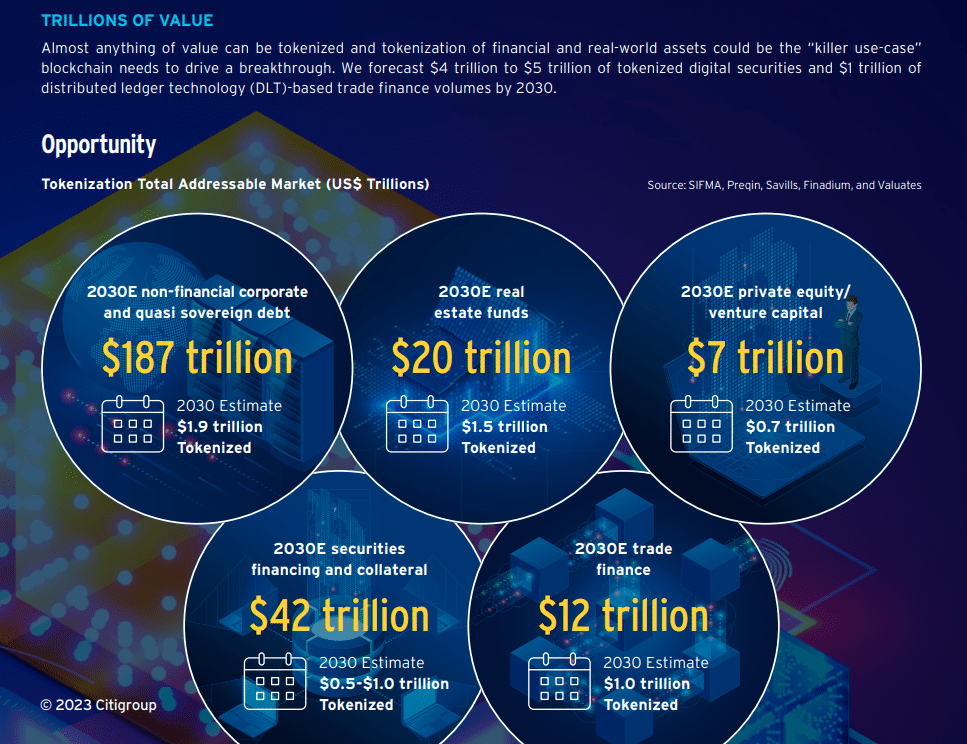

Citi expects $4 trillion in value of tokenized assets by 2030

At The Tokenizer, we get excited every time a new report confirms our own prediction of a great future for asset tokenization. And such reports have been published steadily over the past year or more by a wide range of leading consulting firms and financial institutions. The latest one just released by Citi is no exception. On the contrary, it is a comprehensive 161-page report outlining a highly promising future for asset tokenization and the token economy.

In the report Money, Tokens, and Games: Blockchain’s Next Billion Users and Trillions in Value, Citi states that:

“We believe we are approaching an inflection point, where the promised potential of blockchain will be realized and be measured in billions of users and trillions of dollars in value.”

And further, Citi sees tokenization as the main driver in the blockchain space to finally accelerate the entire industry to a critical point of mass adoption:

“Tokenization of financial and real-world assets could be the killer use case driving blockchain breakthrough with tokenization expected to grow by a factor of 80x in private markets and reach up to almost $4 trillion in value by 2030.”

Tokenized securities and security tokens

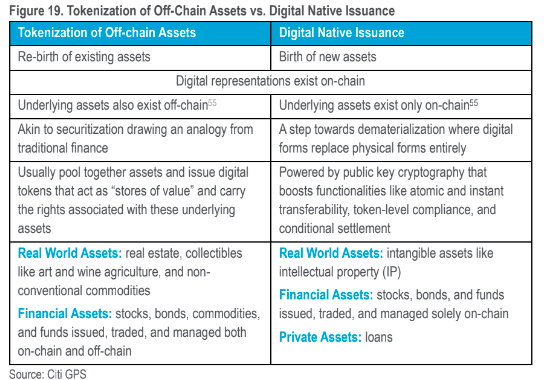

In the report, the authors distinguish between traditional securities being tokenized and security tokens, which they call native digital security tokens. Those two categories of tokens often end up in the same basket, but looking at them separately makes sense and is helpful.

In the report, the first category, ‘tokenized outstanding securities’, is described as follows:

“Refers to the immobilization of an underlying traditional security in a digital infrastructure and reissuance in a tokenized format. This is currently the most common and widespread approach. The use of DLT to record transfer of securities can improve the efficiency of existing processes as paperwork and manual processes are eliminated (subject to local regulatory requirements), while also allowing for fractionalization and use as collateral.”

Interestingly, the authors of the report believe that the second token category, the native digital security tokens, will have the most significant long-term impact:

“Native Digital Security Tokens: Refers to the process of issuing fresh securities directly onto DLT infrastructures and holding them in DLT-linked wallets. While outstanding examples remain limited for now due to regulatory constraints, this is where the largest impact is expected in the long-term.”

This time may well be different

The report’s authors are well aware that a coming boost of blockchain technology has been talked about for years with few clear signs or evidence of actual impact to be seen.

However, people in the industry know that immense work has been done over the years, and progress has been made. And regarding asset tokenization, we have seen an entirely new global industry rise since around 2018. The Citi report states:

“Those who have been promised the benefits of blockchain for many years might roll their eyes. But this time may well be different.'”

—

If you want to deep-dive into the full report, you can download it from this link: http://shorturl.at/nyQ27

Image by Sebastian Pichler from Unsplash

Read other stories: Matrixport Partners With CIAN Protocol to Enhance Institutional DeFi Offerings