Digital Asset Roadmap 2020 by the Stock Exchange of Thailand (SET) Revealed.

By Panumarch Anantachaiwanich, CEO at Flipay

SET – Stock Exchange of Thailand – just announced the roadmap for their digital asset platform in 2020. What does it mean for the Future of Capital Market?

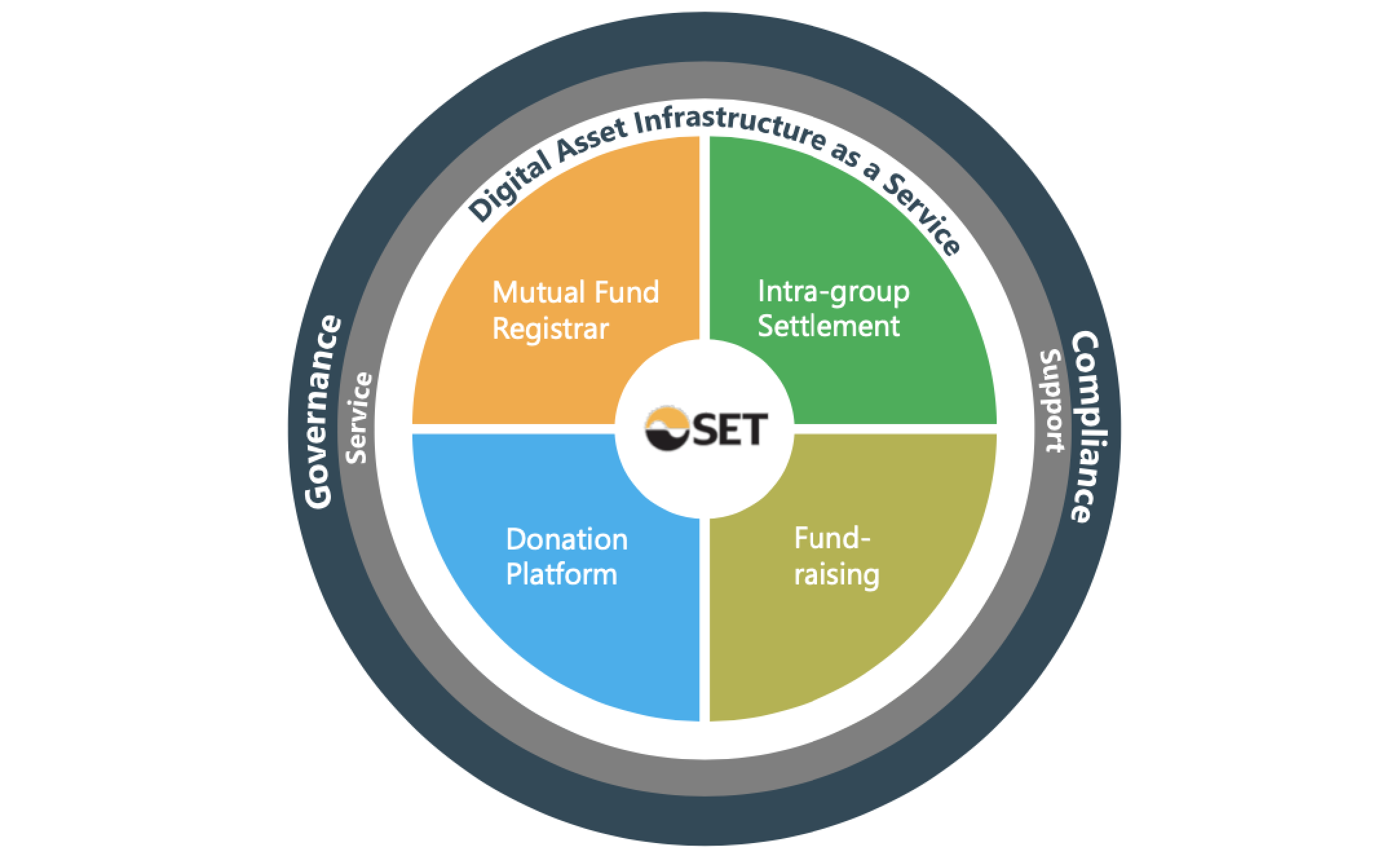

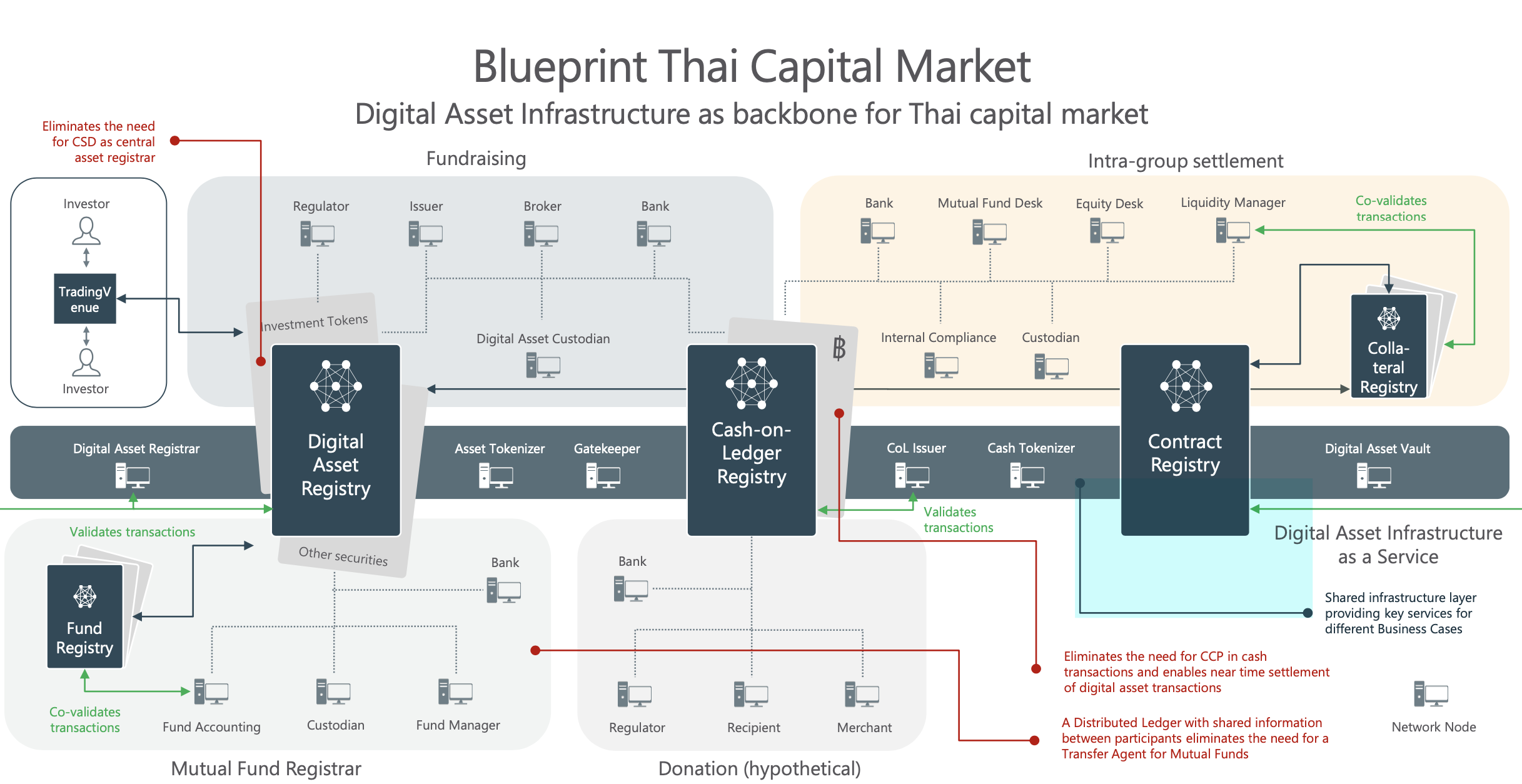

- Their primary focus is the fundraising use case, which is similar to STO (Security Token Offering). SET is working with several enterprises to understand the feasibility to be able to issue security on the platform. The platform will be able to support various products, such as digital bonds, real estate, and investment token.

- Another main focus is Digital Asset as a Service which will help a business get access to digital asset technology quickly without the high cost of building by themselves.

- The following use cases in their interest are mutual fund registrar, intra-group settlement, and donation platform.

- The key common part is Cash-on-Ledger which is a token representing stable value for settlement. It can help the stakeholder achieve the T+0 (same day) settlement or even T-instant settlement.

- The platform will no longer need the clearing parties to operate. While the brokers and custodians will get benefits with some transformation needed.

SET Digital Asset Platform

SET announced the digital asset initiative 3 months ago. And SET has been working with Blocksize Capital and CCAF (Cambridge Center of Alternative Finance) to design and build the business use cases together with the potential partners as well as regulators during their 12-week workshop.

They recently revealed the blueprint and the roadmap for their plan to bring the ideas to life.

This article is going to talk about what is in their digital asset roadmap, explore the platform benefits, and more importantly, how it will impact our businesses, especially the enterprises and the financial businesses. So… should we stay put on this DLT technology, or make a move now?

Why DLT is relevant to the capital market industry?

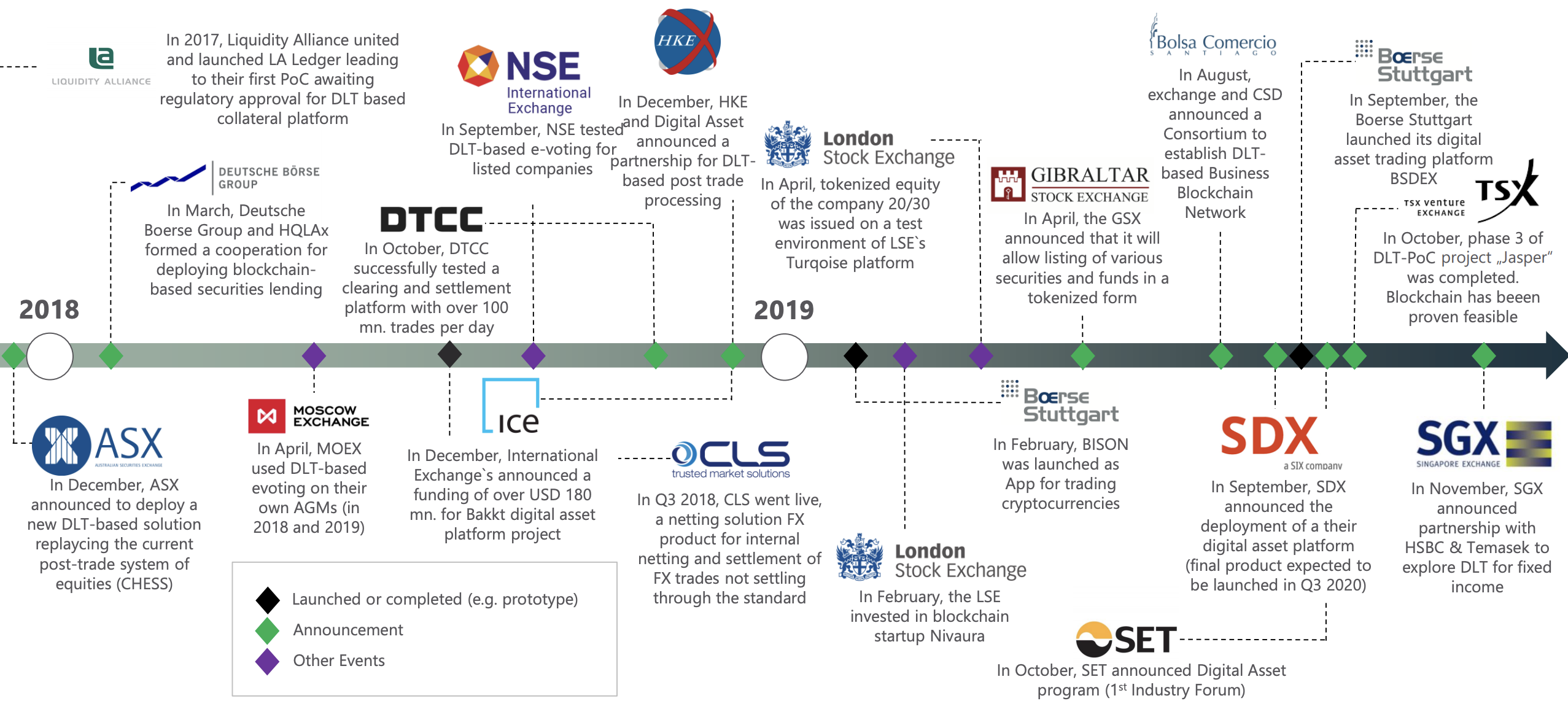

Looking from the global perspective, during the past 2 years, many exchanges started to cannibalize their own businesses with the DLT. They take several approaches to disrupt themselves, either built the new system with DLT, acquired the relevant startups, or replace some small parts with DLT.

Some commercial banks already have DLT in production. Also, some regulators, including the Bank of Thailand and European Central Bank, have started working on CBDC (Central Bank Digital Currency), which will dramatically improve the efficiency and trust of the banking industry.

Why these financial players seem to favor this DLT technology so much?

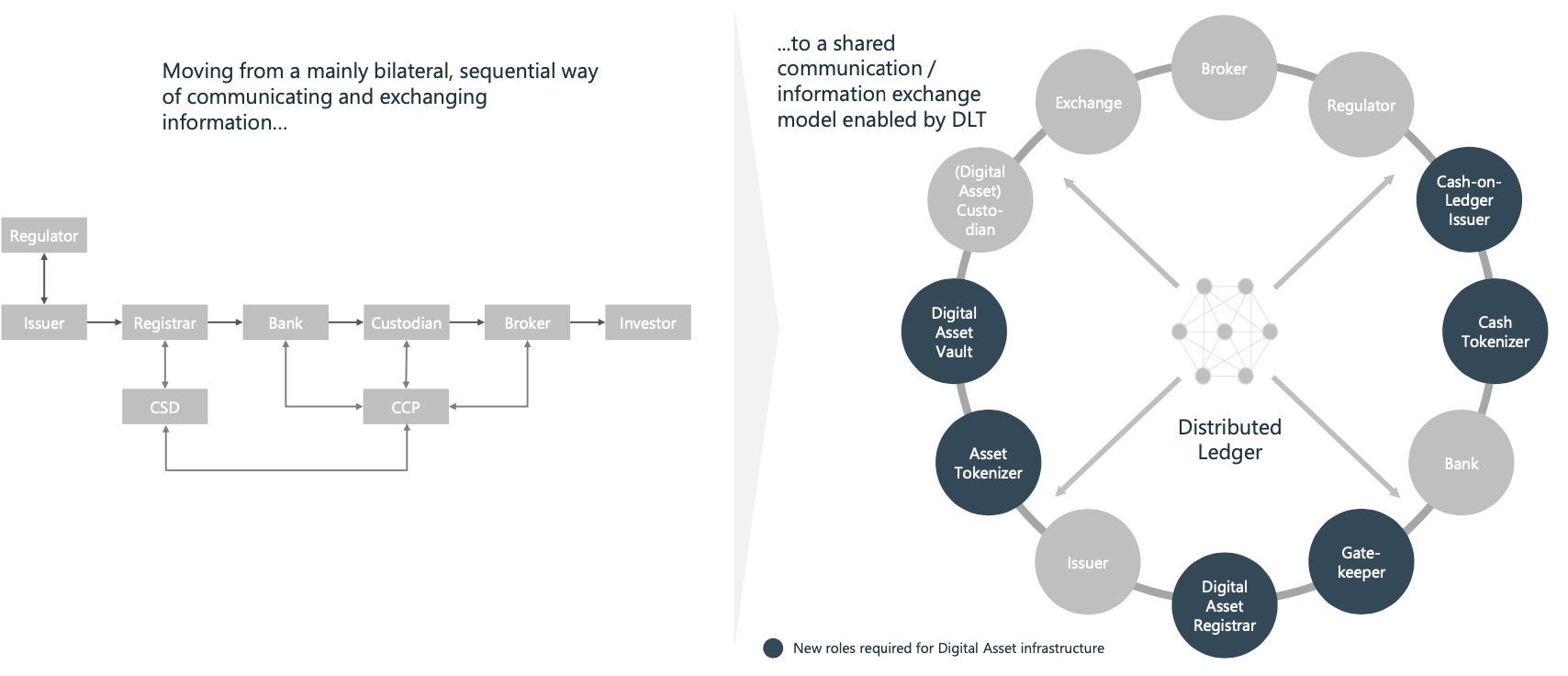

I believe there are reasons that we see such inefficiency, slowness from the big components of a financial value chain, a middle man of middlemen, the seemingly too much separation of roles in which one organization just keeps assets while the other one tells them to move the assets.

Because the whole financial market value chain was designed to mitigate risks with the collaboration of several trusted and regulated entities.

And this whole trusted scheme for mitigating risks comes with a cost. The cost to comply with the regulation, the cost of collaboration (ex. settlement), insurance, including the huge cost of human operation.

But with the coming of DLT or Blockchain, it changes the fundamental assumptions of the financial value chain. With the distributed ledger, it is possible to create trust without any single human to operate. We no longer need financial institutes to tell us how much money we have. We no longer need a costly logistic to move money.

So it brought these questions for the financial players, especially the post-trade operators in the capital markets.

- What if the DLT can provide equal or better trust in processing transactions in the value chain with the near-zero cost and time?

- How many millions or even billion dollars of the economic cost could we save from the efficiency and the new opportunities of DLT?

And these are 4 components of DLT that SET is focusing on utilizing to deliver the values.

“The application of DLT will drastically reduce transaction costs, increase process efficiency and improve compliance leading to greater financial inclusion and potentially to global competitive advantages for Thailand.” SET

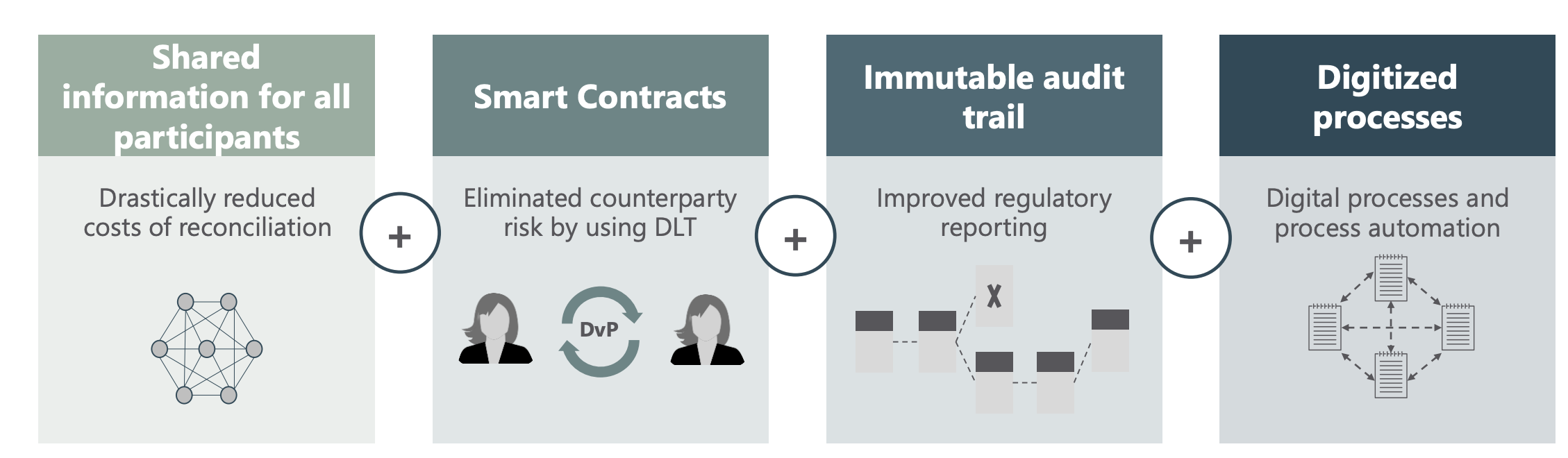

Which business use cases SET are going to build within the SET Digital Asset Platform?

As SET and the team have worked with the potential business partners for 3 months, they have identified 5 use cases that they believe to create the most values to the stakeholders and the ecosystem.

1. Mutual Fund Registrars

The back-office activities and administration of mutual funds are manual and complex. It is not just about the cost of transaction processing but also the time it takes. Hence, they are building the shared and decentralized infrastructure to streamline all the back-office processes.

2. Donation Platform

For every $1,000 donated, charities nowadays spend $100–$400 as an administration fee. Do we know how they use the fund and if the money we donate reaches the recipients?

With the SET digital asset platform, it will allow a completely transparent and fully automated tokenization and transfer of donations. Which means we can track our money from going out of our hands to the recipients. And it is also possible to see the recipients, who receive the donation in the form of digital asset token, spending the token at the drugstore.

3. Intra-group Settlement

This use case is directly targeting the problems of settlement and reconciliation securities between parties in the organization. As we know, reconciliation comes with the cost or checking and correcting. And settlement has a manual process as well as the counterparty risk.

SET digital asset platform aims to provide the common infrastructure to increase the efficiency and reduce the risk. They will need a Cash-on-Ledger to complete the picture of the solutions. The Cash-on-Ledger is typically a tokenized cash, or we can compare it with the THB stablecoin.

4. Fundraising (a.k.a. STO, Security Token Offering)

For a primary market, it is a long and manual process to issue the securities. The ownership transfer process is also cumbersome. Not mentioning the liquidity problem in the non-stock securities such as a bond, real estate, and loan.

The platform will provide the primary market for the issuance of tokenized securities (digital assets) and introduce a new settlement mechanism for digital assets.

This will be a great benefit for broad businesses to have more direct access to the alternative markets to issue the company bond, stock or assets, for example, real estate. It is possible to see the bond in the platform first.

And certainly, the issuer or business will greatly benefit from this. While clearing parties are no longer needed in this new market.

5. Digital Asset Infrastructure as a Service

This one is mentioned to provide key technical infrastructure elements such as Digital Asset Custody to internal and external stakeholders to help enable new DLT-based business models.

So it could help the partners lower the cost of developing the DLT system on their own. Also, it will make the interaction with the digital asset on the SET platform easier.

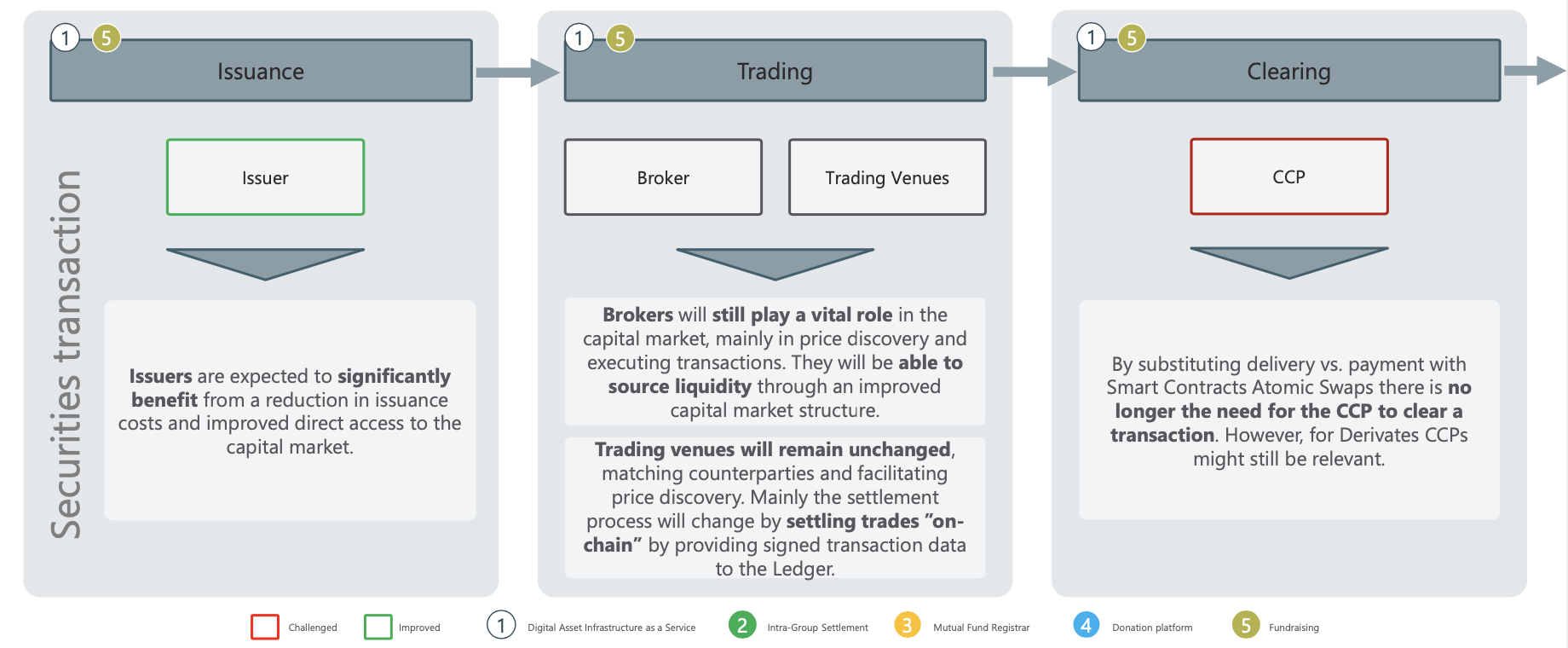

How the SET Digital Asset Platform could impact me or my business?

It is depending on which type of business are you working in right now. And some of these views may be specific to only Thailand’s market.

If you are a capital market operator

- As a broker, it is good news as long as you are open to the digital asset markets. The collaboration with the exchange will be improved through DLT, so the operation can be cheaper and faster.

- As a clearing party, the business is no longer in the new market model. That means the disruption is closed and transformation is needed.

- As a custodian, it is still needed in the new model to still ensure the benefit of asset owners. But the operation will be significantly changed. The technical knowledge is required as the way of keeping assets has changed.

- As a bank, the key impact will be around the Cash-on-Ledger (tokenized cash). The money settlement will take place on DLT more in the form of Cash-on-Ledger. So the transaction volume on bank accounts will be less. However, the banks which handle Cash-on-Ledger can benefit from more cash deposit for tokenizing.

If you are a large company

Large-scaled companies are likely to be involved first. Since they have more chances to get approved to issue new security, like a bond. Later on, it could be the case of tokenized equity fundraising for small to medium size companies.

From the new technology and new regulatory framework on STO, it should be much cheaper and easier for you to issue a security, especially something which is common in the investment market like bonds. Also, it is something that investors already understand.

And later on, there can be an opportunity for tokenizing something exciting like real estates or arts. From the news, several real estate tokenizing projects have not been taken off as the market is still too young to understand and integrate with this new technology.

If you are a technology company

This is probably a great opportunity, especially if you are focusing on blockchain technology. From the new market model above, there is a need to have technology enablers, for example,

- digital asset vault, which will provide the infrastructure to manage the private keys.

- cash tokenizer, which will provide the digital asset infrastructure to issue the Cash-on-Ledger.

Also, several new problems will arise which are certainly the opportunities for the tech company to tackle.

In case you are interested, this is the intensive blueprint for the design of the whole new ecosystem of the SET digital asset platform they designed with the partners.

If you want to learn more, you can check the full SET presentation where all of the images here come from, or can connect with SET through this email [email protected].

“Waiting for `perfect` DLT solutions could mean missing an opportunity to help shape it. To understand how DLT can address challenges in the financial sector requires both research and real-life applications and pilots.” — The World Bank

Thank you Keith Bear, Apolline Blandin, Christian Labetzsch and SET team for delivering and sharing the exciting roadmap.

Photo by Florian Wehde on Unsplash – Sunset over a night market in Bangkok

More Articles:

Digital Asset Tokens: The Potential to Revolutionize Sports Franchise Ownership

Digital Asset Fintech Company, The Bayesian Group, Launch

You Might also Like