Libra untangled: what lies behind facebook´s digital currency project — PART II

Part I of this article deals with the following topics:

- Is Libra a cryptocurrency or a stablecoin?

- Libra will compete with commercial banks and central banks not with Bitcoin

- Libra: how to make your money work for … Facebook&Co.

Part II

Libra will not solve the “unbanked” problem

The unbanked are “unbanked” because of regulations. KYC and AML compliance is so burdensome and costly that pushes poor people out of the legacy financial sector. Achieving financial inclusion by simple means of a fully regulated and centralized coin like Libra is just a fairy tale. If the regulatory and compliance barriers to entry into the legacy financial system are not lowered we will never achieve real inclusion.

Because Libra will effectively lower transaction costs in respect to traditional banking, it will achieve some higher level of financial inclusion, but it cannot solve the regulatory compliance problem which is the root of financial exclusion. This can be solved solely by building an alternative parallel financial system which is decentralized and which does not have to comply with the red tape and regulations of the legacy financial system. But Libra will never be allowed to play such a role by regulators, and it is not even remotely in their interest. Therefore “true financial inclusion” will remain the prerogative of Bitcoin and other fully decentralized privacy cryptocurrencies, but Libra can positively contribute to it by lowering banking costs.

Libra will be never fully decentralized

Libra´s aim at future decentralization will never be realized. You cannot start such a project fully centralized, with Facebook on a lead role and then empower an Association made up of 100 or so powerful corporate entities, with heavyweight business partners such as VISA, Mastercard, Paypal, Uber, etc. and achieve true decentralization. You cannot have both permissioned and permissionless states and claim to be open to everyone:

“Essential to the spirit of Libra, in both its permissioned and permissionless state, the Libra Blockchain will be open to everyone: any consumer, developer, or business can use the Libra network, build products on top of it, and add value through their services”- Quote from the whitepaper.

It will not work. There are too many “central points of failure” and “pressure joints” to which regulators and governments worldwide can apply pressure if necessary. Crucial geopolitical issues are at stake here to think that Facebook and Co. — when summoned by some authority — could hide behind Libra´s association charter and say “it´s not us…sorry, we can´t do anything for you” (more on the next paragraph).

Libra can achieve a good distribution with its nodes, but it will remain a centrally controlled corporate digital currency. It may well get quick traction, work really well as a digital currency and become a successful means of payment, but it will be no different from traditional banking as far as censorship, lack of privacy and limited financial inclusion are concerned. But it can be a great business success for Facebook & Co. if they play it smartly with governments and regulators (more on the next paragraph).

Libra is the geopolitical tool that the US government needs to strengthen the US$ reserve status for time to come.

Since holding fiat funds in cash in a bank account nowadays will end up either yielding nothing or costing some because most of the fiat currencies — in Japan, Switzerland, Euro area, Sweden, Denmark — have negative rates, the funds will have to be invested in those few government securities which still have a positive yield. And with over US$ 13 trillion bonds in negative territory, this leaves only a handful of investment-grade possibilities. If you then want to guarantee high liquidity and around a 2% yield, you are left substantially with only one option: the king US Treasury.

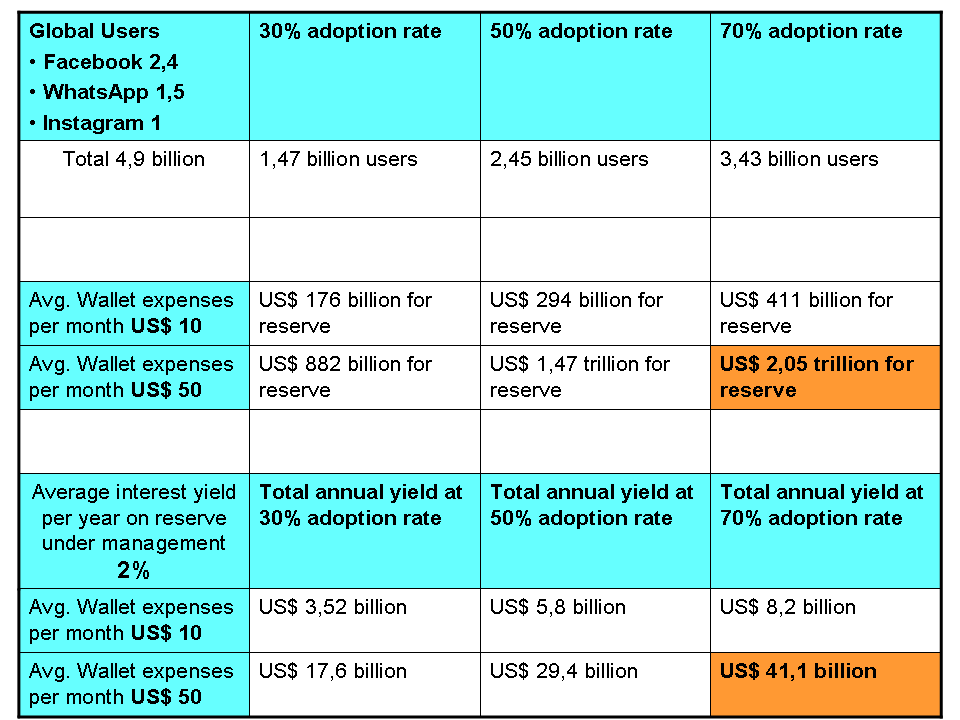

Now let´s go to Table 1 below.

The assumption is that Calibra wallet users may commit anything from US$ 176 billion to US$ 2,05 trillion to the Libra reserve fund depending on wallet adoption rates and average monthly expenses. Just consider for a moment that the current annual supply of US Treasuries is approx US$ 1 trillion. Libra could then satisfy anything from a low 17%, up to almost twice the total annual debt offer by the US government. This can become a very powerful geopolitical tool for the US government, an opportunity that they cannot lose. When large part of the world is looking for alternatives to the US$ as the global trade currency, a corporate global digital currency could be stealthily used to foster once again US geopolitical interests in those very same countries which are trying to escape them, such as in China, Russia, EU, Iran, Venezuela, Syria, Turkey etc.

Add that what Facebook wants to do, others like Google, Apple, Amazon, Uber and Twitter will also likely do, and it is pretty clear that the incentive for the US government to strike a deal “do ut des” with the above corporations is enormous. US President Trump knows how to negotiate a good deal and this is an enormously mutually convenient deal for both the US government and for Facebook and Co. The US government may grant Facebook & Co. the necessary support to smooth regulatory hurdles and bring the project to fruition. In exchange, it will get an indirect control over the use of Libra for geopolitical advantages and to foster financial colonization of the rest of the world.

The reserve will be invested mostly in US Treasuries and this will help perpetuate ad infinitum the demand for US debt and the global reserve status of the greenback. If Nixon and Kissinger did it with the Saudis in the ´70s, why Trump should not do it with Facebook, Amazon and the others?

One cannot stress enough how powerful and how strategic this mechanism can become to perpetuate US financial hegemony. And clearly, the door of the major US tech companies has always been open for the US government. Look how quickly and diligently Facebook, Twitter and Microsofts´Github implemented the sanctions by immediately shutting down the accounts of their users in affected countries.

If you agree — like I do — with economist Michael Hudson´s thesis about the ongoing de-dollarization of the world economy and the problems that this will bring to the US hegemony, then we´d better rethink. Libra might well be the antidote that the US government badly needs. And it may well succeed in reversing the course of the ongoing de-dollarization.

Just watch out for a change of tone in the Libra narrative by US politicians and this will signal that they understood and a deal can be close at hand. In the meantime, lobbyists are already at work.

Libra can help create the network infrastructure for Securities Token

Another key area in which Libra should try to leverage its portfolio of users is the opportunity to broker crypto investments via its Calibra wallet. This may open a massive market for token issuers around the world. And not only.

I have often discussed the potential for security tokens here and here. But in order to foster security token adoption, a number of external factors need to play a pivotal role such as liquidity and market makers, smooth regulation, on-chain programmability and interoperability on-chain. Another key aspect is the creation of network infrastructure for security tokens and even decentralized exchanges. As computer scientist Jesus Rodriguez points out here, only a handful of players can have a meaningful role in building up the necessary network infrastructure and one of them may well be Libra. Again, all the synergies are there. It can rapidly scale to become the largest security token network infrastructure by leveraging Facebook´s 4,9 billion potential wallet users and launching digital securities globally attracting pools of liquidity providers, investors and entrepreneurs.

Conclusions

What I have highlighted above is only a handful of factors which will likely make the Libra coin a very different animal from what the whitepaper initially describes. In 1976, F.A. Hayek — the 1974 Economics Nobel Prize winner and one of the most prominent late members of the Austrian School of Economics — wrote a pamphlet titled “Denationalisation of Money”, in which he foresaw the emergence of privately issued money which could compete among themselves and against the governments´ monopolies, which, in his words, has the defects of all monopolies as “it prevents the discovery of better methods of satisfying a need for which a monopolist has no incentive”.

True, in theory. In practice though, it takes a lot of firepowers to take on governments and challenge them on their own turf. Bitcoin was the first to successfully do it, but it could do it because its creator remained anonymous, there were no precedents to start with and governments could not fear yet an “animal” they did not know. The Bitcoin protocol was designed to be truly decentralized, open, borderless, permissionless, without a central point of attack, censorship-resistant and truly resilient. Bitcoin was never born a “sweet puppy”, it was ready to fight back from birth, it already had long teeth and claws to bite hard if challenged.

Facebook´s Libra is nothing like that. If Facebook & Co. do not cooperate governments will ban the Libra and shut it down. If they do cooperate and they find a mutually convenient agreement, then governments will let them play their digital currency game. This might create a sort of superstate made by the confluence of powerful interest of both corporations and governments. A highly corruptive power which will carry strong influence over governments worldwide.

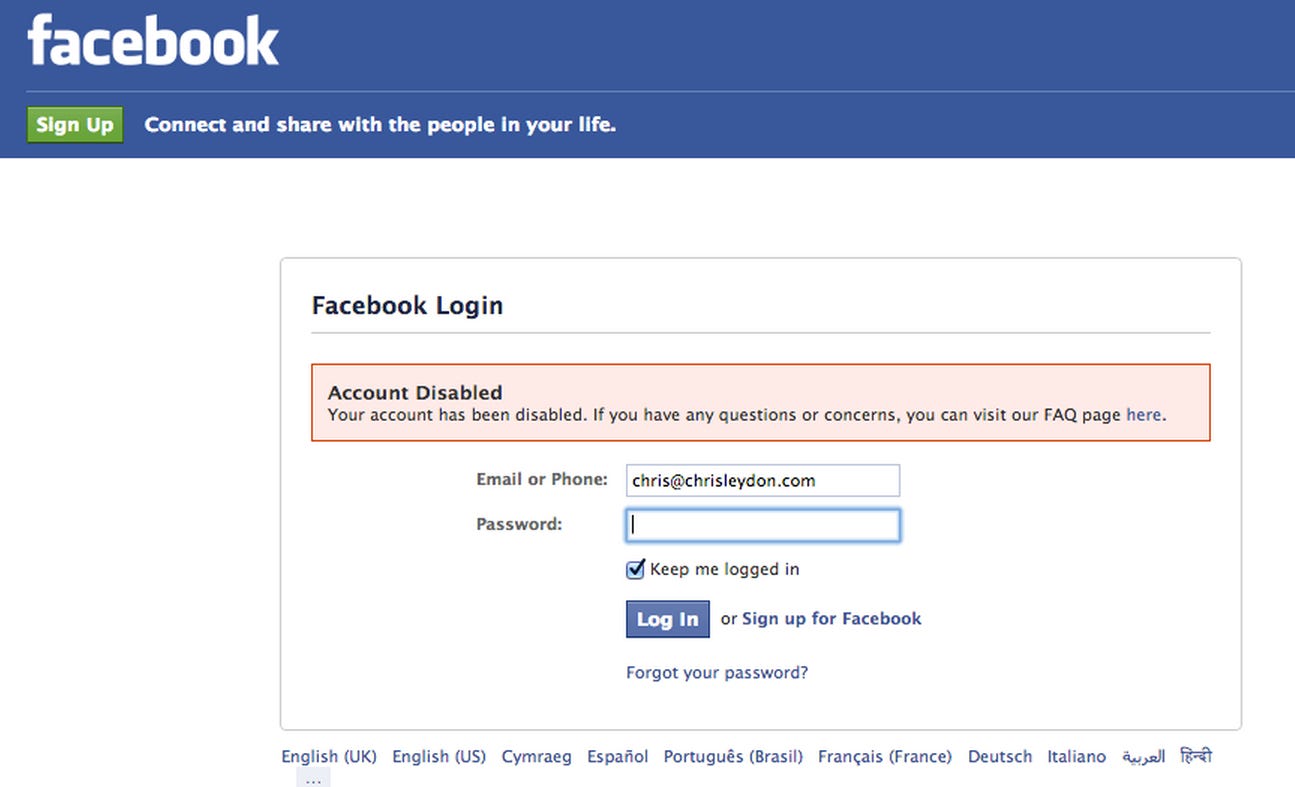

This is already apparent with the globalization. If you give global powerhouses like Facebook or Amazon — which already hold most of your personal data — control over your finances, over your spending habits and now over your money as well, they end up controlling your entire life. And if they do not approve what you do or are being told by the government to censor you, they will take it away from you. They will just shut down your account. Click … sorry … your account was disabled. please visit the FAQ page…

This is what they have repeatedly done in many instances (see above the paragraph on geopolitical issues). This will always happen until there is a central point of failure which can be attacked or put under pressure.

In this scenario, the last stand remains Bitcoin and other fully decentralized privacy projects which stand in between both state currencies and future corporate currencies like Libra. This is the only thing that still separates us from the dystopian Orwellian future which Ms Lagarde already dreams for us.

An elitist cabal of powerful global corporations and politicians may try to take totalitarian control of all the aspects of our lives. It is nothing new. It has been a recurring feature throughout history and it has been called corporatism. So far it has always been a national issue. But now, with technology advancements, digitalization and the controlled use of permissioned, centralized blockchains, it is evolving into global corporatism. A global Orwellian nightmare.

An interesting and maybe worrisome time awaits us.

Legal Disclaimer: The website and the information contained herein is for general guidance only and it does not constitute legal advice. As such, it should not be used as a substitute for consultation with lawyers on specific issues. All information in this paper is provided “as is”, with no guarantee of completeness, accuracy, timeliness or warranty of any kind, express or implied.

Investment Disclaimer: The website and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

© www.bianconiandrea.com — 2019

Photo by Alex Haney on Unsplash

You Might also Like