Libra untangled: what lies behind facebook´s digital currency project — PART I

Libra — Facebook´s digital currency project — has been a very popular talk lately. Even US President Trump tweeted about it. But few have looked at what may be the hidden implications of Facebook´s project.

Libra´s whitepaper is far from exhaustive. It is the first published version and what in the end may be left after the regulators have looked into it may be very different indeed.

All in all the whitepaper is well written and has been put together by a competent team of people, the Libra protocol describes a distributed blockchain which components are open source and can be permissionless built. It is a very “politically correct” whitepaper with mandatory and comforting statements about “banking the unbanked” and “creating an inclusive financial system for the public good”. However, if this project will go through, what we will see coming out will be very likely something different. And this for a number of powerful and compelling reasons which are not immediately apparent.

This article has been divided into two parts: Part I will analyze what Libra is, who the competitors will be and what the economic gains can be for the promoters Facebook & Co.

Part II will deal with the issue of financial inclusion, decentralization, and will analyze the likely geopolitical implications of the use of Libra´s reserve fund as well as the implications for security tokens.

Happy reading.

PART I

Is Libra a cryptocurrency or a stablecoin?

Libra has been defined by the media as a (crypto)currency and/or a stablecoin. The whitepaper correctly defines Libra as a “digital (crypto)currency”. In fact, even if it has none of the features of the classic cryptocurrency paradigm originated by Bitcoin — i.e. being a fully decentralized, trustless, open, censorship-resistant and strongly resilient system of payments — it has though the features of other cryptocurrencies such as being cryptographically secure, runs on a permissioned blockchain and it can be global and fungible, at least in theory.

The whitepaper also clarifies that Libra has two more features: stability and low inflation. Stability will be achieved by means of a reserve made up of bank deposits and government securities which backs up the digital currency. Low inflation is guaranteed by the commitment not to issue coins unless an equivalent amount of fiat funds has been deposited in the reserve. This is the first issue which comes up with Libra. It introduces the element of “trust” where otherwise the aim should be being trustless. What the whitepaper basically says is: trust us that we will not debase it and that we will keep it backed up all the time 1:1. We all know how this usually ends. It remains to be seen though which auditing mechanisms will be implemented in practice to check that the backup ratio is effectively maintained and that the digital currency is not debased.

Moreover, the widespread perception that we are dealing with a stablecoin is also misplaced. Libra is different from how classic stablecoins work.

A classic stablecoin is Tether USDT. This stablecoin has 2 features: (i) a digital coin is issued in exchange for the fiat equivalent and (ii) the fiat equivalent is kept in a reserve to back-up the digital coin. In practice, the monetary supply does not change at all since 1 unit of fiat money is subtracted from the real economy and lies unused in the reserve, while 1 unit of digital coin circulates. That is at least how a stablecoin should work and let´s leave aside for the moment the issue that even USDT seems to be 74% fractionally backed (see, yet again the issue of “trust” comes up).

Despite statements like this one in the whitepaper — Users do not need to worry about the association introducing inflation into the system or debasing the currency. For new coins to be minted, there must be a commensurate payment of fiat by resellers into the reserve — Libra seems to be differently built.

The key issue here is how the reserve — which is being created with the fiat payments made both by founding members/investors and Libra coin users — will be used. According to the whitepaper, the reserve will be a collection of low-volatility assets, including bank deposits and government securities in currencies from stable and reputable central banks.

Differently from the workings of classic stablecoins — where the reserve should remain UNUSED in cash form solely to back up its digital equivalent — here 1 unit of fiat money goes into the reserve fund and buys 1 unit of, say, treasury bond; at the same time though 1 unit of digital Libra is created and transferred to the user who will use it to buy goods and services in the real economy. The result is that the money supply is doubled: 1 fiat unit goes in and buys an investment while at the same time 1 unit of Libra is created and goes to the user who buys goods and services worth 1. This key issue was first highlighted by Alex Lipton in this interview.

Therefore, as it is conceived, Libra is an inflationary digital currency definitely not a stablecoin and far from a non-inflationary or outright deflationary store of values like gold or bitcoin. It will affect directly the monetary supply of the country in which it is spent: by introducing more money which chases the same goods this will increase price inflation and the purchasing power of the local currency will decrease. This can have important geopolitical implications which will be dealt with in Part II of this article.

Accordingly, Libra has been designed from its inception to be an inflationary digital currency to be spent rather than be held as a SOV, both because it affects the monetary supply of the country in which it is spent and because the assets that constitute the reserve are not hard assets (like gold) but financial assets based on fiat currencies which are themselves debased and inflationary.

Also, note that it is not clear how price stability will be maintained. If, for instance, there will be arbitrage to keep the intraday fluctuations of the Libra coin in line with the net asset value of the underlying investments in the reserve, basically like ETFs do.

Libra will compete with commercial banks and central banks not with Bitcoin

Libra may well succeed in totally reshaping the retail banking sector. This is where the impact can be massive. Libra can be digital banking on steroids: 4,9 billion potential customers between Facebook, Instagram and WhatsApp to start with, immediate cross-currency convertibility, global usability, minimal transaction fees, immediate payment settlement and a low to no-cost digital wallet that replaces a physical bank account and can be used to pay for a whole range of services and investments, including crypto tokens. Libra can become the largest retail bank and investment broker in the world without the need to open one single branch.

And it may also become a strong competitor for central banks around the world. By affecting local money supply and by bringing inflation in the countries in which it is spent, Libra effectively acts as a central bank. If it gains traction it may well be a better alternative to any fiat currency. Andreas Antonopoulos pointed out in a recent interview that Libra is also similar to the Special Drawing Rights issued by the IMF and which derive their value from a basket of international currencies.

Libra: how to make your money work for … Facebook&Co.

The project will be managed by a Swiss-based not-for-profit association. It is not the purpose here to examine the workings of this association but simply to focus on some important economic aspects. Just consider that being a not-for-profit organization does not mean that excess revenue (i.e. profits) cannot be legally channelled back to its members. Among the founding members of the association are large financial institutions such as Mastercard, VISA and Paypal. They will pay US$ 10 million to be among those who will drive the project and they are not usually known for doing charity work. Therefore, despite all the niceties and politically correct statements in the whitepaper, Libra is only about one thing: making money.

Few things are better than making money with someone else´s money and no risks. It´s one of the oldest jobs and it´s called banking.

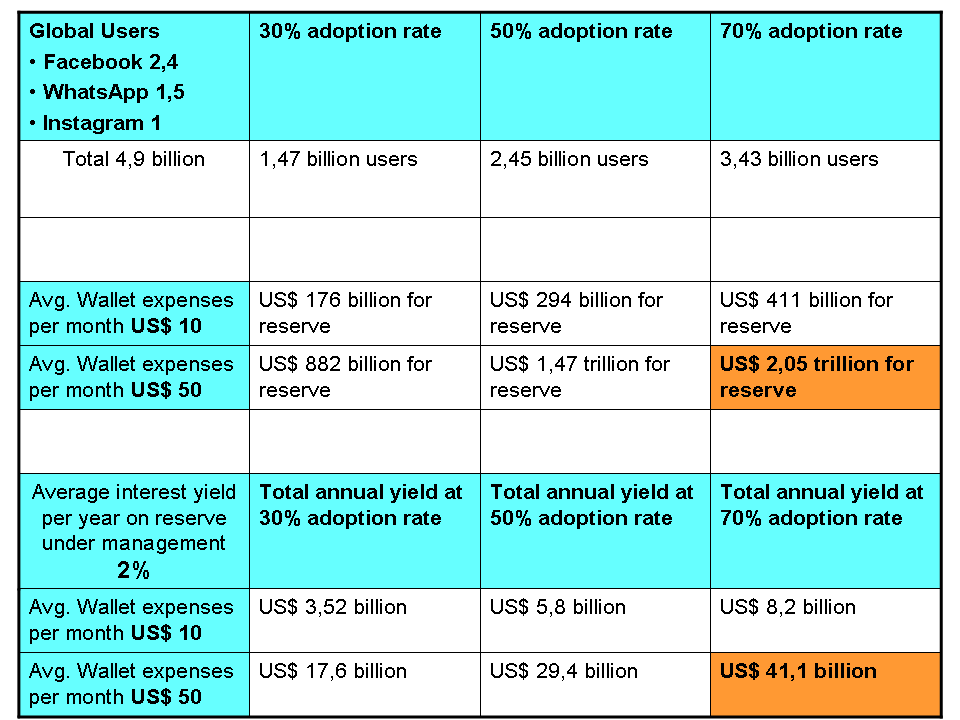

The funds invested by the founding members will go towards financing the start-up and create the initial reserve. As soon as the venture gains traction and users come on board, fiat funds will start flowing in and generate more reserves. The revenues generated by the reserve will not go to the users of the Libra coin but only to the founding members (it is not clear what type of security token they will be given in exchange for their US$ 10 million equity investment). Regardless, let’s make a simple conservative calculation. WhatsApp, Instagram, and Facebook have collectively over 4,9 billion users; now let´s assume that when the project gains traction we might have three possible scenarios which range from low (30% wallet adoption rate), medium (50% wallet adoption rate), and high (70% wallet adoption rate). This is conservative since it does not even discount the possibility that Libra might well grow beyond Facebook & Co. current users to grab a share of the global financial market. Let´s then play two additional scenarios where users can spend with their Calibra wallets anything from US$ 10 per month to US$ 50 per month, again very conservative. In Table 1 below you see the results.

Depending on the scenarios, the annual interest yield for Facebook & Co. could range from the low US$ 3,5 billion in case 30% of its users adopt the wallet and spend only US$ 10 per month, up to well over US$ 41 billion in case the adoption rate is 70% and they spend in average US$ 50 per month on their wallet.

More conservative in between figures will make Facebook & Co. salivate as well.

By adding the transaction fees which Alex Lipton, in the referred interview, has estimated in over US$ 100 billion per year, you have a very powerful business incentive for Facebook & Co. to act like good philanthropists and “unbank the unbanked”. Described in simple terms Facebook´s new business strategy is to pivot to a more profitable fee-based business model — which is called digital banking — and leverage on their 4,9 billion users to promote their own fee-based digital payment system which, by turning your fiat money into a digital coin, can yield them tens of billions without any risk. Of course, nothing new but it is brilliantly set up, smartly sold to the crowds and it will be a massive money-making machine for Facebook & Co.

Continue reading PART II of this article. In Part II the following topics are dealt with:

- Libra will not solve the “unbanked” problem

- Libra will be never fully decentralized

- Libra is the geopolitical tool that the US government needs to strengthen the US$ reserve status for time to come

- Libra can help create the network infrastructure for Securities Token

Legal Disclaimer: The website and the information contained herein is for general guidance only and it does not constitute legal advice. As such, it should not be used as a substitute for consultation with lawyers on specific issues. All information in this paper is provided “as is”, with no guarantee of completeness, accuracy, timeliness or warranty of any kind, express or implied.

Investment Disclaimer: The website and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

© www.bianconiandrea.com — 2019

You Might also Like