Introducing International Token Standardization Association (ITSA) e.V.

This is the third article in a series of four.

- Part 1 – introducing the standards

- Part 2 – Identification: International Token Identification Number (ITIN)

- Part 3 – Classification: International Token Classification (ITC)

- Part 4 – Analysis: International Token Database (TOKENBASE)

By Constantin Ketz, Philipp Sandner

Classification: International Token Classification (ITC)

Building upon ITIN as identification standard for cryptographic tokens, ITSA also provides a holistic and flexible token classification standard: the International Token Classification (ITC). As a guidance tool for the global token markets, the ITC framework has already been applied to 800 cryptographic tokens and shall provide clarity and transparency on their characteristics in various dimensions. This can be particularly helpful for regulators that need a tangible framework for the differentiation of tokens, but also for institutional investors that seek to define investment strategies. Token issuers can use the ITC framework to communicate their token’s characteristics clearly and conveniently towards investors and users. Users, once familiar with the ITC framework, should be enabled to grasp a classified token’s properties within seconds.

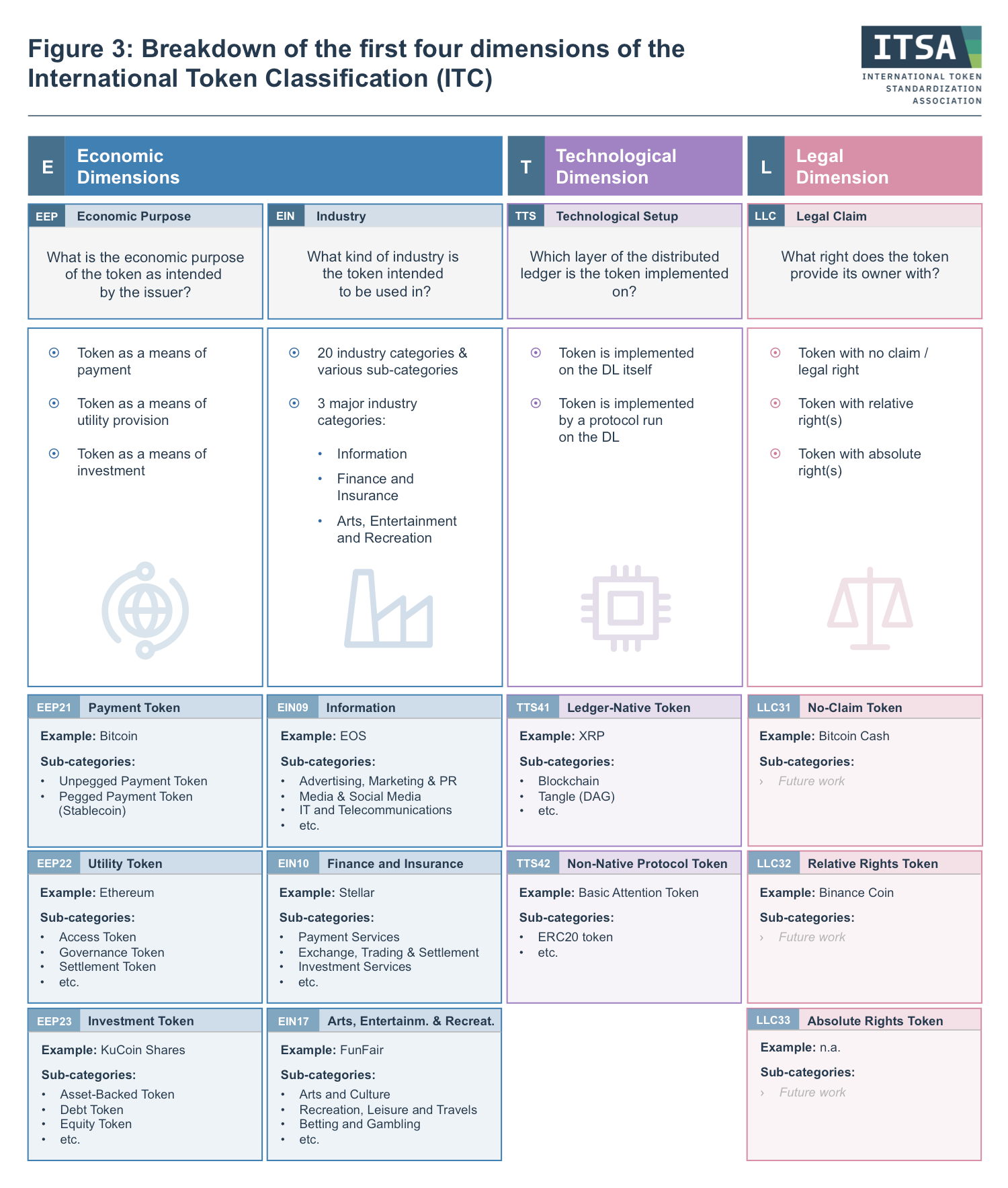

The first version of the framework (ITC v.0.9) has been developed in collaboration with independent scholars as well as industry experts under the lead of the Frankfurt School Blockchain Center (FSBC), which is an associated founding member of ITSA. Future updates will be carried out under the supervision of ITSA and its members. The ITC is based on the current research landscape and incorporates the findings of various previous classification approaches. In its first version, the ITC covers economic (E), technological (T), and legal (L) aspects of DLT- and blockchain-based cryptographic tokens in four dimensions (s. Figure 3).

Dimension 1: Economic Purpose (EEP)

The first dimension is constituted by the Economic Purpose of the token and asks for the token’s raison d’être from the issuer’s perspective. The dimension currently comprises three major categories: Payment Tokens (EEP21), Utility Tokens (EEP22) and Investment Tokens (EEP23). Payment Tokens are defined as tokens that are primarily created for the use as digital currencies that are not limited to a specific environment (e.g. a specific platform, online shop or ecosystem). As such, the ITC category Payment Token (EEP21) captures many cryptographic tokens, which are currently widely considered as cryptocurrencies (e.g. Bitcoin or XRP), yet excludes others that are perceived as cryptocurrencies by the wider public but have not been created with the sole purpose of functioning as a means of payment (e.g. Ethereum or EOS).

Due to the fact that “cryptocurrency” is a collective term for all sorts of tokens and lacks clear definition, the ITC foregoes to use it completely. The category Utility Token (EEP22) comprises all types of tokens that are created to provide any sort of utility within a predefined environment (e.g. access to services or products, transaction settlement, governance functions, or ownership management). As a consequence, the ITC category of utility tokens is very diverse and often features tokens that possess more than one utility attribute.

In these cases, the token is for now classified according to the most important characteristic (e.g. Ethereum and EOS are classified as utility settlement tokens due to their major function as means of transaction settlement within the Ethereum and EOS ecosystems). Investment Tokens (EEP23) represent cryptographic tokens that serve as means of investment to the token holder (e.g. equity, debt or derivative tokens). In current market language, most of these tokens are likely to be labelled as “security tokens”. However, in contradiction to current market practice, ITSA refrains from labelling such tokens as security tokens in this dimension, since the term is not focussing on the economic purpose of a token but on its regulatory status. Moreover, since many jurisdictions have no proper ruling yet on what is to be considered a security token, and since the ITC is designed to be applicable globally and regardless of any specific jurisdiction on which a regulatory status is always dependent, the first version of the ITC does not cover the regulatory status of cryptographic tokens at all. The idea is to add further dimensions focusing on the regulatory status of cryptographic tokens in various jurisdictions in future versions of the ITC whenever there is regulatory clarity. This approach also allows for the classification of tokens as security or non-security tokens independent of their classification according to their Economic Purpose, which is important since some regulators might not only consider Investment Tokens but also certain Utility Tokens or even Payment Tokens as securities.

Dimension 2: Industry (EIN)

The industry that a token is intended to be used in by the issuer represents the second dimension of the ITC. The dimension’s categories are rather broad and generic since they are based on the North American Industry Classification System (NAICS) for facilitated adoption and comparability. The sub-categories, however, are designed according to the characteristics of the global token economy and allow for improved differentiation between cryptographic tokens with regards to their specific fields of use. By default, Payment Tokens and Investment Tokens would be assigned for instance to the industry category Finance and Insurance (EIN10) and the respective industry sub-categories Payment Services (EIN10A) and Investment Services (EIN10D). Yet, since this allocation does not add any significant new information beyond what is already covered in the dimension Economic Purpose (EEP), Payment Tokens and Investment Tokens can also be reassigned to other industries where appropriate. This could be the case for example, where a Payment Token is intended to serve as currency in esports and thus is reassigned to the industry sub-category Entertainment and Gaming (EIN17B). Moreover, for debt and equity tokens, the industry of the company issuing debt or equity is usually considered as the industry of the token.

Dimension 3: Legal Claim (LLC)

The type of legal claim, which a cryptographic token does entitle its owner to, forms the third dimension of the ITC framework. This dimension can be regarded as a preliminary step to future ITC dimensions on the regulatory status of a cryptographic token in various jurisdictions, as the analysis of the rights, which a token provides its owner with, mostly forms part of any regulatory assessment. The dimension features three categories: No-Claim Tokens (LLC31), Relative Rights Tokens (LLC32) and Absolute Rights Tokens (LLC33). While a No-Claim Token does not entitle its owner to any other right than to the token itself, a Relative Rights Token provides certain rights against at least one natural or legal counterparty (e.g. the right to the payment of interest and principal by a third party in case of a Debt Token, or the specified right to access and use a certain platform run by a third party in case of an Access Token). An Absolute Rights Token provides its owner with a right that is not dependent on a third party but exists independently. For instance, ownership rights in intellectual property are an absolute right, which can be managed and transferred through an Absolute Rights Token. In general, most cryptographic tokens currently on the market are No-claim Tokens due to the decentralized nature of their ecosystems and the lack of a third party that a claim could be raised against. Moreover, most jurisdictions currently still do not allow for the management and transfer of absolute rights through blockchains.

Dimension 4: Technological Setup (TTS)

The Technological Setup, as fourth and currently last dimension of the ITC, describes the technological properties of a cryptographic token and asks for the level of its implementation. The ITC differentiates between two major categories: Ledger-Native Tokens (TTS41) and Non-Native Protocol Tokens (TTS42). The first category (TTS41) represents all tokens that are directly implemented on the blockchain or any other distributed ledger and hence function as an integral part of the respective ledger.

For example, Bitcoin is a native token issued on the Bitcoin blockchain. By means of sub-categories, future versions of the ITC will also distinguish between the type of ledger that the token is implemented on (e.g. blockchain, directed acyclic graph (DAG), etc.). The second category (TTS42) comprises all tokens that are not created on the ledger-level but on the protocol-level on top of an existing blockchain or distributed ledger. Here, sub-categories differentiate between the type of protocols (e.g. ERC20). For example, the Basic Attention Token is a Non-Native Protocol Token that builds on the ERC20 standard protocol. The Technological Setup of a cryptographic token is not only an interesting dimension for academics and developers, but it is also an important parameter for its risk and value assessment.

For example, Bitcoin is a native token issued on the Bitcoin blockchain. By means of sub-categories, future versions of the ITC will also distinguish between the type of ledger that the token is implemented on (e.g. blockchain, directed acyclic graph (DAG), etc.). The second category (TTS42) comprises all tokens that are not created on the ledger-level but on the protocol-level on top of an existing blockchain or distributed ledger. Here, sub-categories differentiate between the type of protocols (e.g. ERC20). For example, the Basic Attention Token is a Non-Native Protocol Token that builds on the ERC20 standard protocol. The Technological Setup of a cryptographic token is not only an interesting dimension for academics and developers, but it is also an important parameter for its risk and value assessment.

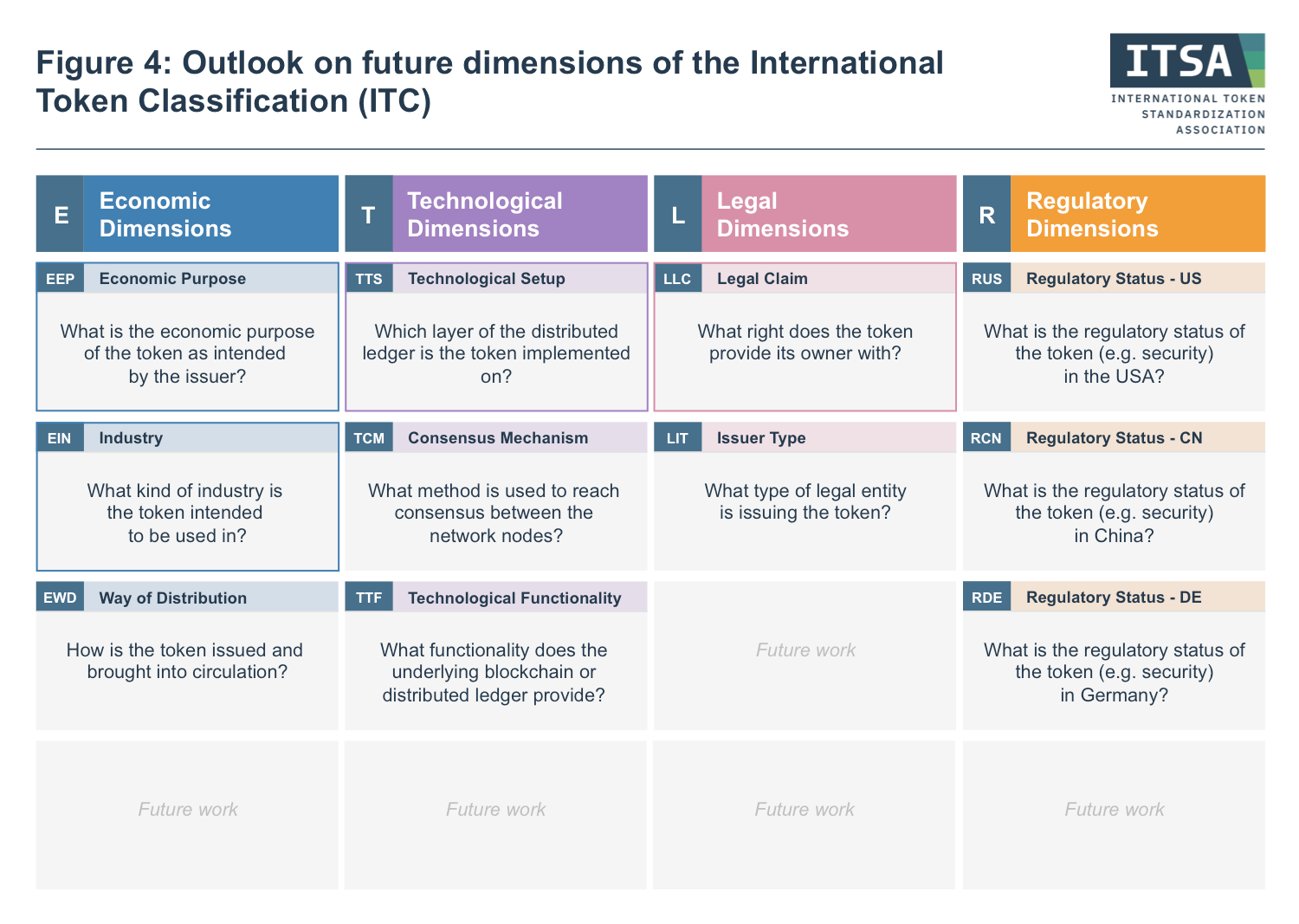

In general, the ITC framework is designed with the aim of giving clear guidance and structure while at the same time avoiding rigidity and facilitating the incorporation of future market developments. Therefore, future versions of the ITC will not only include new dimensions such as the regulatory status of a cryptographic token in different jurisdictions or the way of a token’s distribution, but will also feature new levels of detail in each dimension by adding further classes within the sub-categories. An outlook is given in Figure 4.

- Continue to read part 4 of the series – Analysis: International Token Database (TOKENBASE)

Become a member of ITSA!

If you as an individual (1) and/or your organization (2) are interested in supporting the cause of ITSA, we would be delighted to welcome you as a member. To find out more about the current projects of ITSA and our membership options, please visit us at www.itsa.global.

Furthermore, we are also looking forward to receiving your feedback and questions on ITIN, ITC and TOKENBASE under: [email protected].

Let’s develop the standards for tomorrow’s tokenized economy together!

Constantin Ketz is co-initiator and vice chairman of the International Token Standardization Association (ITSA). Next to his research on token markets and the applications of Distributed Ledger Technology (DLT) in the financial industry at the Frankfurt School Blockchain Center (FSBC), he works as a consultant for DLT and financial technology solutions with a focus on debt capital markets and asset securitization. Mr. Ketz holds a B.Sc. in Economics from the University of Mannheim as well as a Master in European Public Affairs from Maastricht University and the European Institute of Public Administration (EIPA). You can contact him via email ([email protected]) or via LinkedIn (https://www.linkedin.com/in/constantinketz).

Prof. Dr. Philipp Sandner is head of the Frankfurt School Blockchain Center (FSBC) at the Frankfurt School of Finance & Management. In 2018, he was ranked as one of the “Top 30” economists by the Frankfurter Allgemeine Zeitung (FAZ), a major newspaper in Germany. Further, he belongs to the “Top 40 under 40” — a ranking by the German business magazine Capital. The expertise of Prof. Sandner in particular includes blockchain technology, crypto assets, distributed ledger technology (DLT), Euro-on-Ledger, initial coin offerings (ICOs), security tokens (STOs), digital transformation and entrepreneurship. You can contact him via mail ([email protected]), via LinkedIn (https://www.linkedin.com/in/philippsandner/) or follow him on Twitter (@philippsandner).

Photo by Matthew Hamilton on Unsplash