Market standards for the global token economy (part 2)

Introducing International Token Standardization Association (ITSA) e.V.

This is the second article in a series of four.

- Part 1 – introducing the standards

- Part 2 – Identification: International Token Identification Number (ITIN)

- Part 3 – Classification: International Token Classification (ITC)

- Part 4 – Analysis: International Token Database (TOKENBASE)

By Constantin Ketz, Philipp Sandner

Identification: International Token Identification Number (ITIN)

Identifying or differentiating DLT- and blockchain-based cryptographic tokens may confront market players with ambiguity and uncertainty. This is often caused by coincidentally similar token names or ticker symbols, but also by intentionally created confusion as part of scams. Sometimes different tokens carry the same ticker symbol across exchanges (e.g. Bitcoin Gold and the now inactive project Bitgem, which were both using BTG). Sometimes one and the same token carries different ticker symbols across exchanges (e.g. Bitcoin, which is to be found under XBT or BTC). Sometimes a token is renamed but the old ticker symbol is kept, and sometimes a token receives a new ticker symbol while still keeping its old name (e.g. Bitcoin Cash, which was first to be found under BCC and is now listed under BCH since the nowadays inactive project BitConnect was already using BCC before). In short, dealing with cryptographic tokens, and especially trading them on different exchanges, can be a real mess. The imminent lack of transparency combined with fast market developments creates high operational risks for all parties involved.

In order to increase transparency and safety, ITSA has developed the International Token Identification Number (ITIN) as a unique identifier that is conceptually similar to the International Securities Identification Number (ISIN). Hence, an ITIN serves as a non-ambiguous means of identification for cryptographic tokens. Yet, while an ISIN is assigned to a security on request of the issuer by the respective National Numbering Agency (NNA) that may or may not charge fees for potential costs incurred, an ITIN is assigned proactively, free of charge and on global level by ITSA itself in order to provide an inclusive and holistic global market standard for the identification of cryptographic tokens.

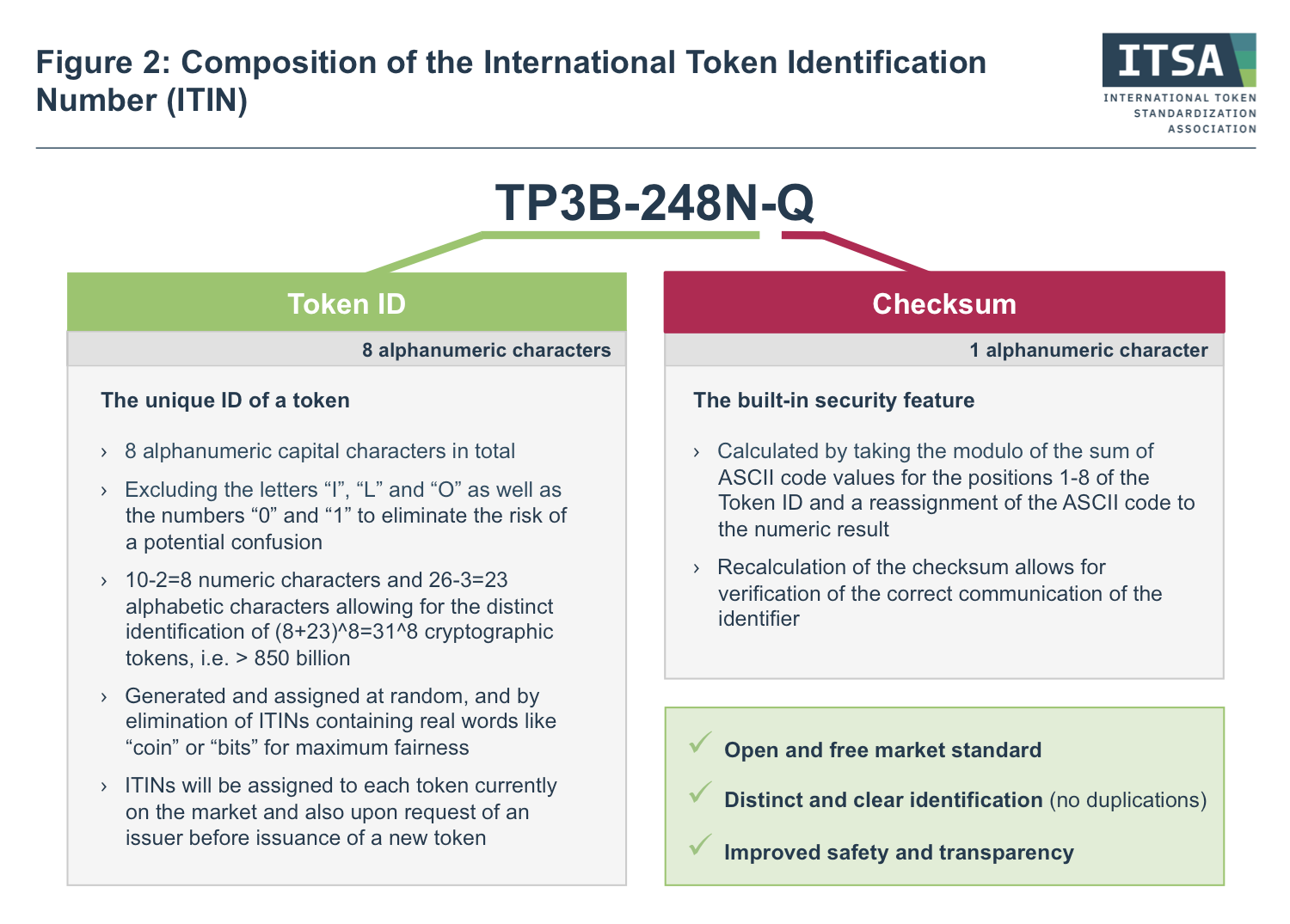

Moreover, ITINs will not only be assigned to payment and investment tokens in the financial sphere, but to all different types of tokens issued, regardless of their purpose or fungibility. An ITIN is a 9-digit alphanumeric code, composed of a Token ID and a Checksum (s. Figure 2).

Token ID

The Token ID consists of 2 blocks with 4 alphanumeric capital characters each that are separated by a hyphen (8 characters in total). Not included are similar looking characters such as the letters “I“, “L“ and “O“ as well as the numbers “0“ and “1“ in order to avoid any possibility of confusion. The total of 31 remaining alphanumeric characters allows generating over 850 billion unique Token IDs with the 8-digit code. These are generated and assigned at random to each token currently on the market. Token IDs can also be requested before token issuance by the issuing party. Notably, Token IDs that include actual words are eliminated to maximize fairness and to prevent distortions upon search requests.

Checksum

Each ITIN includes a deterministic checksum based on ASCII encryption. The checksum is a 1-digit alphanumeric character following the 8-digit Token ID. It is derived by first calculating the modulo of the sum of ASCII code values for the positions 1 to 8 of the Token ID, and subsequently assigning the respective ASCII code to the numerical result of the modulo. The checksum can be recalculated by everyone to verify the correct communication of the identifier and thus serves as a built-in security feature to prove the validity of each ITIN. Just like for the Token ID, the letters “I”, “L” and “O” as well as the numbers “0” and “1” are excluded to prevent confusion.

Continue to read part 3 of the series – Classification: International Token Classification (ITC)

Become a member of ITSA!

If you as an individual (1) and/or your organization (2) are interested in supporting the cause of ITSA, we would be delighted to welcome you as a member. To find out more about the current projects of ITSA and our membership options, please visit us at www.itsa.global.

Furthermore, we are also looking forward to receiving your feedback and questions on ITIN, ITC and TOKENBASE under: [email protected].

Let’s develop the standards for tomorrow’s tokenized economy together!

Constantin Ketz is co-initiator and vice chairman of the International Token Standardization Association (ITSA). Next to his research on token markets and the applications of Distributed Ledger Technology (DLT) in the financial industry at the Frankfurt School Blockchain Center (FSBC), he works as a consultant for DLT and financial technology solutions with a focus on debt capital markets and asset securitization. Mr. Ketz holds a B.Sc. in Economics from the University of Mannheim as well as a Master in European Public Affairs from Maastricht University and the European Institute of Public Administration (EIPA). You can contact him via email ([email protected]) or via LinkedIn (https://www.linkedin.com/in/constantinketz).

Prof. Dr. Philipp Sandner is head of the Frankfurt School Blockchain Center (FSBC) at the Frankfurt School of Finance & Management. In 2018, he was ranked as one of the “Top 30” economists by the Frankfurter Allgemeine Zeitung (FAZ), a major newspaper in Germany. Further, he belongs to the “Top 40 under 40” — a ranking by the German business magazine Capital. The expertise of Prof. Sandner in particular includes blockchain technology, crypto assets, distributed ledger technology (DLT), Euro-on-Ledger, initial coin offerings (ICOs), security tokens (STOs), digital transformation and entrepreneurship. You can contact him via mail ([email protected]), via LinkedIn (https://www.linkedin.com/in/philippsandner/) or follow him on Twitter (@philippsandner).

Photo by Sean Pollock on Unsplash

You Might also Like