Market standards for the global token economy (part 1)

Introducing International Token Standardization Association (ITSA) e.V.

This is the first article in a series of four.

- Part 1 – introducing the standards

- Part 2 – Identification: International Token Identification Number (ITIN)

- Part 3 – Classification: International Token Classification (ITC)

- Part 4 – Analysis: International Token Database (TOKENBASE)

By Constantin Ketz, Philipp Sandner

The year 2018 has been truly exciting for the global token economy. Even though token markets have lost approximately USD 700bn or 85% in market capitalization in comparison to their all-time high in January 2018, it has been a year of extreme ecosystem growth. More than a thousand different Initial Coin Offerings (ICOs) have been launched with a total volume above USD 21bn, including the first true unicorn ICOs to date with EOS raising more than USD 4bn and Telegram raising USD 1.7bn alone.

However, at the time of writing in May 2019, we find a different dynamic: many of the over 2,000 tokens that are being traded over global exchanges are slowly recovering in terms of price and market capitalization, and analysts carefully start to predict a new crypto market rally. At the same time, ICOs are declared to be dead and Security Token Offerings (STOs) have stepped onto the scene, providing a new way to raise capital in a more regulated environment that caters to the increased risk awareness of investors.

Next to security tokens other types of cryptographic such as stablecoins are emerging and extending the general scope of a token’s characteristics or purpose. Hence, the market is not only expanding in terms of market capitalization and quantity of tokens being issued and traded, but also in terms of diversity. Finally, the advancing diffusion of DLT- and blockchain-based cryptographic tokens gives rise to new business models in various industries and fosters the global trend of economic and social decentralization – which will be accompanied by increasing tokenization of assets.

Looking at the global token market developments in May 2019, one can state that DLT- and blockchain-based cryptographic tokens have come a long way. They are on the verge of becoming a recognized institutional asset class and will most likely form an integral part of modern economies. Yet, the ever-growing variety of cryptographic tokens is raising questions concerning their individual specifications and regulatory treatment amongst users, investors, regulators and academics alike. Global token markets still suffer from vast opacity and the lack of tangible and holistic token market standards. Standardization, however, is an important and necessary step to open token markets for institutional investors, to provide a basis for industrial usage, and to foster widespread adoption of cryptographic tokens by overcoming the current economic, technological, legal and regulatory uncertainties.

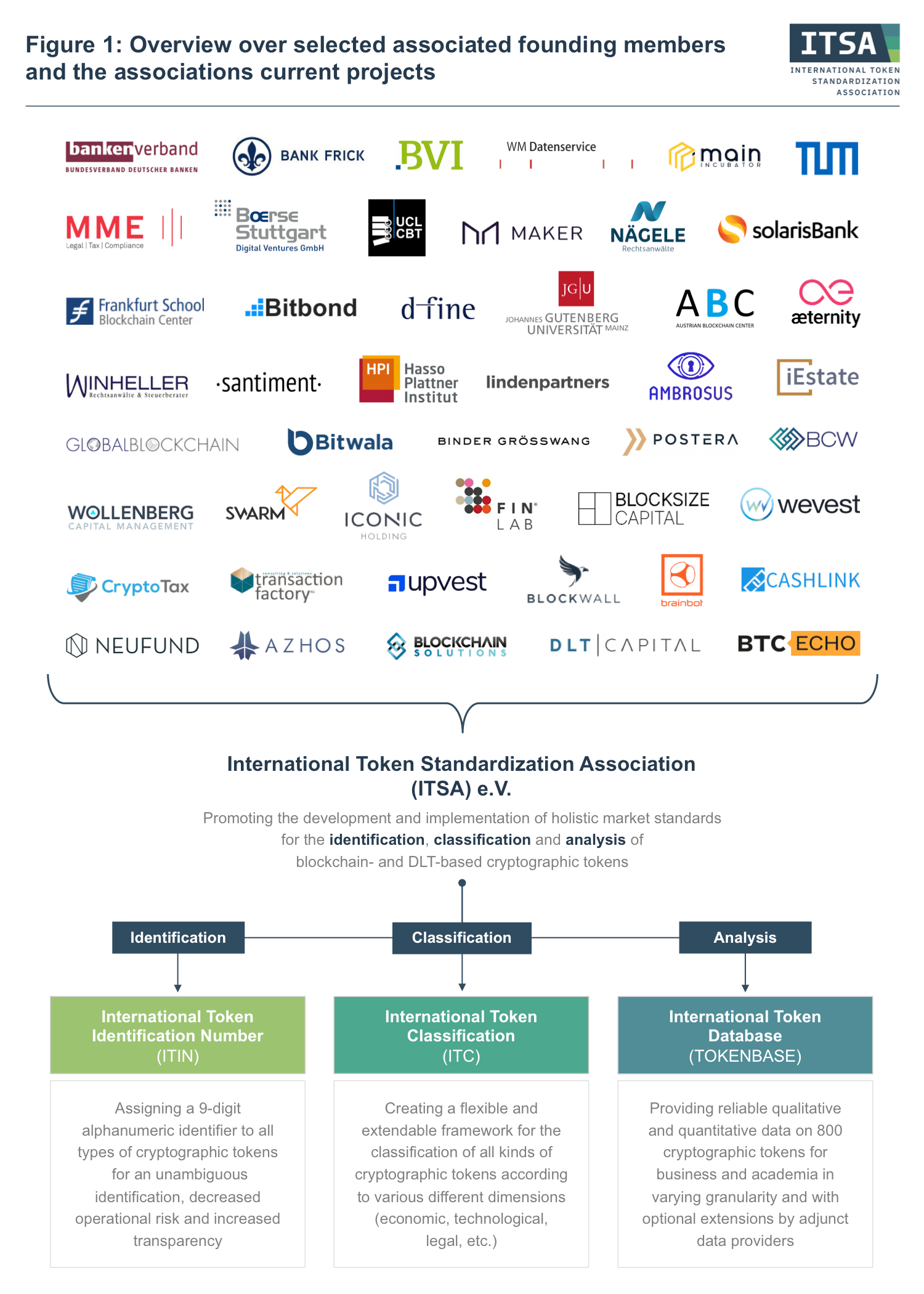

Acknowledging the market‘s need for more standardization in order to grow and mature, the International Token Standardization Association (ITSA) e.V. pursues the aim of developing and implementing holistic market standards for the identification (1), classification (2), and analysis (3) of DLT- and blockchain-based cryptographic tokens. Initiated in December 2018, it already builds upon the support of more than 100 reputable associated founding members, including major companies, startups, token issuers, investors, exchanges, universities, research institutes, consultancies, law or tax firms and large associations (s. Figure 1).

Next to the German Investment Funds Association BVI also the Association of German Banks (Bundesverband Deutscher Banken e.V. (BdB)) has joined ITSA as an anassociated founding member. Both organizations have just recently issued a public call for more standardization on global token markets in their latest press releases (Press release of BdB / Press release of BVI – both in the German language). Catering to that call as well as to its own proclaimed objectives, ITSA is currently developing the following three standardization projects, which are already covering more than 800 of the top cryptographic tokens and thus 99% of the current token ecosystem according to market capitalization:

Continue to read part 2 of the series – Identification: International Token Identification Number (ITIN)

Become a member of ITSA!

If you as an individual (1) and/or your organization (2) are interested in supporting the cause of ITSA, we would be delighted to welcome you as a member. To find out more about the current projects of ITSA and our membership options, please visit us at www.itsa.global.

Furthermore, we are also looking forward to receiving your feedback and questions on ITIN, ITC and TOKENBASE under: [email protected].

Let’s develop the standards for tomorrow’s tokenized economy together!

Constantin Ketz is co-initiator and vice chairman of the International Token Standardization Association (ITSA). Next to his research on token markets and the applications of Distributed Ledger Technology (DLT) in the financial industry at the Frankfurt School Blockchain Center (FSBC), he works as a consultant for DLT and financial technology solutions with a focus on debt capital markets and asset securitization. Mr. Ketz holds a B.Sc. in Economics from the University of Mannheim as well as a Master in European Public Affairs from Maastricht University and the European Institute of Public Administration (EIPA). You can contact him via email ([email protected]) or via LinkedIn (https://www.linkedin.com/in/constantinketz).

Prof. Dr. Philipp Sandner is head of the Frankfurt School Blockchain Center (FSBC) at the Frankfurt School of Finance & Management. In 2018, he was ranked as one of the “Top 30” economists by the Frankfurter Allgemeine Zeitung (FAZ), a major newspaper in Germany. Further, he belongs to the “Top 40 under 40” — a ranking by the German business magazine Capital. The expertise of Prof. Sandner in particular includes blockchain technology, crypto assets, distributed ledger technology (DLT), Euro-on-Ledger, initial coin offerings (ICOs), security tokens (STOs), digital transformation and entrepreneurship. You can contact him via mail ([email protected]), via LinkedIn (https://www.linkedin.com/in/philippsandner/) or follow him on Twitter (@philippsandner).

You Might also Like