Introducing International Token Standardization Association (ITSA) e.V.

This is the fourth article in a series of four.

- Part 1 – introducing the standards

- Part 2 – Identification: International Token Identification Number (ITIN)

- Part 3 – Classification: International Token Classification (ITC)

- Part 4 – Analysis: International Token Database (TOKENBASE)

By Constantin Ketz, Philipp Sandner

Analysis: International Token Database (TOKENBASE)

TOKENBASE is the third project of ITSA and is intended as the go-to standard database for the analysis of DLT- and blockchain-based cryptographic tokens. The database incorporates both ITIN and ITC and merges this qualitative data with third-party quantitative market data (daily prices, circulating and maximum token supply, trading volumes, etc.) from reputable providers. By combining both types of data and including additional information such as a token’s mineability or links to relevant web sources (e.g. token’s website, or github and reddit urls, etc.), ITSA is creating a unique token database that offers a built-in multi-dimensional token classification framework for enhanced structural market analysis.

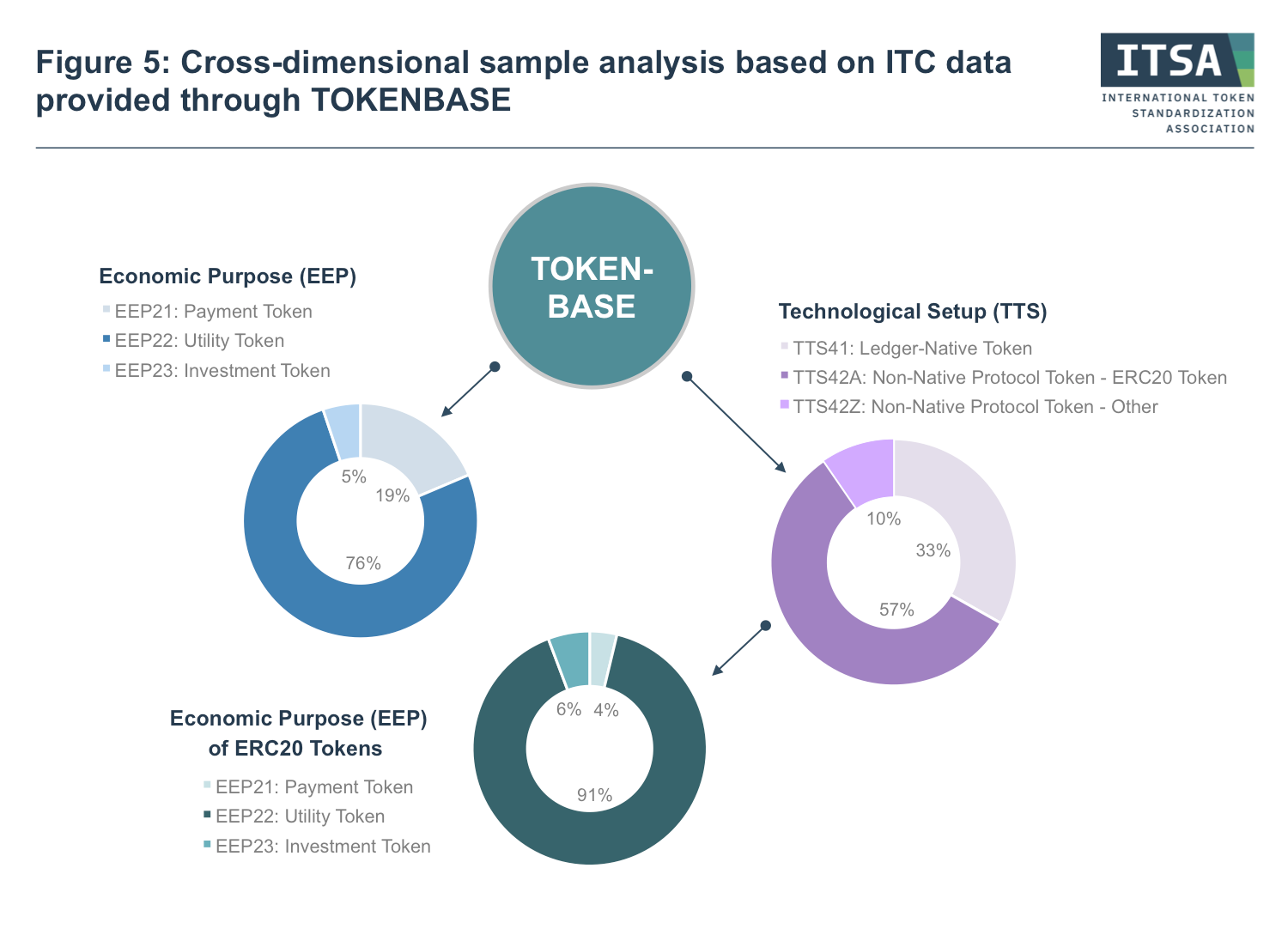

This allows for instance to compare the market capitalization of Utility Tokens (EEP22) that are used in the Advertising, Marketing and Public Relations industry (EIN09A) to the market capitalization of Utility Tokens (EEP22) in the Betting and Gaming industry (EIN17E) over time, or to assess differences in the price development of Unpegged Payment Tokens (EEP21U) and Utility Tokens (EEP22). In Figure 5 you can find a cross-dimensional sample comparison of the token category distribution within the dimension Economic Purpose (EEP) for all 800 cryptographic tokens with the token category distribution within the same dimension for the subset of ERC20 Tokens (TTS42A).

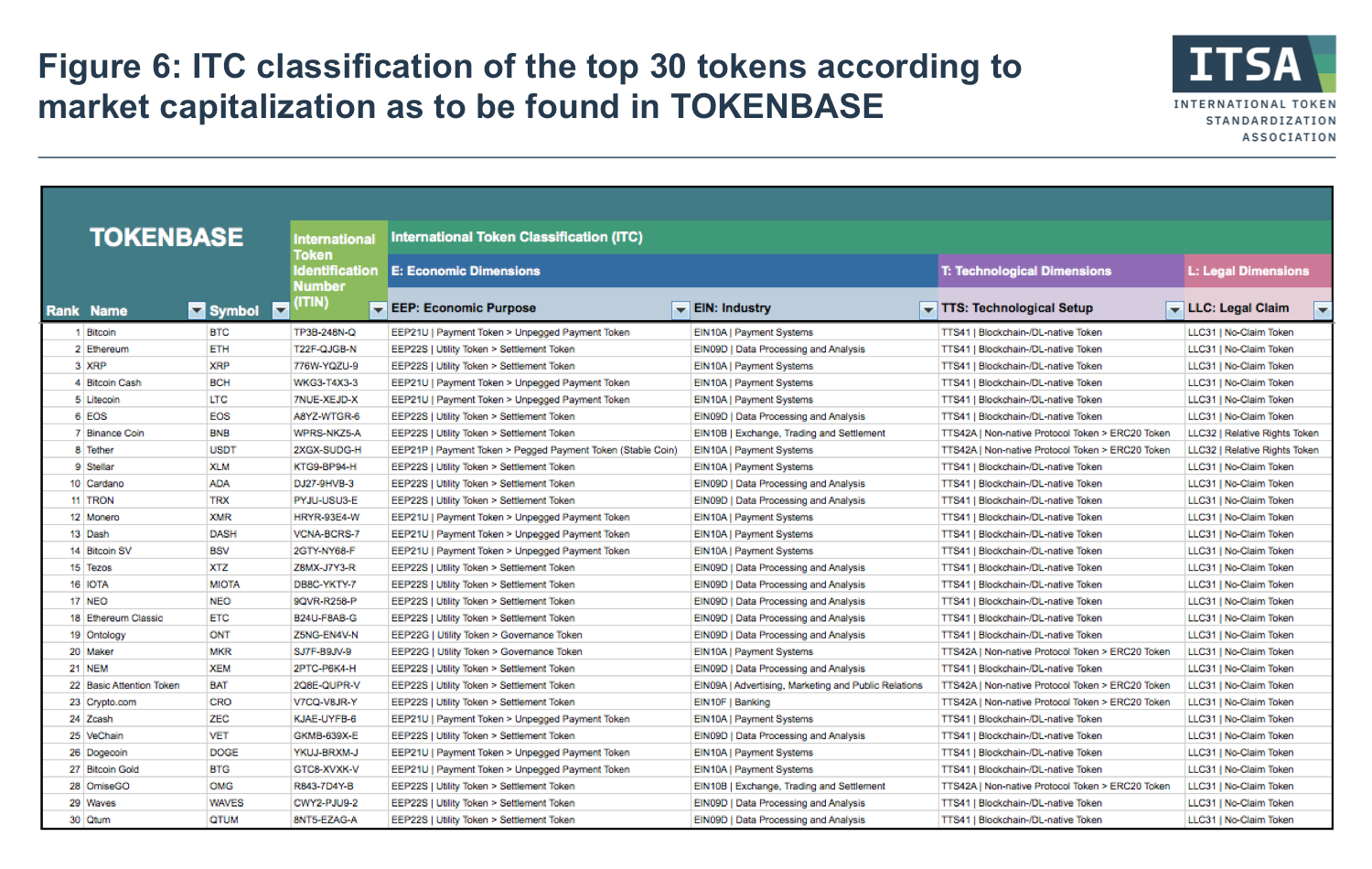

Figure 5 above indicates that the subset of ERC20 Tokens (TTS42A) tends to feature relatively more tokens that are created with the Economic Purpose (EEP) to serve as a means of utility provision or as a means of investment in contrast to a means of payment, than the basic population of all cryptographic tokens in the database that tends to comprise a higher percentage of Payment Tokens (EEP21). The addition of qualitative data creates not only vast opportunities for researchers but also for investors and regulators. It allows diving into completely new ways of analysis. In Figure 6 you can find a sample extract of TOKENBASE with the ITC classification data for the top 30 tokens according to current market capitalization.

ITSA is constantly working on the extension of the database’s token coverage, as well as on the depth and degree of detail provided with regard to external market data. In this regard, TOKENBASE is also intended to serve as market data aggregation tool, which shall enable and facilitate the comparison of data provided by various different suppliers in order to increase transparency and to highlight inconsistencies or frictions across the data feeds. Moreover, the upcoming spring of Investment Tokens (EEP23) will lead to the incorporation of additional token information such as official reports, ratings, maturities or the name of the issuing entity in the medium term. Finally, a potential future surge in the number and types of Ownership Tokens (EEP22O) in the course of ongoing tokenization of assets and rights will call for a further adaptation of the database just like a further breakdown of the Ownership Token sub-category of the ITC. In general, the development of TOKENBASE and the ITC go hand in hand in order to ensure seamless consistency and usability. As TOKENBASE does serve as well as public ITIN registry, some parts of the database can be accessed freely. Most parts, however, are currently reserved for ITSA members only.

Become a member of ITSA!

If you as an individual (1) and/or your organization (2) are interested in supporting the cause of ITSA, we would be delighted to welcome you as a member. To find out more about the current projects of ITSA and our membership options, please visit us at www.itsa.global.

Furthermore, we are also looking forward to receiving your feedback and questions on ITIN, ITC and TOKENBASE under: [email protected].

Let’s develop the standards for tomorrow’s tokenized economy together!

Constantin Ketz is co-initiator and vice chairman of the International Token Standardization Association (ITSA). Next to his research on token markets and the applications of Distributed Ledger Technology (DLT) in the financial industry at the Frankfurt School Blockchain Center (FSBC), he works as a consultant for DLT and financial technology solutions with a focus on debt capital markets and asset securitization. Mr. Ketz holds a B.Sc. in Economics from the University of Mannheim as well as a Master in European Public Affairs from Maastricht University and the European Institute of Public Administration (EIPA). You can contact him via email ([email protected]) or via LinkedIn (https://www.linkedin.com/in/constantinketz).

Prof. Dr. Philipp Sandner is head of the Frankfurt School Blockchain Center (FSBC) at the Frankfurt School of Finance & Management. In 2018, he was ranked as one of the “Top 30” economists by the Frankfurter Allgemeine Zeitung (FAZ), a major newspaper in Germany. Further, he belongs to the “Top 40 under 40” — a ranking by the German business magazine Capital. The expertise of Prof. Sandner in particular includes blockchain technology, crypto assets, distributed ledger technology (DLT), Euro-on-Ledger, initial coin offerings (ICOs), security tokens (STOs), digital transformation and entrepreneurship. You can contact him via mail ([email protected]), via LinkedIn (https://www.linkedin.com/in/philippsandner/) or follow him on Twitter (@philippsandner).

Photo by Samuel Zeller on Unsplash