Fight wealth inequality with blockchain and tokenization

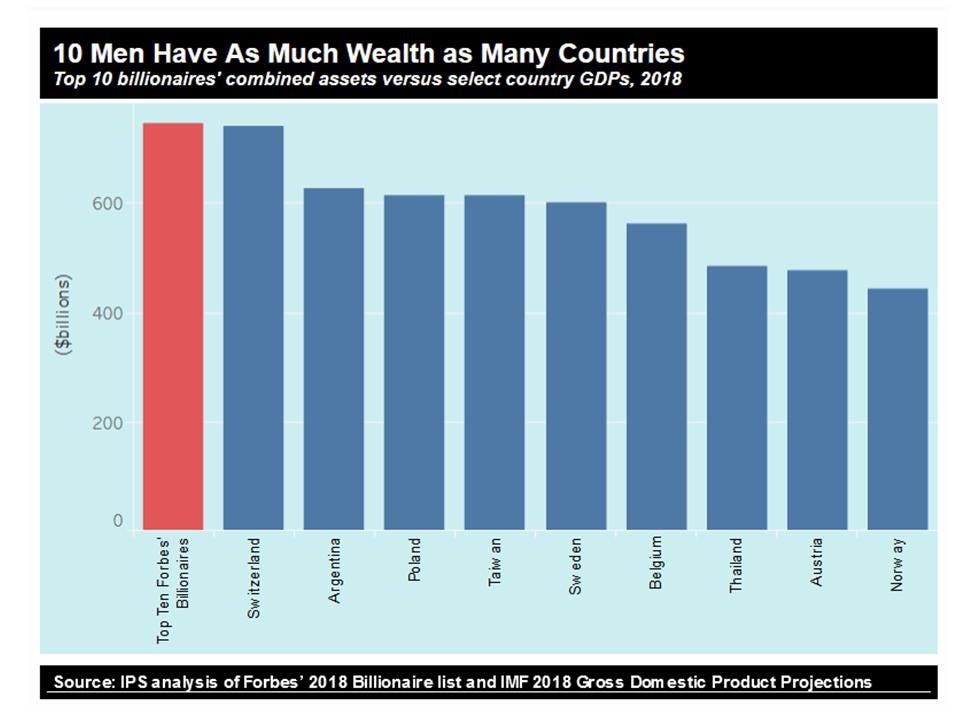

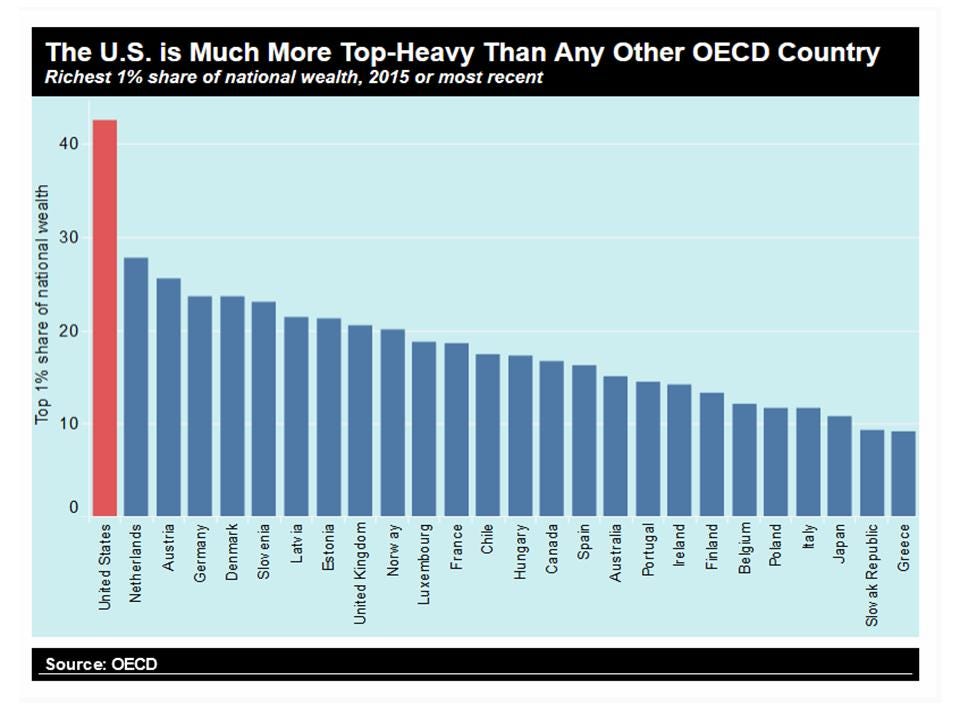

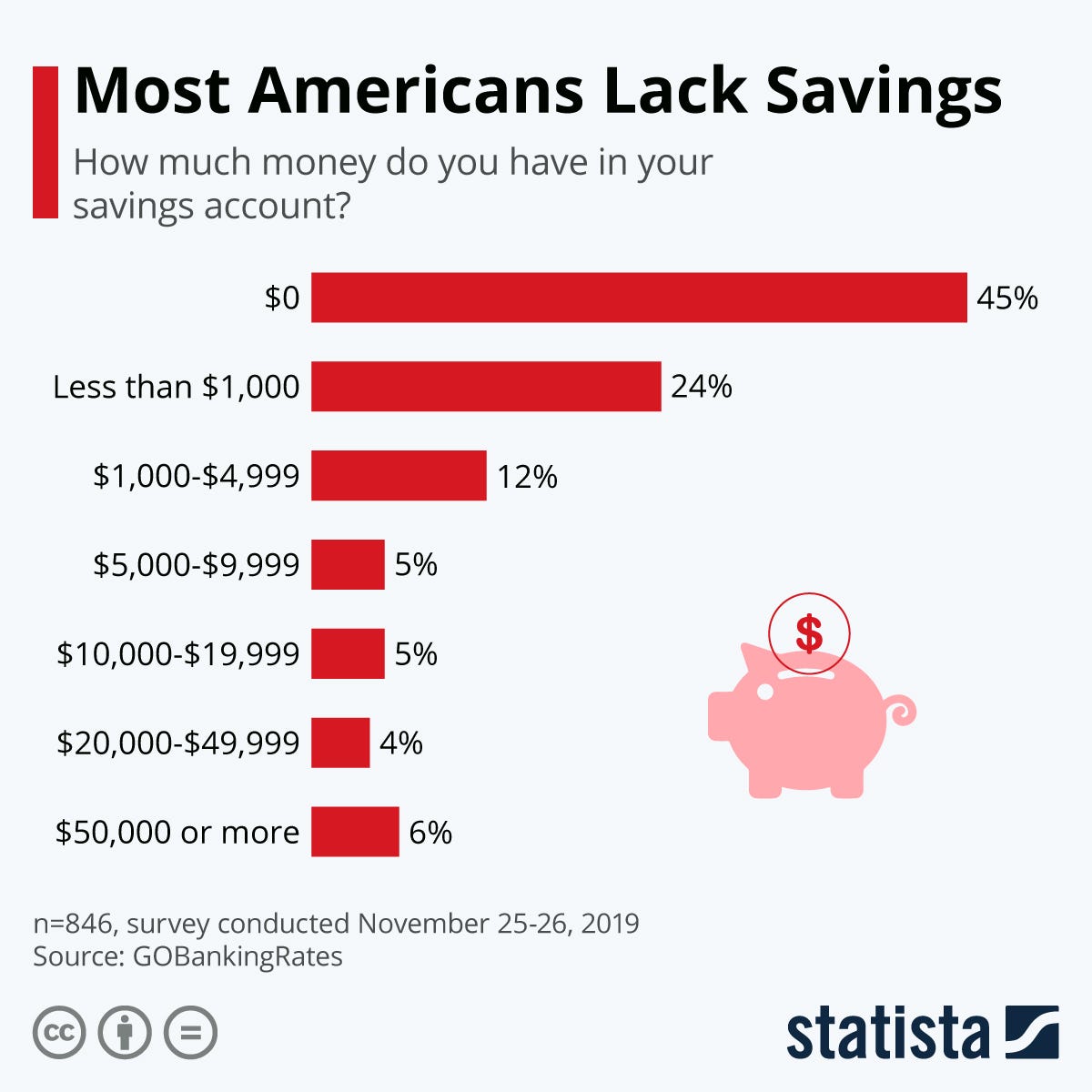

While Bloomberg has celebrated the best decade in history for financial returns, it is not a coincidence that wealth inequality has reached proportions not seen since the roaring twenties. And while this does not seem to concern the financial elites — who celebrated another fat end of the year — this is, in reality, a major concern for all the others, the 99%’ers. This has created all sorts of distortions, not only in the economies and in financial markets but also in political systems of countries which were traditionally considered as the most democratic forms of government around the globe, such as the USA and the EU.

The massive amount of wealth concentrated in few hands tends to manipulate the markets and to corrupt political systems globally, so much that today it is impossible to see a normally functioning (i.e. not manipulated) financial market or a truly democratic form of government. This “cancer” has spread fast in the USA and throughout the EU.

The “globalization doctrine”, coupled with the last 10 years of heavy Central Bank manipulations of interest rates and trillions of dollars and euros created out of thin air which has been thrown into the pockets of the cronies and speculators, have escalated a trend which has been already ongoing since the ´80s -´90s.

Some also openly accuse the capitalistic system itself. Even if the capitalistic system is certainly far from perfect — and in particular “liberalism” and “laissez-faire capitalism” are especially dangerous if not kept “in check” by able politicians — the real root of the problem is not the capitalistic system itself — which remains the best system possible — but rather crony capitalism and “central bank market manipulation, which goes against the very principles of capitalism”. Jesse Colombo in this Forbes article points out that the consequence is that the “situation is only temporary” and that “the asset bubbles behind the wealth bubble are going to burst and cause a severe economic crisis”.

This is likely the scenario that is going to happen if no other measures are taken to defuse the incumbent threat. But this is also the scenario that will generate dramatic consequences globally and year-long depressions ´30s style. That needs to be avoided at all costs. The author proposes “to strike at the root by working to defuse the dangerous asset bubbles, by reining in or shutting down the Fed, and by shoring up the integrity of the U.S. dollar again by backing it with gold so that it can’t be recklessly debased.”

This is only a partial solution to the problem. There may be a different and completely new approach to try which has been only recently enabled thanks to emerging technologies such as the blockchains and new social studies based on behavioural economics and game theory, the so-called “token-economics”.

The middle-class problem

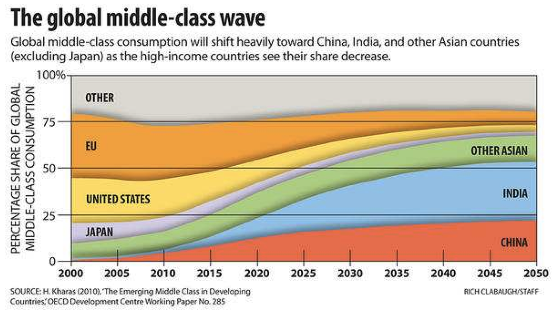

One of the chief reasons why we are stuck in a substantially zero-growth environment in the western countries and especially in the EU is that the middle class — which is the real engine of the economy — is being destroyed. Historically, it is the middle class that creates new enterprises and new jobs which boost the real economy and generate economic growth.

It is the middle class that consumes the most.

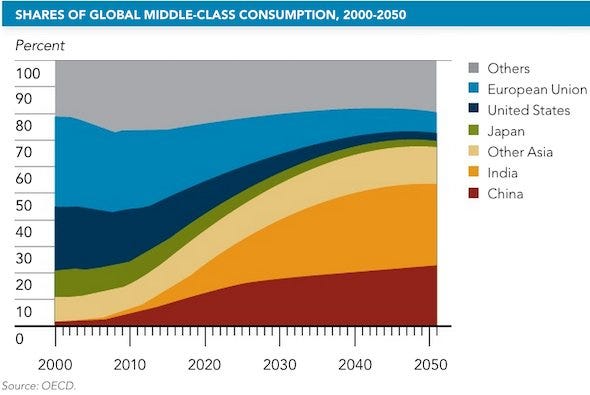

Certainly not the UHNWI who buys his 10th supercar or a new yacht or invests in a Picasso or speculates in the stock market or destroys a car worth hundreds of thousands just to show off how…well …a sub-human idiot he is and how his inherited and undeserved wealth would be better confiscated and put to a much better use. This chart shows that the middle-class wave consumption is getting thinner by the year in the western countries and grows instead in the east.

The east is doing today what the west has done from the ´50s to the ´90s. If this wave is not inverted and if European and American middle classes are not promptly resuscitated, the western economies are doomed and we will descend into new feudalism.

Therefore, considering that it is the middle class which is the entrepreneurial class which moves the economy, it is essential that they can have access to funds to create new enterprises. This is the classic chicken and egg situation. Try to go to a bank and ask for a loan to expand your small business or buy some new machinery or do some other necessary investment to boost your business productivity.

Despite the zero interest rates policy, banks will not lend you unless you have some collateral to guarantee repayment. This is particularly felt in southern European countries. This is the impasse that must be broken. We have to create a completely new system of incentives so that the massive wealth concentrated in the hands of the 1% per cent — which sits in low yielding bank accounts and brokerage accounts — is literally forced into the real economy, into the hands of the middle-class entrepreneurs which can use it to create new businesses, new jobs, pay salaries and resuscitate the stagnating western economies. Forget the bullshit “trickle-down economics” made up by the financial elites.

This is the real thing, the economic shock that is needed. And it should not be a trickle at all. It has to be a massive waterfall.

But how this can be done? We would need substantially three things: (i) a state-owned investment agency, (ii) a cleverly balanced mix of incentives for the wealthy to invest in the real economy and “asymmetrical” disincentives/sanctions to force them to choose the investment option rather than alternative “elusive” options which may disproportionately backfire if caught by the sanctions (iii) a blockchain/DLT based system of accounting to guarantee transparency and accountability together with digital tokens representing the government debt issued.

The Structure, the Incentives and the Disincentives

A State-owned investment agency is needed. The investment agency collects funds and issues a debt instrument paying interest at a rate which is slightly higher than the rate applied by commercial banks on the liquidity held.

Say that today paying an interest rate around 2–2,5% will be a very appealing proposition for wealthy citizens. Those funds are then lent into the real economy to businesses at a rate which is slightly higher (say 3% to 4%) but still far lower than the rate at which those businesses will normally get financings outside of the legacy banking channels.

In addition to the above financial incentives, the Government can add benefits such as:

- a governmental backup guarantee for the repayment of the principal and interest

- tax breaks for the wealthy investors if they decide — for instance — to roll over the instrument for an additional number of years

- tax breaks can be offered also to small businesses and entrepreneurs who benefit from the loans by exempting them from taxation if the profits made are reinvested instead of withdrawn

- target hoarded money stashed under the bed or in safes and even — why not — black money. Black money is challenged always in the wrong way, through sanctions rather than with incentives. What needs to be fought and sanctioned is the creation of black money in the first instance, but once black money has been created, the attempt to uncover it and to sanction it only pushes this money out of reach of the governments, usually off-shore. Be pragmatic, this is always a loss of revenue and resources for the state. Therefore the state should at least profit from that money to foster its growth by channelling black money into real businesses. Once the black money circulates in the real economy it becomes “white”, it generates profits, growth which will be ultimately taxed instead of ending up in a Luxembourg holding which then speculates in the stock market or inflates real estate prices in markets around the world. Offer an incentive to turn black money into white.

Now on to the disincentives and sanctions. While the incentives are fundamental, there must be also governmental pressure on wealthy citizens to show them that going down the “elusion” path will have possibly asymmetric negative consequences. Introduce the sanctions:

- a wealth tax is a hot topic both in the USA and in many EU countries. It is a delicate issue that I do not want to address here. The main concern is that any such tax should really target that 1% of the super-rich and not rather fall again as a burden onto the dying middle class or pensioners and their savings. And for the purpose of the topic treated in this article a wealth tax should only (i) be used as a disincentive, i.e. to sanction those who do not choose the investment option sponsored by the government and (ii) target only “liquid” wealth sitting in bank accounts and brokerage accounts. Take Italy for instance. Arguably the most savings rich country in Europe. Italian banks sit on Euro 4,3 trillion of savings/liquid wealth. Say that for our purpose the Italian Government declares that accounts holding liquidity and financial instruments above x will be taxed at an x% rate unless at least x% of the funds are invested in the proposed government scheme. What would you rather do? Deliberately choose to try to hide/move this money or rather happily get a 2,5% yield, with a backup guarantee by the state so zero financial risks and an additional tax break for rolling over the instrument at expiration? Is it better to leave this money sitting into some Bank account at zero or negative yield and risk a bail-in if the bank goes belly up? I believe that investors will flock to this investment opportunity from all over.

The Blockchain and the Tokenization

You may object that the blockchain is not needed for such a scheme and that you do not need to tokenize this debt instrument, it can be done easily in a conventional way. True, but blockchain and the tokenization become indispensable if one looks ahead into the future and wants to achieve certain objectives which cannot be achieved with traditional instruments. For instance:

- it is possible to disintermediate the legacy banking channels, avoid the commissions and possibly the risk of boycotting of the investment proposed. The banks will market to their clients only what it is in their interest to sell. They will aggressively market primarily those products which guarantee the fattest commissions and kick-backs. Unless the State wants to pay fat commissions to the banks it is better to cut them out and spend that money in a big marketing campaign. A State-owned digital bank to manage this operation is also necessary. Just like with the Investment Agency, the keyword here is State-owned.

- it is possible to enable a direct p2p investment between the citizens and the State Investment Agency.

- the blockchain brings transparency as to how many funds are received, how many bond-tokens are issued and to whom the funds are lent (the ultimate beneficiaries).

- the tokenization allows fractionalizing the debt in smaller token-tranches. A market for those tokens can be easily created and will allow investors to trade the token at a discount to par value if they want to exit the investment.

- it is possible to program the token (i.e. smart contracts) to enable the automatic execution of ancillary provisions such as the roll-over of the loan to avoid taxation at expiration and the automatic deduction of the taxes due.

- governments can use this opportunity to jump-start the use of their own national crypto-currency with a gradual bottom-up approach. For instance, the state-owned investment agency issues debt-tokens to the investors and at the same time releases the funds to the beneficiaries in the form of a new national crypto-currency and the businesses can start using this national crypto to pay for their costs and salaries. Immediately this national crypto-currency starts circulating in the real economy without the need for airdrops to the citizens. Its adoption will be both automatic and very gradual from the bottom up.

- the blockchain brings transparency into the real money supply of any such national crypto-currency.

Conclusion

The data are indisputable. Wealth inequality is the by-product of decades-long crony capitalism, financialization of the economy and middle-class destruction, all this enabled by pay to play lobbyism and the systematic corruption of politics by highly concentrated wealth. History tells us what consequences can we reasonably expect in similar cases.

And if the politicians, the 1%-ers, the elites and their servants think that they can contain the revolts, they are wrong. Look at France. Despite the almost universal and coordinated boycott by the mainstream media of the bad news coming from France — while at the same time we are inundated with news anytime a window glass is smashed in Hong Kong or in Russia — the French protests have been going on every week now for 15 months since October 2018, with deaths, amputated hands, blinded eyes and lots of innocent blood spilt on the streets. And they are not diminishing. Rather, they are escalating. Some recent ARTE TV Reports have documented the dramatic effects of disproportionate violence used by warfare armed police against protesters.

Anyway, the trend is clear, and this is a wake-up call for 99% of the citizens in the west. There is not much time left to act before western societies plunge in widespread disorder. Political courage to reverse ineffective and damaging past policies, vision for a new course and strong leadership to implement new visionary policies are badly needed at this dangerous juncture. Unfortunately, this is very rare merchandise nowadays among the current breed of mediocre western politicians.

Legal Disclaimer: The website and the information contained herein is for general guidance only and it does not constitute legal advice. As such, it should not be used as a substitute for consultation with lawyers on specific issues. All information in this paper is provided “as is”, with no guarantee of completeness, accuracy, timeliness or warranty of any kind, express or implied.

Investment Disclaimer: The website and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

https://www.bianconiandrea.com/

https://www.linkedin.com/in/andrea-bianconi-blockchain-law/

https://medium.com/@andreabianconi

http://thinkblocktank.org/

http://www.untitled-inc.com

You can contact Andrea Bianconi here: https://www.bianconiandrea.com/contact/

Image by José Manuel de Laá from Pixabay

More Aritcles:

And the Covid-vaccine winner is… the blockchain

Could blockchain have prevented the 2020 US elections´ fiasco?

You Might also Like