Margin lending allows traders who put up collateral to leverage their positions, or more simply put, it allows you to invest more money than you actually have. Done wrong, the risks with margin lending can be drastic but done right, a margin lending fund can be used to minimize anticipated drawdown risk.

The Invictus Margin Lending Fund aims to do just that — minimize risk — while maximizing interest income on USD and USD equivalents. The IML strategy is to offer dollar-based loans on exchange margin lending platforms. The fund is currently available on Invictus’ investment platform.

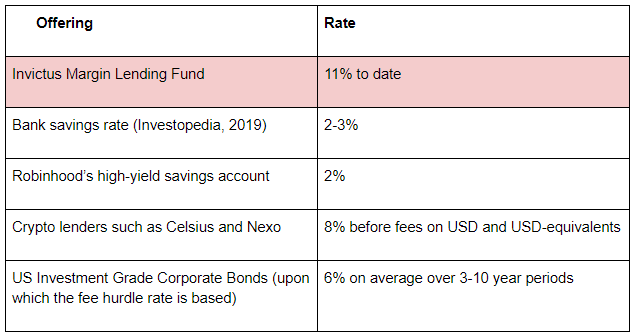

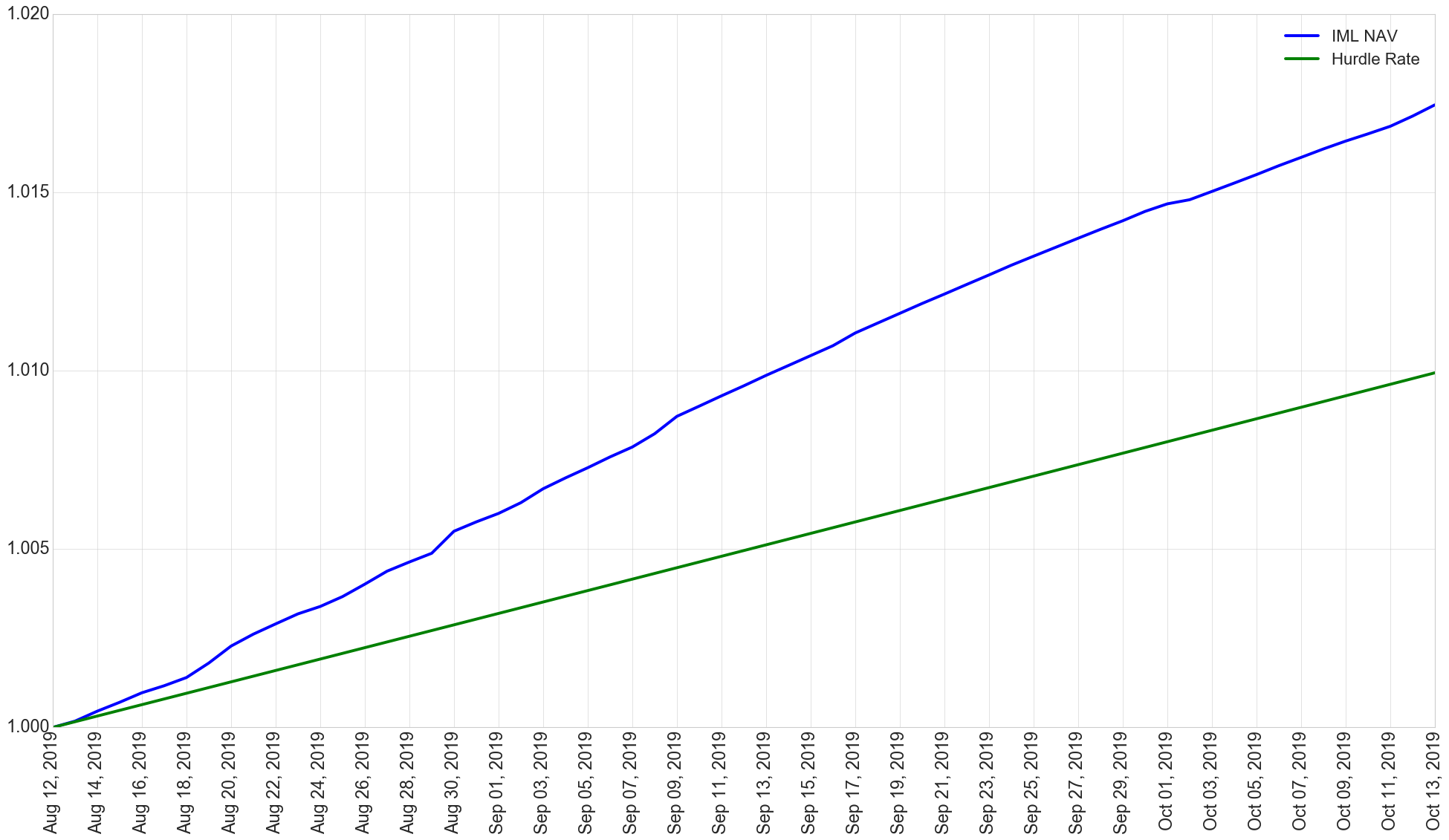

What’s noteworthy here is that IML has historically beaten DeFi (decentralized finance) performance and platforms like Celsius and Nexo — without having any lock-ups and exceeding the hurdle rate since inception, as seen below:

The hurdle rate is the minimum rate a company expects to earn investing in a project, so any area above the green line is essentially a “bonus.” Beating the hurdle rate makes an investment an acceptable risk for an investor, so by significantly beating this rate and minimizing risk, IML becomes a highly attractive proposition, especially compared to similar offerings:

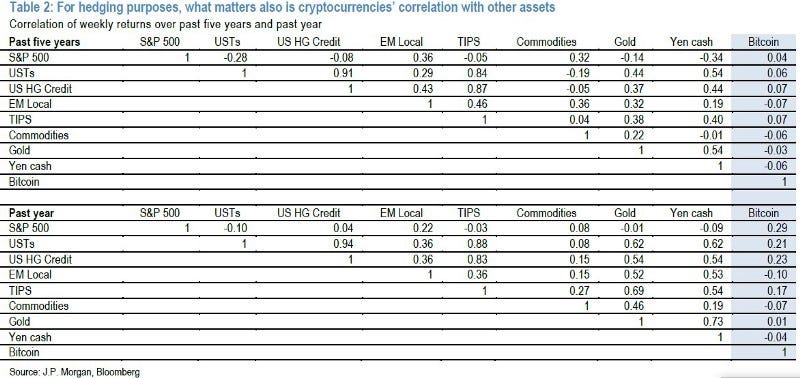

In a recent update to IML, Invictus Capital revealed that Bitcoin volatility enabled the fund to lock in even higher rates, “some as high as 22% annualized per day.” Beyond the maximization of interest income on USD, the fund’s return has a low or negative correlation to the S&P 500, making it valuable as a diversification tool in its own right.

In the “Investing In Blockchain” report, I discuss how “smart money is interested in uncorrelated returns,” and IML is a perfect example of a low beta addition. As this chart by “J.P.Morgan Perspectives: Decrypting Cryptocurrencies” shows, crypto brings the appeal of portfolio diversification:

Why Margin Lending?

More specifically, margin lending can be a great investment for a number of reasons, not the least of which being that crypto lending is experiencing explosive growth.

Unsurprisingly, crypto market volatility is expected to continue, increasing the demand for leveraged trades, which in turn drives higher interest rates on dollar-based loans.

IML enables investors to take advantage of that volatility during the growth of crypto lending, with less risk. Invictus answers a number of specific questions regarding the fund here.

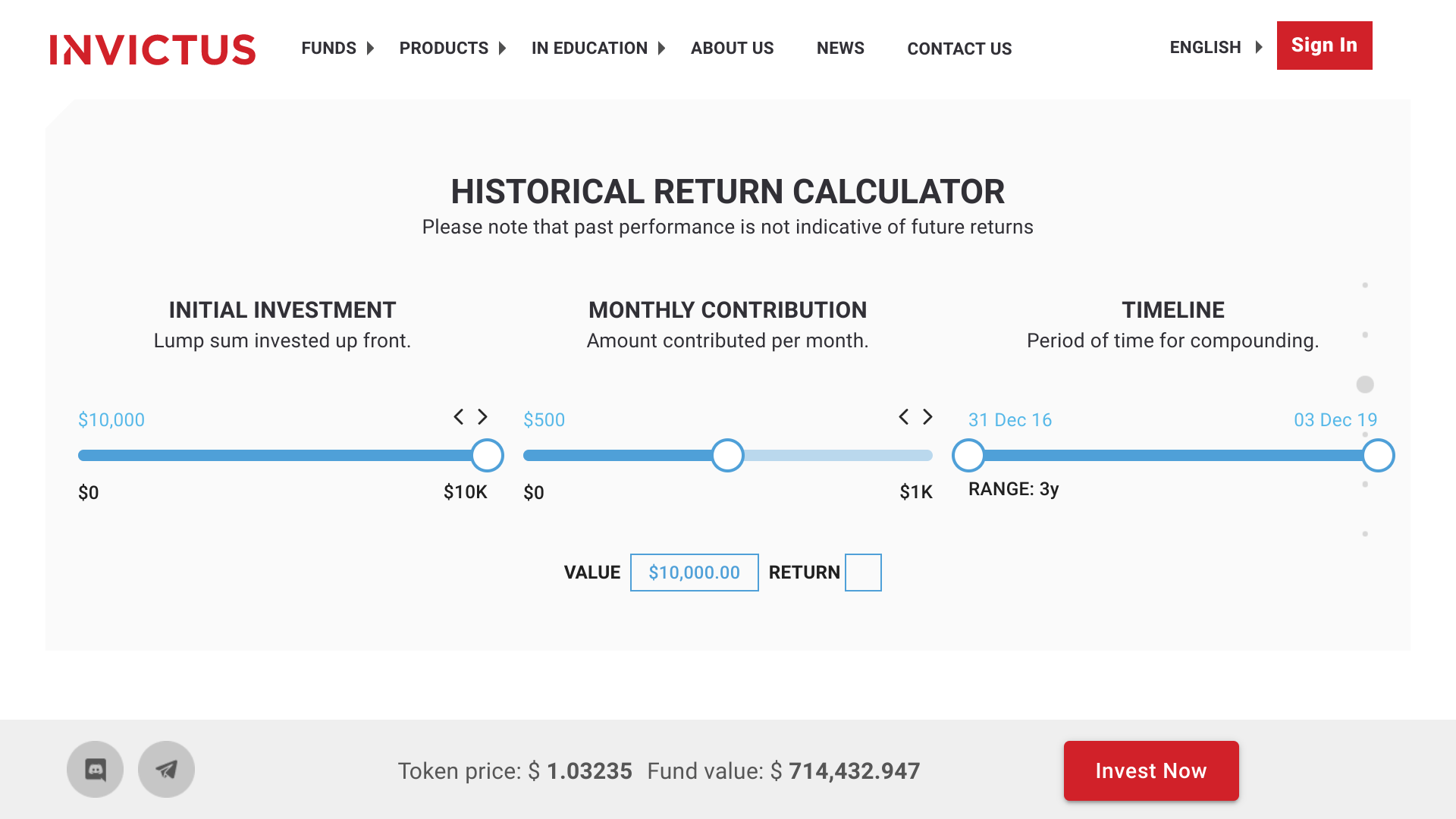

Invictus’ site offers tools like a historical return calculator, clearly showing the strong returns possible through IML:

Ultimately, tokenized margin lending isn’t the hottest topic in blockchain, but it’s worth looking into as a powerful investment vehicle.

Photo by Bob Fisher on Unsplash

More Aritcles:

Global Study of Digital Securities Ecosystem

Boerse Stuttgart launches Germany’s first regulated trading venue for digital assets