The tokenization of racehorses, does it really make sense?

Racehorses are an expensive vocational pursuit. But it is also a pretty good business for all those involved, such as the owners, the trainers, the jockeys/riders, the breeders and the various sportive federations.

Successful racehorses not only make a lot of money in prize wins — Winx an Australian thoroughbred was the highest all-time earner with over US$ 14.5 million in 43 races — but they are even bigger money-machines after they retire.

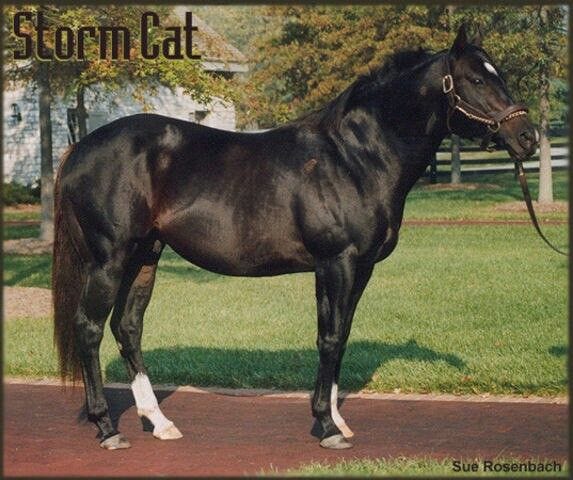

The stallion named Storm Cat was paid a US$ 500.000 stud fee to cover on average 120 mares per year. That´s an astronomical US$ 60 million per year only for mating.

But if Storm Cat was the “Ronaldo” of stallions, stud fees of tens of thousands of dollars are fairly normal for good and fairly successful thoroughbreds.

No wonder that when it comes to selling one of those highly valuable assets prices can hit tens of millions of dollars. Fusaichi Pegasus set the record at US$ 64 million in 2000 while Shareef Dancer — owned by the Emir of Dubai — is still the second most expensive ever racehorse with a US$ 40 million selling price back in 1983.

That´s why fractional ownership of racehorses has been common practice even before it became so for other types of assets, such as real estate, aeroplanes, etc. So-called Stallion Syndication Agreements are commonly entered into between dozens of owners to share the profits of breeding (stud fees), the costs and expenses, any proceeds of the sale of the horse and frequently grant also the right to one or more free mating of the horse with a mare chosen by the owner. Specialized companies have been selling fractional ownership schemes in racehorses for a while (more on that topic below under (iii) Fractional Ownership).

The case for the tokenization of racehorses

The idea to tokenize racehorses has been first advanced in an interview by Wave Financial´s Benjamin Tsai. As far as I am aware there has been no real following to that idea, at least so far. Although this may sound extravagant, large farmers, breeders and owners of racehorses still have very good reasons to think about the tokenization of their prized asset. Let´s try to see then how this can be done and which advantages this could bring:

(i) Token standard: this depends on what is being tokenized. There are basically two options:

a) is to tokenize the horse itself as a unique asset and use a non-fungible token format. The simplest solution here would be the Ethereum based ERC-721 or ERC-1155 standard.

b) is to tokenize the shares of an SPV (in the USA LLCs are commonly used), in which case the ERC-20, ERC-223 or ERC-777 standard would do.

(ii) Ownership Title: as background information, the law does not generally prescribe a specific mandatory form for the validity of the ownership title sale and transfer. Only if you want your horse to compete in races and sports events, you will have to register it with one of the main horseracing associations/federations (eg. the FEI, the Jockey Club, the AQHA, the USHJA and the USDF) and get a sort of passport for your animal.

The federations are responsible for maintaining the chain of ownership title within their registries. Accordingly, the written form only becomes necessary if you wish to enrol with the federations and update the records of the ownership title. Therefore this gives us the freedom to use the token as a legally valid tool to transfer the ownership of the horse. The update of the ownership title chain with the federations can be done at a later stage by the new owner.

In case (i)(a) above the owner can digitize the ownership title, the purchase agreement and other records, such as the microchip implantation or in the future the horse´s biometric data, and pack all that as a “digital passport” in an ERC-721 token on the Ethereum public blockchain. Even if the federations continue to run their paper-based registries and eventually one has to update the federation´s records after the sale of the animal, the buyer has still the advantage of a time-stamped proven clean title to the horse together with all the annexed documentation and the animal´s passport in a digital format. As we all know, things oft go awry. Records at the federation could also be lost or accidentally erased and so on. And if one owns a stable/farm with dozens of thoroughbreds worth millions then it might just be wise to have “an immutable digitalized back-up copy” of your prized assets.

(iii) Fractional Ownership: while companies like myracehorse or team valor are trying to bring the long-established concept of horse fractional ownership into the digital age, no doubt that going a step ahead — by tokenizing either the shares of the SPV which owns the assets or indeed the animal itself as explained in (i) (a) and (b) above — will add to their business model more transparency, liquidity and more opportunities to custom shape contractual relationship in a flexible way thanks to smart contract embedded programmability.

(iv) Profit Participation Rights: tokens can be a very effective way to represent various economical rights to the horse which could be smoothly transferred from the seller to the buyer or to other partners in a Syndication Agreement or in a joint venture or in an open market. The economical rights which can be packed into a digital token can be many and between different parties:

- mating rights.

- profit participation rights to prize moneys, stud fees, proceeds from sale of the animal, sponsorships and endorsements.

- a breeder could sell tokenized option rights to certain prized foals and thereby hedge the risk of that foal not becoming a future champion and at the same time increase its cash flow.

- stables/farmers/owners with dozens of competing racehorses could sell option rights to share the prize money or stud fees. This could dramatically improve the liquidity of a non-liquid asset. When such rights are in a digital token format a market for such new asset class could easily develop as well.

- also, horse auctions will not escape digitalization. If the horses are also packed into a digital token format, auctions can scale easily and faster and this will bring liquidity to the sector.

- clearly, digital markets to trade all the above rights could also develop in the future.

(v) Legal treatment of the horse token: this depends on a number of variables such as the rights attached to the token, how the tokens are marketed and in which jurisdiction this is done. Therefore it is advisable to talk to a lawyer before taking any such initiatives. However, as a rule of thumb, the sale of a token representing the simple ownership title will not be treated differently from exchanging a paper contract or a handshake to sell the horse. If instead, we are dealing with more complex profit participation structures — which are marketed as investments to the public — then you might have to comply with applicable securities regulations. But even in this case, there are a number of regulatory solutions which have been devised to favour small entrepreneurs to access financial markets such as the Growth Prospectus Regime in the EU and Regulations A, D and CF in the USA. Currently, the USA, Switzerland, Liechtenstein and Malta are the most favourable jurisdictions to consider for issuing tokens.

Conclusion

Despite it being a niche market, the proposed tokenization of economical rights derived from racehorse ownership has certainly some merit.

Improving the frictionless circulation of such rights and the liquidity of otherwise illiquid investments, it may help the sector to scale and promote racehorse investing among the general public.

PS: and if you love horses, this is the link to an inspiring story of love, friendship and literally blind trust between humans and that wonderful animal. Enjoy

Legal Disclaimer: The website and the information contained herein is for general guidance only and it does not constitute legal advice. As such, it should not be used as a substitute for consultation with lawyers on specific issues. All information in this paper is provided “as is”, with no guarantee of completeness, accuracy, timeliness or warranty of any kind, express or implied.

Investment Disclaimer: The website and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

#blockchain #bianconiandrea #racehorses #tokenization #tokens

© www.bianconiandrea.com — 2019

Photo by Pietro Mattia on Unsplash. Horse race in Sankt Moritz, Switzerland, called White Turf. It takes place every year on the iced lake of Sankt Moritz.

More Article:

Fusang wins new security-token listings

You Might also Like