Bank of Lithuania provides recommendations on raising capital through STOs

The Bank of Lithuania has issued the Guidelines on Security Token Offering (STO) which provide greater regulatory clarity and aim at higher investor protection.

“The current focus on security token offerings is taking over the waning interest in initial coin offerings (ICOs). Businesses are interested in this particular way of raising capital as an alternative to bank lending. The Guidelines on Security Token Offering are aimed at explaining our position in this regard rather than creating new regulatory arrangements. In a strict regulatory environment, such as the securities market, it becomes crucial to set rules in order to avoid any miscommunication, misunderstandings and their consequences,” said Marius Jurgilas, Member of the Board of the Bank of Lithuania.

The Bank of Lithuania has become one of the first market regulators in the world to issue guidelines on STOs. Previously, it has also published (and later updated) its position on ICOs.

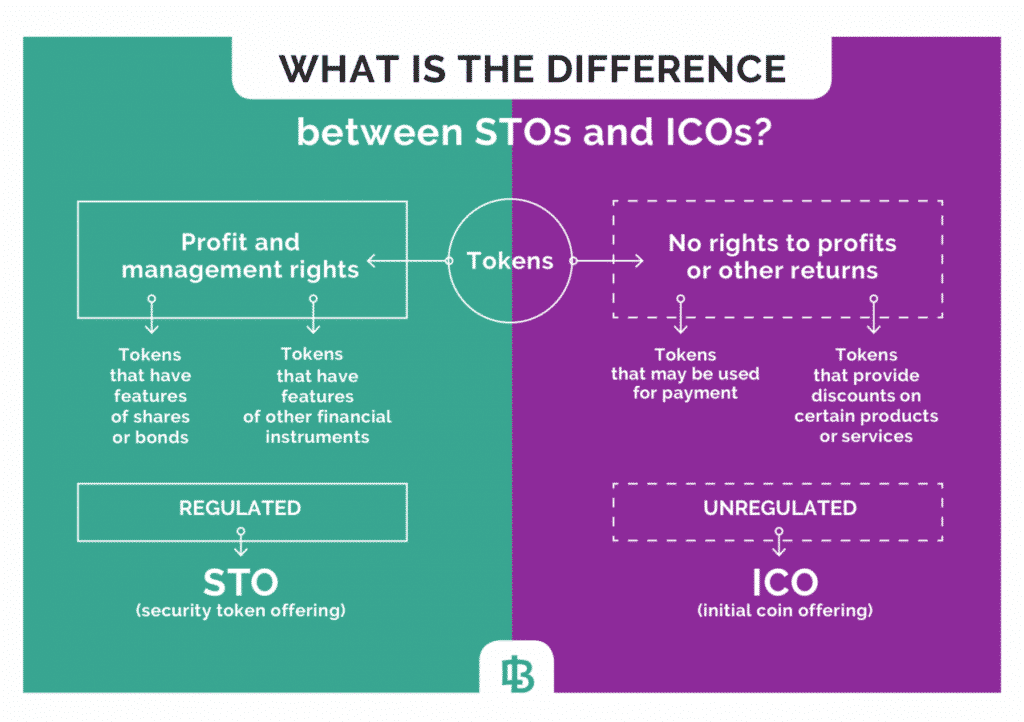

Setting forth the regulatory approach of the Bank of Lithuania to tokens as a financial instrument, the new Guidelines focus on their classification (what tokens should be categorized as having features of securities or other financial instruments), assess specific cases, provide recommendations related to the issue of security tokens and clarify applicable legal regulation.

Companies planning to use the STO method for issuing tokens qualified as transferable securities or other financial instruments will have to comply with EU and national legislation regulating capital-raising activities.

“In case market participants are not sure whether their offered tokens are subject to regulation, we stand ready to provide them with consultation on this matter,” said Mr. Jurgilas. While drawing up the Guidelines, the Bank of Lithuania initiated two public consultations with market participants, took into account some of the received suggestions and provided the needed explanations.

The Bank of Lithuania has decided to take a technology-neutral regulatory approach, which means that if a certain product will have features of a financial instrument (e.g. securities), it will apply relevant regulation and supervision regardless of the technology used in its creation. Given the unique nature of this product, each case will be considered individually, while taking into account the substance over the form.

Guidelines on Security Token Offering, click here

Additional information: STOs are the new way of raising capital where an entity seeking to raise its funds does not issue shares, bonds, or any other traditional financial instruments. Instead, it issues tokens recorded on a public or private ledger which entitles the bearer to a variety of rights similar to the rights granted to shareholders or owners of bonds or other financial instruments. Another specific characteristic of this method is that the issuance of tokens is conducted through a new Distributed Ledger Technology.

More: https://www.lb.lt/en/news/bank-of-lithuania-provides-recommendations-on-raising-capital-through-stos

Related Articles:

What happened to STOs? A breakdown of the current market

Are YOU Being Misinformed On Security Tokens / STOs?