Earn.re Welcomes Pinnacle Storage Properties as Project Sponsor

Earn.re, the blockchain-based commercial real estate (CRE) financing platform, has announced that Pinnacle Storage Properties LLC has become a project sponsor and an early adopter of its technology.

As a project sponsor, Pinnacle Storage Properties intends to list more than $100 million of self-storage projects on the Earn.re platform over the course of 12 months commencing in late 2019.

Based in Katy, Texas, Pinnacle Storage Properties is a privately held national acquirer, developer, owner and operator of self-storage facilities with a portfolio of 20 properties totaling more than 1 million square feet of rentable self-storage space.

“We’re pleased to have secured the commitment of an experienced sponsor with a strong track record of success and increasing momentum,” said Aaron Lohmann, CEO, Earn.re. “By becoming an early adopter of Earn.re, Pinnacle Storage Properties will enjoy enhanced transactional certainty, speed, liquidity and transparency when financing projects in the future.”

“We recognize the potential of Earn.re to become a major disruptive force by bringing liquidity to what is traditionally an illiquid asset class. Self-storage investors typically wait a long time to see a return, and sponsors have to deal with compliance challenges along the way,” said John Manes, CEO, Pinnacle Storage Properties. “The ability to trade CRE security tokens like stocks or bonds will add flexibility and speed to an industry that has historically moved pretty slowly in terms of completing transactions.”

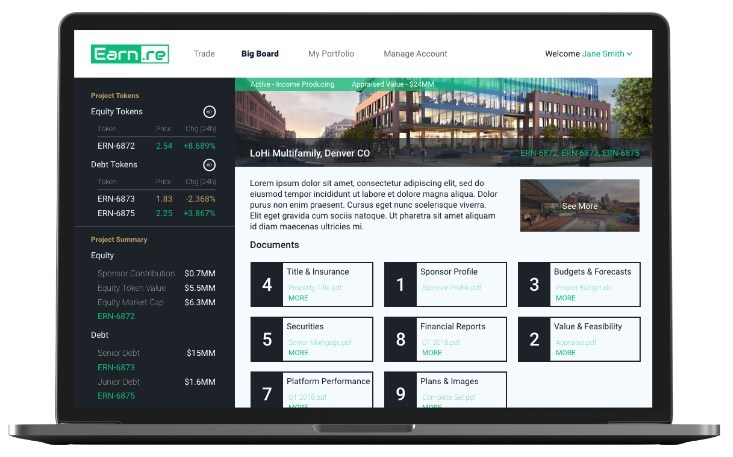

Designed to connect lenders and accredited investors directly with project sponsors, Earn.re is building a platform that offers debt and equity investment opportunities to Earn.re participants. Earn.re generates a security token—a virtual contract—that represents a fractional ownership stake in a debt or equity instrument verified within the blockchain. Each token is programmed to automatically compute and distribute returns to investors’ private crypto wallets.

Once created, Earn Debt and Earn Equity tokens can be traded on the Earn.re exchange, just as stocks and bonds are traded, in one of the CRE industry’s first digital secondary markets for debt and equity securities. Through the exchange, Earn.re will bring liquidity to CRE financing in compliance with regulatory requirements.

The Earn.re platform is built on the Ethereum public blockchain and provides users with a secure means of investing in U.S. CRE with full transparency and in compliance with U.S. securities and data privacy laws. It will offer debt and equity securities backed by nearly every property type, including retail, multi-family, self-storage, hospitality, industrial and government. Through Earn.re security tokens, investment documents such as deeds, mortgages, notes, shareholder agreements and more are attached digitally to the blockchain.

The Earn.re platform is expected to launch in late 2019.

More Articles:

Real Estate Token Contracoin to List on ProBit Blockchain Exchange Platform