The rise of peer to peer crowd-lending, the slow death of banks and what tokenisation can bring to the sector

Ray Dalio has summed it up pretty well in his latest post — “The World has gone mad, and the system is broken” — and in this interview with CNBC.

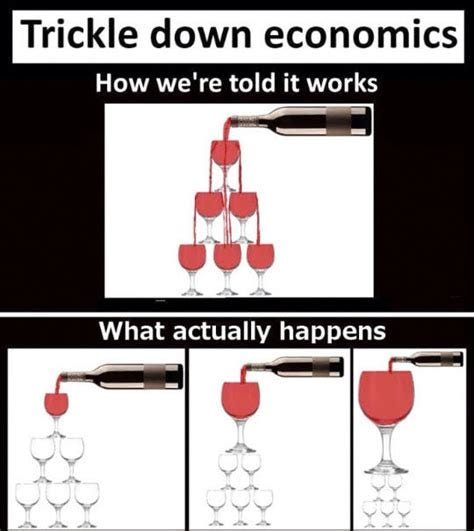

There is clearly a combination of opportunistic reasons, greed, a quest for power and cronyism as to why the bullshit economics behind the trickle-down narrative — despite its historical failure and well-documented criticism — was sold to the masses by liberal lobbies and special interest groups, in bed with the politicians, during the last decades.

This causes today not only major economic and financial imbalances, asset price distortions and a dramatic increase in income inequality not seen since the roaring ´20s, but also — more dangerously — a social breakdown which Dalio describes as sliding towards a social/civil “warlike environment”. Examples of civil unrest around the world are plenty to see, from the French yellow-vests to Chileans and Lebanese people to name the latest. The recent bank runs in Lebanon are a déjà vu of the EU banking crises in Iceland, Greece and Cyprus in the last decade.

But plenty has already been written on that topic. I wish rather to focus on how — from bottom-up (and not vice versa) — the market economy finds new solutions and creates new opportunities for investors to finance the production of goods and services without the economic aberrations of negative interest rates and outside the legacy banking system.

The time value of money and the rise of p2p lending

One of the capitalistic market fundaments is that the capital must be rewarded. There must be an incentive to save and invest your savings in the economy. This is achieved through market-based interest rates that are paid to someone to lend his money. The weirdness of zero/negative rates — which is not by the way the result of market dynamics but rather the arbitrary and fraudulent manipulation of central banks — has torn apart the basic principle that “money has time value” (i.e. one unit of money today is worth more than one unit of money tomorrow).

But what is likely missed is that — while such financial follies continue unabated — the real economy continues to work with the usual dynamics of a healthy capitalistic system where positive interest rates are determined by market participants to lend money to productive businesses.

So far, entrepreneurs without a good enough credit standing, start-ups, SMEs or people not wealthy enough to post a collateral guarantee, had a tough time financing their businesses or consumptions with the banks, although the financial system has been awash with the liquidity injected by central bankers globally.

So, when banks stop doing what they are supposed to do (lend money), and people are not rewarded with adequate interest rates to keep their savings with the banks, they take their money out of the banks and start lending it to other people and businesses which cannot be otherwise financed by the legacy banking system. Call this alternative non-bank lending or peer to peer lending or crowdlending, whatever pleases you.

Nowadays, fintech is enabling the growth of a whole new breed of peer to peer lending platforms where lenders and businesses meet and determine market-based interest rates to reward capital deployment.

Some figures and data will give you a much better idea of what is happening unnoticed by many.

A US$ trillion market

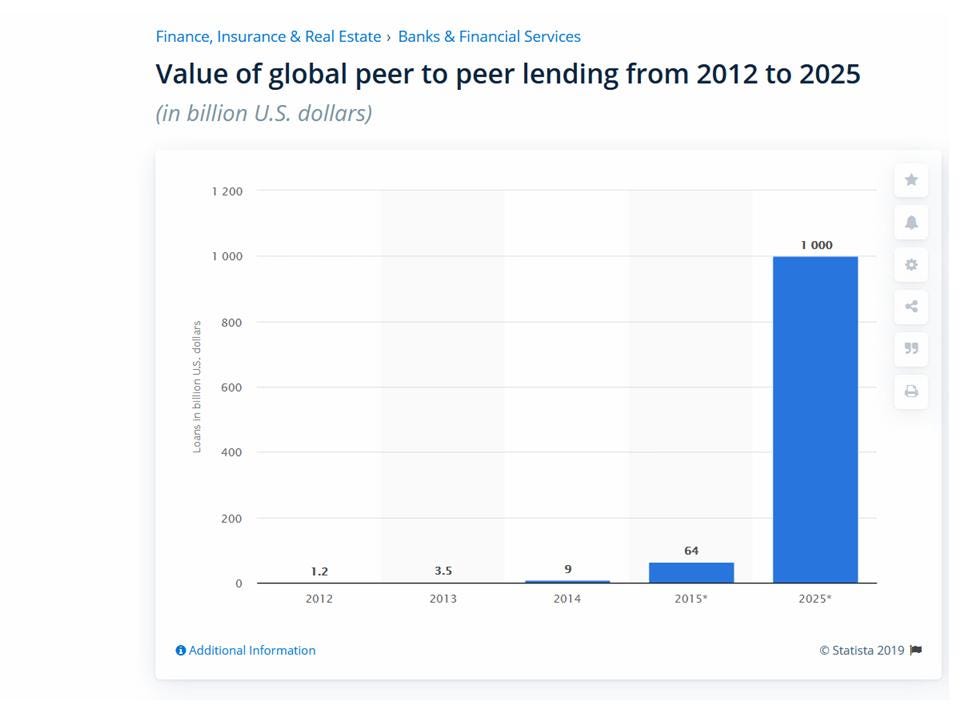

The equity crowdfunding market is more known than the peer to peer lending market (crowdlending), and it also has a long history. According to this research by Statista.com, this global market was worth approx. US$ 7 billion in 2019. Less than peanuts. According to fundly.com, the equity crowdfunding industry is projected to grow to US$ 300 billion by 2025. Still, nothing to be overly excited about.

Now let´s look at what the peer to peer lending sector is doing instead.

According to Statista.com, it was worth US$ 9 billion at its very inception in 2014, the next year was already worth US$ 64 billion, and it is projected to grow to a US$ 1 trillion industry by 2025. Now, that´s not peanuts.

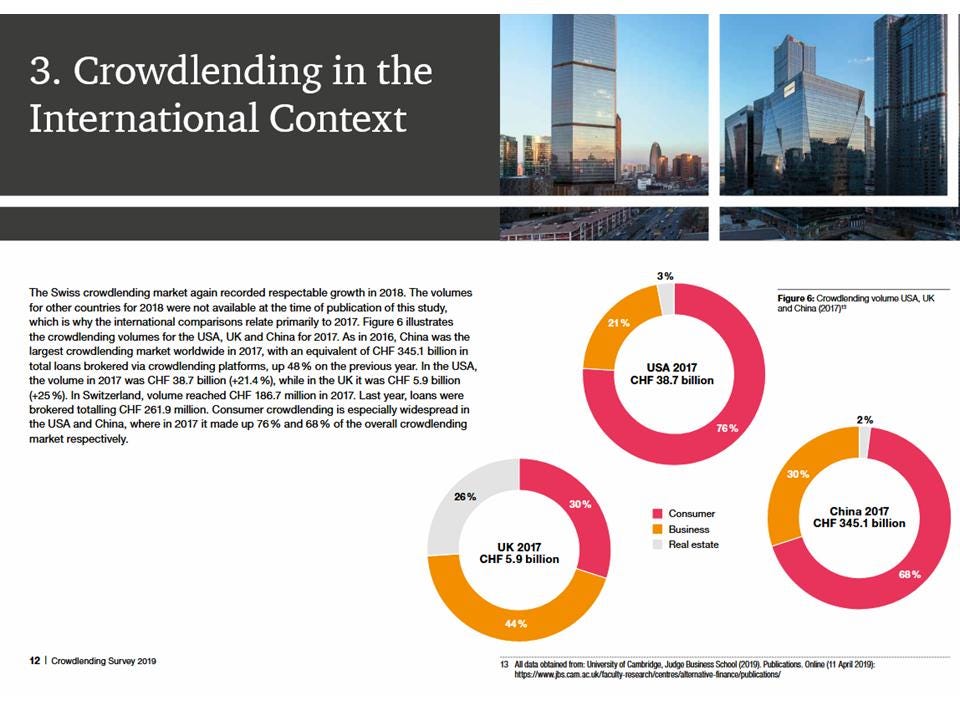

This 2019 PWC research estimates the current worth of the peer to peer US lending industry at CHF 38,7 billion and the Chinese market ten times that with CHF 345 billion.

The crowdlending market dwarfs the equity crowdfunding, and its growth will very likely exceed the forecasted US$ 1 trillion mark.

More in this Business Insider report “A look at the non-bank and alternative lending industry in 2019”.

Explosive growth

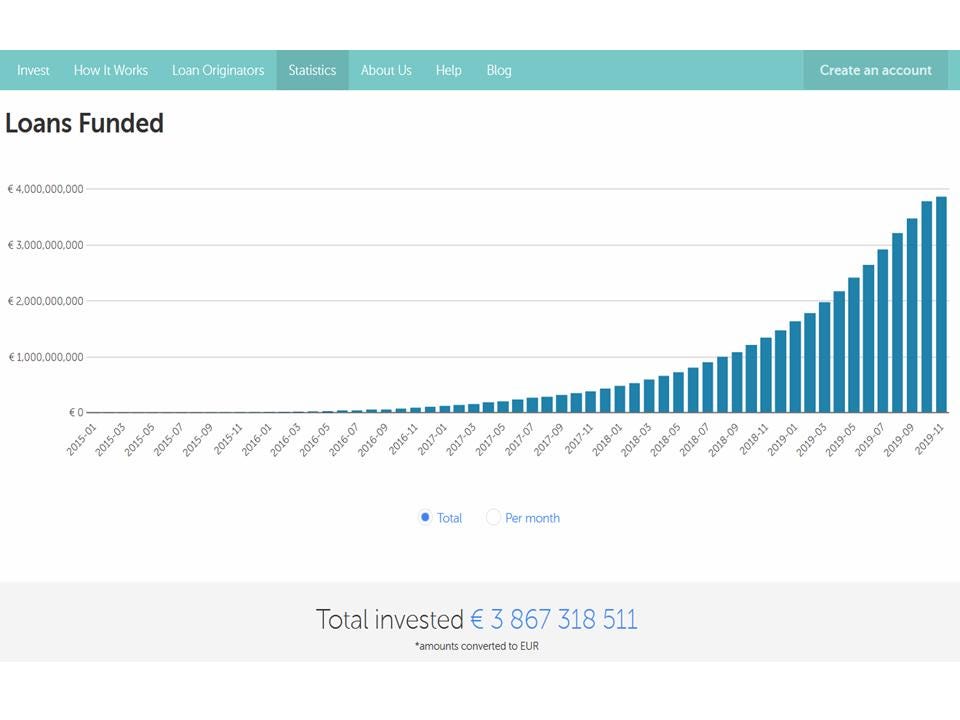

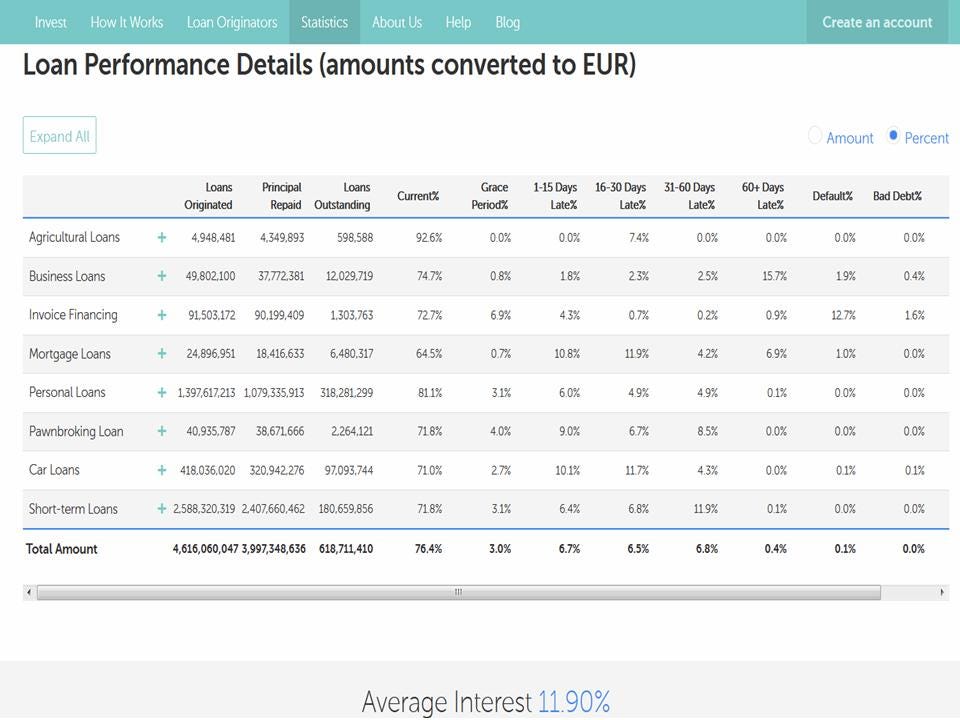

The following chart is worth more than words. Mintos is a Latvian Fintech company which was launched in 2015 to become a “global marketplace for peer to peer loans”. Through their platform, small investors can lend money to almost any sector of the real economy. You name it, agriculture, forestry, car loans, consumer loans, invoice financing, real estate mortgage loans etc.

According to their data, small investors had lent through their platform almost € 1 billion up to August 2018. Then, in the following 15 months — thanks to the new wave of zero/negative interest rates — the investments have more than tripled to € 3.8 billion. And this is not the only one. The likes of crowdestor or ablrate or investly, just to name a few, they all have their own market focus, and all of them claim double or triple-digit growth.

More importantly, looking at the published loan performances, I was surprised to see that the disclosed default risk was in average quite low between 0,5% and 1,3% of the transacted volume, while the loan performance was quite high with an average interest rate return for lenders of approx. 11,9%**.

This is the peoples’ response to the bankers’ fraudulent manipulations of interest rates, just like bitcoin is the response to the continued debasement of fiat currencies.

While the banks are slowly – but inexorably – being deprived of their traditional social role as lenders, the people are taking control of their savings back in their hands. And before we know it, those platforms will accept cryptocurrencies as it is already happening. They will operate through channels parallel to the legacy banking system, therefore reducing transaction costs and the transfer time of funds by using stablecoins and cryptocurrencies instead of fiat. Revolut — a UK based fintech bank — is now opening crypto accounts next to traditional fiat accounts and also accepts crypto funds.

The Tokenisation of p2p Loan Portfolios

The next step will be to tokenise entire loan portfolios so that a global, frictionless, secondary market for such loans will be born.

The tokenisation of such loan portfolios will bring a number of important advantages:

(i) the programmability of the loan terms within the token via smart contracts;

(ii) the semi-automatic and instantaneous settlement and execution of the loan terms such as interest payments and principal reimbursement, as well as the deduction for the platform fees (some functions cannot be fully automated since the borrower must always initiate payments);

(iii) the frictionless transfer of the token and the rights to the underlying loan in the secondary markets;

(iv) the possibility to trade the token in several secondary markets provided the token standard is compatible with such markets. This will also enhance the liquidity, which is now limited to the bid and offer of that single platform, totally lacking interoperability. This also solves the current problem that if the platform becomes insolvent, the whole secondary market (which is directly dependent on the platform) comes to a halt. Even if legally speaking the lender´s rights to the underlying loan are not impacted by insolvency of the platform, without the platform performing its key intermediary role there will always be inevitable disruptions for the lenders;

(v) the self-custody of the private keys to the tokens in your personal wallet and therefore, the reduction of the counterparty risk which will be then limited to the intrinsic risk of default of the borrower. Currently, some platforms expressly claim that client accounts are kept segregated and that in case of insolvency of the platform such funds cannot be apprehended by the receivership;

(vi) a reduction of the paperwork currently needed and a reduction of the intermediary functions performed by the platform. Though some key functions, which cannot be automated, will still be performed by the platform, such as:

– repossess collateral assets or enforce loan guarantees (personal or banking) or mortgages

– chase the borrower for late payments/default

– initiate debt recovery procedures in case of default.

Conclusions

For nobody, as far as I am aware, is tokenising peer to peer loan portfolios yet, I have asked Giuseppe Morlino — founder of the tokenisation start-up Stonize — why is it so: “The finance sector has lagged behind in terms of digitisation, and this is probably due to the high level of centralisation that has characterised it, at least so far. The reason why tokenisation is a game-changer in finance is because it democratises access to liquidity and investment opportunities. In other words, the true value of decentralisation in finance is democratisation: DeFi (Decentralised Finance) implies DeFi (Democratised Finance). And peer to peer lending is just one of the best possible use cases. We are carefully looking at that sector, and we are already discussing with Loan Originators to do just that. Our Stonize T3 Protocol (Trusted Token Transfer) provides a seamless compliance solution enforcing the rules governing the digital security on issuance and secondary trades, and it is agnostic. Currently, it is compatible with the Ethereum, Stellar and Algorand ecosystems and it is ready to leverage more advanced decentralised permissionless blockchains, as they will emerge. This is our approach to contribute to the rise of DeFi, the Democratised Finance in the future and peer to peer lending in particular.”

The commercial banking model, as we know it is dying before our eyes and the bankers do not see it. If only 7,6% of the banking CIOs agree with Morlino´s statement above — which considers blockchain disruptive for the sector — this means that we can reasonably expect that few of today’s´ traditional banks will survive this revolution. The next 5 to 10 years will be a “Blockbuster moment” for the banking industry worldwide.

** Read carefully the disclaimers below. Do your own due diligence before investing your money into any of the above-mentioned platforms. Importantly, should you decide to lend your money, spread your investment across the highest possible number of loans to reduce the adverse impact of any possible default? Read carefully the terms and conditions for the loans and consider carefully the counterparty risks, default risks and any other risks represented by the proponent of the investment.

#blockchain #bianconiandrea #crypto #thinkblocktank #bitcoin #fintech #peertopeerlending #crowdfunding #crowdlending

Legal Disclaimer: The website and the information contained herein is for general guidance only and it does not constitute legal advice. As such, it should not be used as a substitute for consultation with lawyers on specific issues. All information in this paper is provided “as is”, with no guarantee of completeness, accuracy, timeliness or warranty of any kind, express or implied.

Investment Disclaimer: The website and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

© www.bianconiandrea.com — 2019

Photo by chuttersnap on Unsplash

More Articles:

Driving the industry of tokenization – PART ONE

DEEFI PARTNERS WITH ARCHAX FOR TRADING IN TOKENISED ASSETS

You Might also Like