The new Growth Prospectus Regime: a Potent Instrument for Security Token Offerings

The time is ticking. On the 21st of July 2019, the new Prospectus Regulation (2017/1129) will become applicable in all the EU member states. This regulation will repeal the previous Prospectus Directive 2003/71/EC and introduce a new set of important provisions which may just well be the boost needed by the crypto sector to launch intra EU public offerings of security tokens (STOs).

By Andrea Bianconi

This new regime was conceived with the purpose of allowing SMEs easier and cost-effective access to capital markets across the EU. The regulation enters into force in two different phases.

Exemptions from the obligation to issue a prospectus.

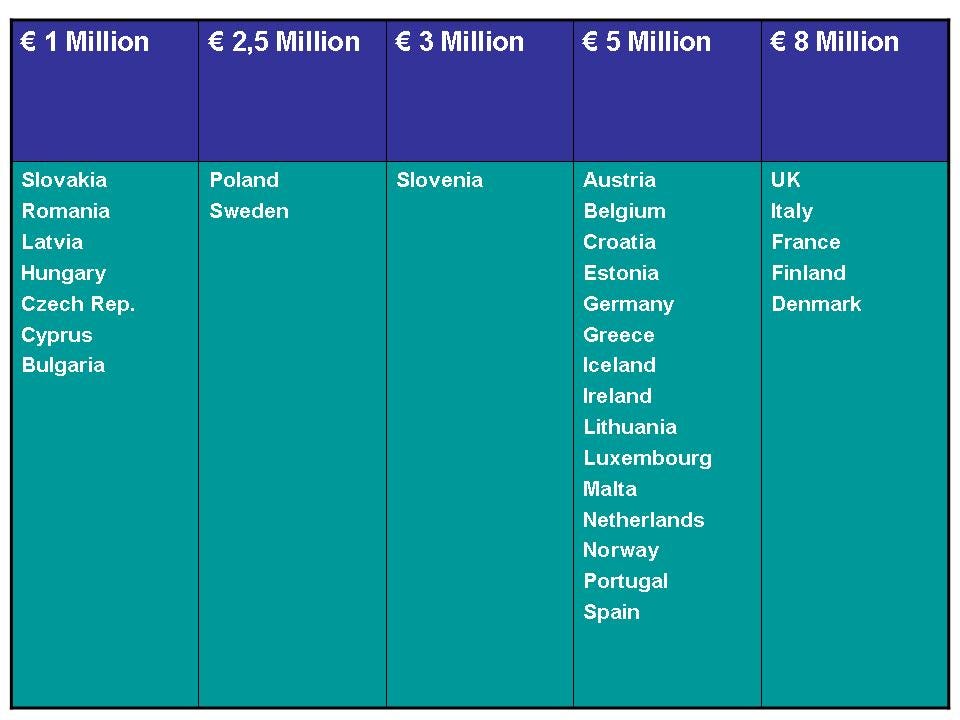

Firstly, as of 21st of July 2018, member states have adopted a new set of provisions to exempt security issuers from the obligation of drawing up a prospectus if the offering is under the thresholds set out in the Table below. The thresholds have been discretionally set by member states according to Art. 3.2 (b) of the Prospectus Regulation. The regulation, however, sets the discretionary range for such exemptions, which is between € 1 Million (a non-discretionary lowest threshold which is exempted in all EU member states) and € 8 Million (a highest discretionary threshold that could be set by any member state).

Countries such as Italy, France, UK, Denmark and Finland have opted for the highest threshold, which could theoretically favour STOs in such jurisdictions. It goes without saying that these exemptions suit really well the average sized crypto startup to enable an easier access to funding within the home jurisdiction. Please note that, because no prospectus is issued here, the fundraising must be limited to the home country and the passporting regime does not apply.

The new Growth Prospectus regime for SMEs

Secondly, as of 21st of July 2019, EU companies not falling under the exemption thresholds mentioned above — and willing to issue security tokens — may do so by taking advantage of a new simplified prospectus regime called “Growth Prospectus”. This should be a relatively straightforward and cost effective process if compared with the standard/basis prospectus otherwise needed.

Art. 15 has broadened the definition of SMEs, which could issue the Growth Prospectus, to include companies which meet at least two of the following criteria:

- had less than 250 employees on average during the year

- had a total balance sheet not exceeding € 43 Million

- had an annual net turnover not exceeding € 50 Million.

Likely, most SMEs in the EU would fall under the above definition. But the EU legislator has gone further than that. It has opted for extending the benefit of the Growth Prospectus also to non SMEs, in particular to:

- any other issuer whose securities are traded or are to be traded on an SME Growth Market (such as MTF — Multilateral Trading Facilities), provided that those issuers had an average market capitalisation of less than € 500 Million on the basis of end-year quotes for the previous three calendar years.

- any other issuer provided that:

– the offer of securities to the public is of a total consideration in the EU not exceeding € 20 Million over a period of 12 months, and

– such issuers have no securities traded on an MTF, and

– such issuers have an average number of employees during of up to 499.

The specific format and the information content of the Growth Prospectus have been laid out in a delegated act recently adopted by the EU Commission.

Simplified passporting of prospectuses within the EU

Thirdly, also as of 21st of July 2019, the process for obtaining the certificate of approval attesting that the prospectus has been drawn up in compliance with this regulation should become simpler. In particular, the previous Prospectus Directive was implemented differently across the EU. This created a number of frictions with sporadic requirements by certain member states of additional burdens for the issuer — such as the publication of the prospectus on magazines, more publicity requirements, payment of fees and translations. Conversely now — because this is a regulation and not a directive – no implementation is required by member states in their national legislations. This regulation will be therefore automatically enforced in the national legislations, thereby eliminating the risk for the above mentioned inconsistencies.

Once a Growth Prospectus for an STO is approved in a member state it will be therefore valid for any offer of security tokens to the public across the EU.

Conclusions

The entry into force of the new Prospectus Regulation, with clear exemptions for some security issues coupled with the new Growth Prospectus regime and the simplification of the passporting procedures, should become a potent instrument for companies willing to tap EU capital markets by issuing new security tokens or by tokenizing existing securities.

In the summer 2020, after one full year from the entry into force of the Prospectus Regulation, we will be able to assess its impact on the crypto sector.

https://www.bianconiandrea.com/

https://www.linkedin.com/in/andrea-bianconi-blockchain-law/

https://medium.com/@andreabianconi

http://thinkblocktank.org/

http://www.untitled-inc.com

Photo by Frederic Köberl on Unsplash

More Articles:

Switzerland and Liechtenstein improve their crypto friendly regulations to favour STOs