– an interview with Andrea Bianconi, Independent Consultant, Cryptos, Blockchain & Law

How is the corona crisis affecting you and your professional activities/company?

For my consultancy work, it is mainly about travels restrictions, which for me is not an issue at all since I have always used available technology to reduce travel as much as possible and to meet remotely. But clearly, businesses are feeling the economical impact. So I expect that the wave will soon impact us as well and some projects might have to be put on hold for the time being. Let’s hope a way out will be quickly found before the extent of the damages in the real economy becomes too large.

Does the crisis mean a setback for the development of the emerging industry of security tokens and asset tokenization?

Not at all. But a slowdown – for some sectors and specific projects and activities – yes, certainly.

But what is your analysis of how the crisis may impact the emerging industry of security tokens and asset tokenization both in the short and long term?

Generally – and independently of the COVID-crisis – there is a real need for more digitization, and this trend cannot be stopped. If anything COVID is a catalyst for more digitalization and we see this across all sectors.

Specifically, the impact varies a lot, depending on the business sector. The word “Tokenization” is used for a very broad spectrum of activities. It is not only about raising capital by issuing security tokens.

Many DeFi applications also have to do with tokenization. There is a whole new range of assets – both digital and real which are not necessarily “securities” – that are being tokenized for many different reasons. All this new range of tokenized services, products and use cases are either very little or not at all affected by this crisis.

The most negatively impacted sector at the moment is the funding market and the issuance of new security tokens. Unfortunately this sector – despite lots of expectations – has never really taken off. This is because of both regulatory complexities and the low quality of the projects which were seeking funding – the classic chicken and egg problem. The COVID crisis has clearly impacted the financial markets, and the credit crunch is felt strongly also in the traditional banking and VC sectors and even more so in the STO-ICO sectors.

Do you see anything positive coming out of the corona crisis for the security token and tokenization industry?

There are very exciting new projects about to tokenization of assets, both digital and real. Here I do not see any major problems, maybe just a slowdown. Even real assets such as real estate portfolios have been tokenized in this difficult period – if the project offers a high value proposition in terms of technological improvement, efficiency and large savings for the participants, both economical and in time consumption (see here).

Also, a major player like HSBC has recently tokenized a private placements portfolio. In this case, there were very compelling technological and economic reasons for the project which is a test for the near future in which HSBC and other banks will be issuing tokens representing private placements directly to their clients’ wallets using the blockchain. Therefore this type of players continues to experiment – despite the crisis – because this technology is impacting their operations, and it is not possible to turn back in the face of technological advancement.

Many luxury items (watches, bags, diamonds, etc.) and bottles of wine are being tokenized for authenticity/counterfeit purposes or to enable some different kind of customer experience for the clients. All those projects, which have a digital world component to it, are going ahead. Another sector for which there is a lot of interest is the tokenization of the sports industry. So, even if a football team puts on hold its fan-token project, this kind of products, services and use cases are not going away with the crisis. It is just a temporary slowdown in the pace for adoption.

Also, as far as DeFi applications are concerned, COVID has shown both the importance and the need for cryptocurrencies. And there has been a strong acceleration in the last two months with China testing the retail adoption of its CBDC Yuan and the Dutch Central Bank pushing the go-ahead for a digital Euro. So, as you can see, it is a very varied sector, and a lot is going on despite the general crisis.

If we focus generally on blockchain-based COVID use cases, there are dozens of extremely interesting new use cases and applications. One for instance – which I have lately suggested in this article here – has to do with the need to bring much-needed transparency and trust to the somewhat opaque activities of philanthropic foundations financing vaccines and the pharma industry. For instance, Bill Gates is on the TV news more than politicians these days, and people and politicians start questioning the real interests behind his grants. And the “trust-machine” is the only tool that can shed light into those activities.

Finally, from a macro perspective, this crisis shows all the limits of the capitalistic globalization and centralized systems: the EU, the WHO, NATO, centralized production and supply chains, etc., they have all miserably failed. This shows the need for a much more distributed world architecture to be able to respond efficiently to a crisis like that. Even among states, those that do best seem to be those who have adopted a flexible and “decentralized” response like Federal Germany.

The opposite negative example is Italy, where the management of the crisis by the Conte government has been disastrous because Rome has not been able to respond to very different situations in the various regions: the whole country has been shut down when in most regions the situation was totally under control. This has created a national economic emergency without precedent since WWII, and the negative effects will be felt for years to come.

Does the crisis mean a setback for the development of the industry?

Not at all. But a slowdown – for some sectors and specific projects and activities as explained above – indeed yes.

Has it become significantly more challenging to raise investments for industry development?

Absolutely. The credit crunch is gripping the whole legacy financial system as I have explained above. It is certainly not a good time to try to raise funds with an STO or ICO. Even traditional IPOs are on hold. How long this will last is impossible to say. It all depends on what happens to the real economy. So far the only response has been a “monetary tsunami” from the FED and other central banks to support financial markets (with over US$ 3 trillion). But this has nothing to do with the real economy and the root causes of this crisis.

This is a true black swan event, a demand/supply shock which cannot be fixed with “QE Infinity”. The virus will not disappear, businesses will not reopen, and planes will not fly again until the root causes are solved. They should throw money to the people and SMEs rather than to financial markets (i.e. helicopter money). And for the real economy, especially in the EU, very little has been done because the EU’s restrictive policies do not allow the ECB to monetize debt in unlimited quantities like the US is doing. Issuing more debt in this crisis will only delay the inevitable. This is why I am not optimistic at all. I see a huge economic crisis developing. You cannot shut down the whole economy for more than a month without having massive consequences in terms of insolvencies and unemployment. I wrote this article precisely on that topic.

But a big crisis is also a moment for big opportunities. Certainly, there will be possibilities for investors to buy up good projects cheaply. Businesses and startups with excellent ideas and good products may need cash or may face difficulties to raise needed funds. Therefore smart investors with cash must be ready to do some very serious shopping. Investors interested in discussing this can contact me on my website here.

Could you elaborate a bit more on the positive things that might come out of the corona crisis for the tokenization industry?

As I said, this crisis is a huge positive catalyst for increasing digitalization at all levels. Just think for a second about the implications of the new apps which will be used to track down the infection. There is the need to protect the user’s data, the need for a blockchain-based decentralized app in which tokens can be programmed to allow the access to the data only to some authorized users and only upon certain circumstances. This is just an example, but there are dozens of opportunities. Tokenization of assets, both real and digital is the future, and this is just about to start. I cannot even imagine what will be the new possibilities and new use cases in just a couple of years.

Do you have any advice for the industry about how to get the most out of the current situation?

Those most at risk in this crisis are young startups which might run out of funds and find it very difficult to raise new capital. They should keep their costs under control and concentrate on technology-development and their new products and services. Simply put, keep the head down and make the vision become a reality. The storm will pass, and good ideas, good products and good services will always find a market.

https://www.bianconiandrea.com

https://medium.com/@andreabianconi

https://www.linkedin.com/in/andrea-bianconi-blockchain-law/

https://hackernoon.com/@andreabianconi

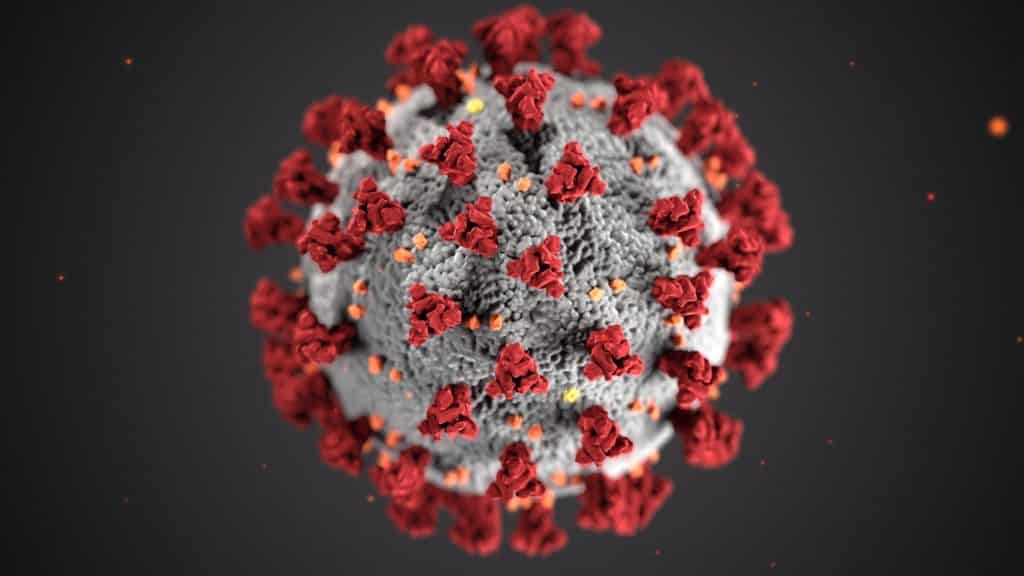

Image by Gerd Altmann from Pixabay

More articles:

How the Corona Crisis Has Shown Us That we Need Bitcoin, Ether & Co.

You Might also Like