Blockchain, DLT and Crypto Assets: Trends and Predictions for the New Year 2020

By Philipp Sandner, Jonas Gross, Marcel Kaiser, Simon Seiter

After 2019, where Bitcoin showed enormous volatility, where companies started to gain more interest in blockchain, where capital markets were envisioned to run on DLT systems, where the Ethereum-centered Decentralized Finance (DeFi) ecosystem grew, we wondered about trends for 2020. From the perspective of Germany, what can we expect from blockchain, DLT and crypto assets in 2020? What are the trends for 2020 in the crypto and DLT space?

Setting the scene

2019 has been a very successful year for Bitcoin, for crypto-assets and for blockchain technology in general. On an annual basis, Bitcoin’s price development has outperformed almost all traditional financial market products such as US and European stocks, bonds and commodities. More generally speaking, blockchain technology slowly starts to become more mainstream.

The German legislator has introduced a new “Crypto Law”, which will come into force at the beginning of 2020. This new law will decrease regulatory uncertainty and will attract startups and investors. Further, the German Government has released a blockchain strategy in summer 2019 promoting blockchain technology in wide fields. From companies — be it financial organizations or industrials — we can observe more and more interest; this includes both the enterprise domain of DLT systems and the domain of crypto assets. As a surprise to almost anyone, Germany has put itself to the forefront of blockchain via establishing broad regulation this year.

Outside Germany, we can observe similar developments in other countries: Switzerland installs progressive regulations; China seeks to become a leader in blockchain; startups from the UK are strongly funded; investors — both interested in crypto-assets and also venture capital — build infrastructure and vehicles to invest.

After the successful year 2019: What can we expect from blockchain, DLT and crypto assets in 2020? What are the trends for 2020 in the crypto and DLT space?

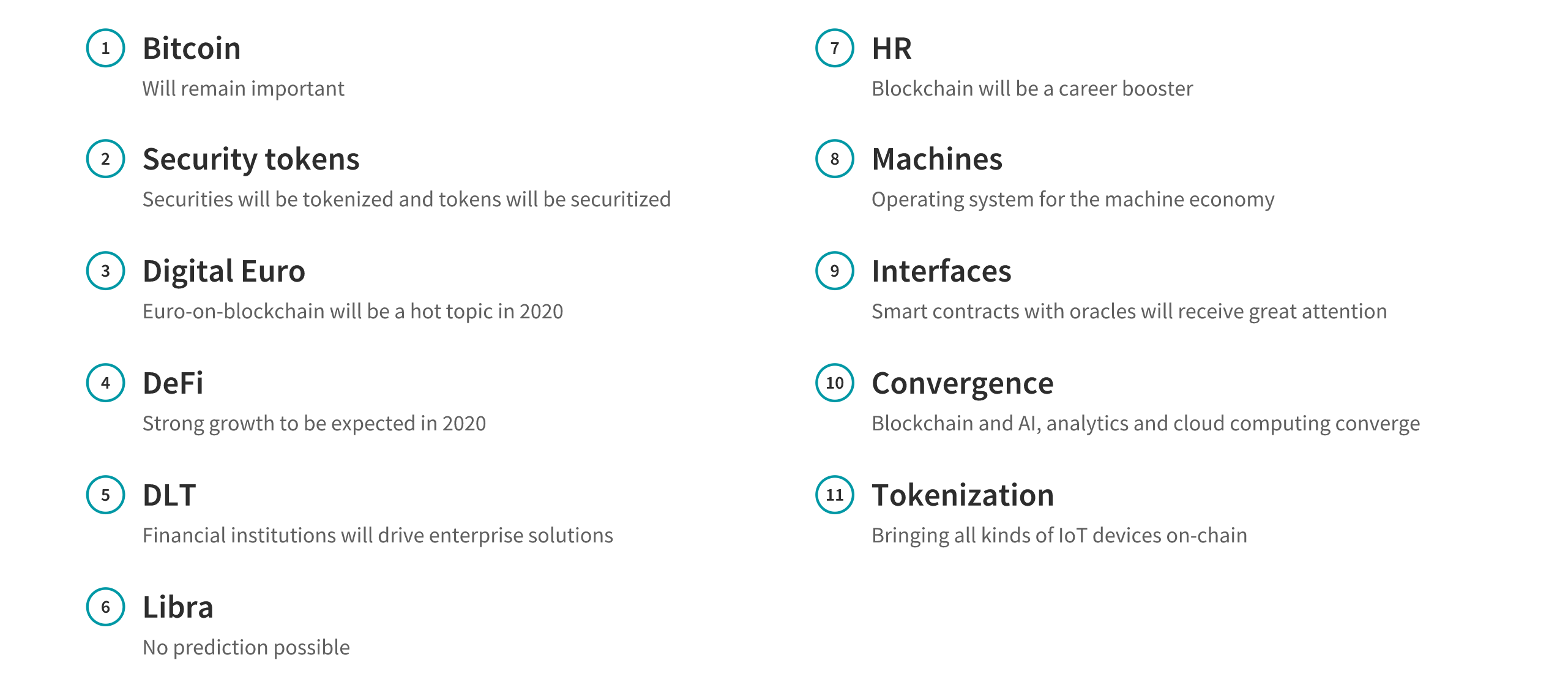

Predictions and trends for 2020

1. Bitcoin: Will remain important

Fuelled around the world by infrastructure and regulatory frameworks for digital assets being built, we will see that a new asset class arises. This class is currently led by Bitcoin: Cryptocurrencies are still the only liquid products in the market and Bitcoin has by far the leading position in this market. We think it will remain the largest digital asset traded, while it might not be the biggest liquidity pool in the long run.

2. Security tokens: Securities will be tokenized and tokens will be securitized

Only a few crypto assets are truly digital at this point in time. We see, however, first movers into tokenization of other assets as well as regulatory frameworks preparing themselves for the broad implementation of digital assets in the whole financial industry. While traditional assets will be embodied in new digital ways (e.g. “tokenize securities”) we will also see new asset classes being put in known regulatory frameworks to make them tradable in existing infrastructure (e.g. “securitize tokens”). This means the convergence of traditional financial instruments and new digital embodiments. Suitable and regulatory compliant infrastructures for digital assets will hence be a tipping point for the adoption of digital assets beyond crypto.

3. Digital Euro: Euro-on-blockchain will be a hot topic in 2020

In 2019, both startups and traditional institutions have issued a regulated, digital blockchain-based Euro via tokenizing E-Money. The digital Euro is not simply a stablecoin since it is issued via an E-Money license such that the tokens are the actual Euro (in a similar mechanism as the Euros are in one’s bank account). Simply put, it is a “stablecoin + regulation”.

The German Government, the Association of German Banks (Bundesverband Deutscher Banken) and players from the German industry have publicly demanded such a digital Euro, which will drive the automation of the German industry by using Euro-based smart contracts.

This makes it possible to leverage the functionalities of the new distributed technology while keeping the stability of central bank money. The European Central Bank (ECB) has announced to set up a taskforce for analyzing the potential issuance of a digital Euro. The recent paper by the ECB about such a digital Euro suggests that a digital Euro could be issued on a blockchain system. If we refer to the digital Euro, we also mean related digital fiat currencies such as the digital US dollar, the digital Yuan, the digital Swiss Franc etc.

In 2020, we will see more companies privately issuing the digital Euro and we will see plenty of companies starting to use the digital Euro in process automation, leasing, factoring, Industrie 4.0, supply chain processes etc.

4. Decentralized Finance (DeFi): Strong growth to be expected in 2020

Decentralized Finance is a rather new topic but we saw major development steps last year. At the beginning of 2019, less than USD 300M has been locked in DeFi. By the end of this year, this value is around USD 700M. DeFi is a collective term for blockchain applications (mainly based on Ethereum) which focus on making financial markets permissionless and inherently transparent.

DeFi is an entire system of interconnected smart contracts. Products such as lending and borrowing, insurance, liquidity provision, exchanges and trading, leveraging and shorting, synthetic financial instruments and more can already be realized with the perks of the blockchain technology. In 2020, we will see more such products. We expect up to USD 2B being locked into DeFi smart contracts — and we will see regulators starting to scrutinize DeFi since they will see that a full-fledged capital market can potentially arise. This could replace a wide array of traditional financial organizations but also exhibit regulatory issues (e.g. AML/KYC not met; prospectus requirements not met).

To really hit off in 2020, experts like Brendan Forster (Dharma) state that it is required to have easier conversion between any crypto asset and fiat money to make DeFi more accessible, insurance in case of failing smart contracts in order to reduce systemic risk, better software oracles to transmit information from external markets and improved management of private keys. If all these criteria are fulfilled, finance can become what it was meant to be.

5. DLT: Financial institutions will drive enterprise solutions

Many prototypes have been made and many studies have been written. But only rarely, real production systems are live or soon to be launched given the tremendous potential of the technology. This process will speed up in 2020. Networks are being built and systems will go live.

The ultimate goal of full-fledged DLT-based capital markets will though not be reached in 2020 but rather in 2022 or later. Then, the local currency would run on-chain as well as securities. This would allow delivery-vs-payment (DvP) to be moved from central clearinghouses to smart contracts executing atomic swaps in seconds.

6. Libra: No prediction possible

Libra has been a blast in 2019. It took a few weeks and suddenly all regulatory bodies and financial institutions were awake. At the end of 2019, it became clear that Libra would not be realized as originally planned (as a basket of currencies and bonds).

However, the codebase of the Libra project is one of the most active ones we currently see. Also, experts speculate whether Libra could simply use standard licenses (e.g. E-Money license) to tokenize existing currencies in a straightforward way. No basket, no mix between currencies and bonds. Rather, straight forward tokenized money similar to the digital Euro.

If Libra takes this route there would be enough room to comply with regulatory requirements and go live for dozens of millions’ users. Maybe not hundreds due to the difficulties of KYC procedures. The idea of a basket mixing currencies and bonds could then in the long run easily being done as a “passive investment smart contract” on the higher layer when individual currencies are tokenized on the lower layer. Think LEGO bricks that together form a house, but first, you need to have the single bricks.

7. HR: Blockchain will be a career booster for employees dealing with this technology

We believe that blockchain technology and its increasing importance have the potential to positively affect the career path of interested persons since there is a lot to do over the next few years — and even decades — within this dynamic and fast-growing segment. We expect the demand for skilled personnel significantly increasing as of 2020 while the supply in the job market develops relatively slow.

This way, the risk of losing a job (e.g. in the financial sector) as a result of increasing digitization and automation can be minimized due to outside options that start to appear in the entire economy due to companies searching for blockchain experts. Blockchain technology will not disappear but rather grow. It will drive the automatization of business processes and the German industry and the digitization of a wide variety of products (e.g., cars, machines, trucks — just to name a few).

8. Machines: Blockchain will become the operating system for the machine economy

As outlined above, smart contracts have tremendous potential for the German industry. Combined with a blockchain-based Euro (see also above), this will enable Euro-denominated smart contracts and drive automation and digitization.

Once all kinds of machines, all kinds of mobility devices (e.g. cars, trucks, trains), all kinds of sensors are connected to blockchain networks, these IoT devices can participate in financial transactions directly. This will allow a broad set of new automated business models once these IoT devices start to interact with financial markets through pay-per-use, leasing, factoring, securitization or new ways of financial instruments we do not even know yet. So far, we mainly talked about industries such as automotive or machinery but of course, other industries will also discover blockchain: utilities, medical technology, etc.

In 2020, we will see industrial companies that offer such machines, cars, sensors etc. connecting their devices to blockchain networks. They will also discover the broad variety of process automation and automated business models that might be possible.

9. Interfaces: Smart contracts in combination with oracles will receive great attention

Companies that offer interfacing solutions between software (e.g. oracle solutions) and IoT hardware (e.g. crypto chips with private keys, embedded systems) will become more and more important. We saw the first developments here in 2019. Especially in the industry, so-called hardware oracles enable to combine off-chain data (e.g. data or measurements) and blockchain systems. Powerful tools can be created with the interplay between smart contracts and oracles.

10. Convergence: Blockchain will converge with AI, analytics and cloud computing

Once more progress has been made in this area, we will see innovations like blockchain, AI, data analytics and cloud computing to converge. Until now, startups, larger companies and the public administration are giving their best to understand the single “technology silos”. But it is reasonable to expect that as of 2020 convergence of these technologies will take place even though these individual technological domains are often not fully understood yet. We will see more projects in areas where multiple of these technological domains are touched.

11. Tokenization: Bringing all kinds of IoT devices such as sensors, machines on-chain

Blockchain technology can be particularly beneficial for the dematerialization of assets, which is commonly known as tokenization. Assets, such as sensors or other IoT devices, can be tokenized and then get the status of an autonomous entity.

For example, tokenizing a street lamp leads to the situation that payments can be made directly to the lamp, triggering the lamp to turn on. The city council would pay for the evenings by default; a resident, that demands high security could pay for the lamp to shine throughout the entire night. Double payments by multiple interested persons would be avoided. The lamp could also carry a camera and weather sensors for which the same on-demand-logic would apply.

Such tokenized assets can also be made available for investors. Consequently, investors could be willing to build and maintain these lamps on a full scale. In return, investors would receive their share on the lamp’s profits. This application is a potential game-changer for infrastructure and capital investments and will be further developed in 2020.

Conclusion

Blockchain, in general, provides tremendous benefits in the field of finance as it can enhance security, transparency, immutability and data privacy of transaction data. Even more so, it will be the basis for most financial transactions and — once smart contracts are adopted — it will also be the basis for a wide array of fully automated financial services.

Why do organisations not fully embrace blockchain yet, as it seems? In our opinion, this is due to the high regulatory burden for financial corporations. But here, governments are changing laws to remove frictions between decades-old law frameworks and dematerialized assets and rights based on blockchain, crypto assets and DLT. Also, executives and decision-makers have often not understood the potential of blockchain to a sufficiently required degree. One reason for this is that understanding blockchain takes time. In the heavy-loaded calendar of executives, there is maybe room for a 30-minute blockchain presentation by an external expert but not enough room to really understand the technology and its potential.

Yet, this will not prevent the uprise of this technology. We believe that organizations should intensively deal with blockchain technology in order to leverage this brilliant technology. The reason is simple: In 10 years, there will hardly any finance, transactions, assets without DLT.

Given the huge opportunities ahead, it is worth it to dig into this technology.

If you like this article, we would be happy if you forward it to your colleagues or share it on social networks. More information about the Frankfurt School Blockchain Center on the Internet, on Twitter, or on Facebook.

Prof. Dr. Philipp Sandner is head of the Frankfurt School Blockchain Center (FSBC) at the Frankfurt School of Finance & Management. In 2018, he was ranked as one of the “Top 30” economists by the Frankfurter Allgemeine Zeitung (FAZ), a major newspaper in Germany. Further, he belongs to the “Top 40 under 40” — a ranking by the German business magazine Capital. The expertise of Prof. Sandner, in particular, includes blockchain technology, crypto assets, distributed ledger technology (DLT), Euro-on-Ledger, initial coin offerings (ICOs), security tokens (STOs), digital transformation and entrepreneurship. You can contact him via mail ([email protected]) via LinkedIn (https://www.linkedin.com/in/philippsandner/) or follow him on Twitter (@philippsandner).

Jonas Gross is a project manager and research assistant at the Frankfurt School Blockchain Center (FSBC). His fields of interest are primarily cryptocurrencies. Besides, in the context of his Ph.D., he analyzes the impact of blockchain technology on monetary policy of worldwide central banks. He mainly studies innovations as central bank digital currencies (CBDC) and other crypto currency projects as “Libra”. You can contact him via mail ([email protected]), LinkedIn (https://www.linkedin.com/in/jonasgross94/), Xing (https://www.xing.com/profile/Jonas_Gross4) or follow him on (Twitter Jonas__Gross).

Marcel Kaiser is a project manager and research assistant at the Frankfurt School Blockchain Center (FSBC). His expertise is primarily decentralized finance (DeFi) and industrial blockchain applications. He analyzes the impact of blockchain technology on the economy in his master thesis. He speaks at public events about topics like Libra, quantum cryptography and blockchain in general. Feel free to contact him via mail ([email protected]), LinkedIn or Xing.

Photo by Emile Guillemot on Unsplash

More Articles:

Could blockchain have prevented the 2020 US elections´ fiasco?

Fight wealth inequality with blockchain and tokenization

You Might also Like