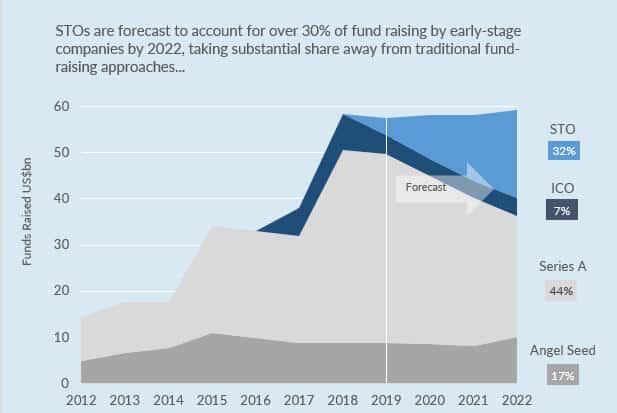

Security Token Offerings poised to account for 32% of early-stage funding by 2022

Paris based management consultancy, Opimas, has released their recent study of the impact and potential of Security Token Offerings (STOs) to the market for early-stage funding.

While co-founder of Opimas, Axel Pierron, calls for a healthy dose of realism when looking at the promises brought on by the STO enthusiasts, the report clearly concludes that the benefits offered by tokenized assets will transform the funding models – especially for early-stage funding – significantly over the coming few years.

Opimas lists the main advantages that STOs bring to the private markets

- The asset to be tokenized is already a financial one.

- Tokens have the capacity to embed shareholder agreements into self-enforcing smart contracts.

- This is a market that, despite numerous attempts to revamp its infrastructure, is still very paper intensive, requiring significant manual labour in post-deal administrative and accounting tasks.

- The time horizon of institutional investors in private markets, which tends to be mid-term, is well suited for the type of trading velocity that can be handled by the blockchain infrastructure.

Opimas highlighs that despite obvious advantages, there are still challenges to this new industry: “The challenges when trading many of these assets is not the lack of proper infrastructure, but the expertise required to operate in these markets and the resources needed to ensure proper maintenance of these assets in the physical world” says Axel Pierron.

As STOs gain traction in the market, they are also set to impact the existing stock markets as companies funded by STOs will be less likely to convert these tokens to traditional stocks or migrate from a blockchain based infrastructure to the legacy systems currently managing publicly traded stocks. “Therefore, it is quite probable that eventually, STO adoption in private markets will cause the attrition of traditional IPOs and, over the longer term, pose a clear threat to investment banks that usually get 3-7% of the deal size when taking firms public and also to central securities depositories (CSDs),” explains Axel Pierron.

As it is still early days, many or most players are still taking a wait-and-see approach, but Opimas concludes that “The size of the STO market, the threat that it could eventually represent to legacy infrastructure providers, and the significant potential upside are driving a limited number of incumbent players—mostly exchanges—to beef up their offerings and develop partnerships with FinTech providers. “

Read more about the report on Opimas’ website.

Read More Articles:

The new Growth Prospectus Regime: a Potent Instrument for Security Token Offerings

A new wave of Security Token Offerings: digitizing alternative investments

You Might also Like