What happened to STOs? A breakdown of the current market

Written by Darpan Kumari – research by Blockdata

Security Token Offerings have been knighted as “the next step in the evolution of the cryptocurrency industry” for some time now, but are STOs actually worth the hype? Security tokens were supposed to be the saving grace we all have been waiting for, after the death of the Initial Coin Offerings (ICO) in late 2018.

Before we jump into the questions like — whether STOs fulfil what they promised, are they fundamentally transparent, are they actually the most reliable crowdfunding mechanism, among others; we need to understand what actually STOs are and what prompted the industry to move towards STOs?

The Beginning Of The Security Token Era…

Blockchain, the underlying technology behind the most popular invention of the 21st century — Bitcoin, changed the fundraising scenario of the world forever, by paving the way for ICOs. The ICOs, also known as Initial Coin Offerings enabled blockchain-based startups to raise capital for their project, in a blink of an eye.

Between 2016 to 2018, ICOs reached dizzying heights and helped projects raise billions of dollars in funds but with this rose the number of scams in the ICO market causing millions in losses. Ultimately, the dazzling rise of the ICO model was peppered by a mix of failed products, high-profile frauds & scams, and the unregulated flow of funding created a sense of general lawlessness that scared retail investors away. Despite the downfall, ICOs raised funds over $21.5 billion in 2018 alone. The unbridled enthusiasm that ICOs once garnered faded with increased scrutiny from regulators and consumers.

The rise of Security Tokens

All this forced the crypto industry to look for alternatives to improve the confidence in the crypto fundraising model and regain the trust lost in a barrage of failures and scams and thus came the Security Token Offerings (STOs). So what are STOs and why did we progress from ICOs to Security Tokens? To answer your questions, fundamentally STOs are the new ICOs or IPOs with digitised forms of financial securities supporting them.

When you participate in an ICO, you get tokens that do not give any rights or obligations; rather they just provide you access to a specific network, platform, or service. On the other hand, the tokens offered in an STO are financial securities backed by tangible assets, profits, bonds, shares, or revenue of the company. The security tokens serve the same purpose as conventional security, except that they confirm ownership through blockchain transactions along with making fractional ownership possible.

Benefits of Security Tokens

With the advent of security tokens, the race for tokenization has accelerated to yet another level. Proposed with a prospect to reduce friction in asset issuance and trading, securitize intellectual property rights, and to enable issuers to tap into hard-to-access liquidity around the world, STOs aim to bring the much needed regulated environment where the fundraisers cannot just disappear to obscurity.

Greater Liquidity With Global Trading Capability: STOs hold the potential to tokenize any asset or financial instrument relatively easily for trading online along with their eligibility for trading on the global scene. The security tokens cherish higher levels of liquidity, as they allow anyone from around the world to participate in the STO. The wider acceptance of the STO fundraising method with increased adoption has also helped in boosting the liquidity levels.

Low Barrier For Entry with Fractional Ownership: By tokenizing assets and eliminating middlemen, security tokens make it more affordable for many low-capital investors to contribute to STOs. They also help smaller, early-stage businesses to raise large amounts of capital quickly without needing to pay huge fees as STOs remove lots of middlemen like brokers, exchange fees, etc., that originally cost huge sums of money.

Cost-effective 24/7 Trading: Security tokens are cheaper than traditional financing models because they can raise funds directly from investors, cutting out expensive middlemen, and making them a great return on investment. Since the tokens are automated through coded programs, there is no need for administration staff to manage contracts which makes STOs a more cost-efficient fundraising method. Also, trading on an STO platform doesn’t come with a time constraint. Thus, STOs provide round the clock access to capital and liquidity for investors on a global scale.

Flexibility For Business Owners and Security For Investors: For business owners, security tokens offer much more flexibility in terms of running their business as they are not tied to a single exchange or beholden to analysts’ recommendations. Also, compliance such as KYC checks or AML checks can be hard-coded into the security token through new standards developed on blockchains such as Ethereum. The STOs provide security for investors as they are backed by something tangible like the assets, profits, or revenue of the company, and which offer legal rights such as voting or revenue distribution to the investors.

Truth or Mirage?

So the security tokens protect investors to a certain extent as Security Tokens are subject to federal laws that govern securities. That’s it! Isn’t this the saving grace we all have been waiting for — a world where we digitize assets and put them into a liquid format, making them accessible to people and entities that previously did not have any access to them? Well, having an organization, company, or nation/states which are governed via blockchain and where each “token” held is a vote on something which is then executed immutably is a beautiful idea, but only if it were true! Till now the idea of such a setup has not been materialized and has only made into whitepapers designed to raise funding!

The young STO market is still very risky for both businesses and investors. Also, as of now, nothing has been extensively tested in the long-term and there is not much legal precedent to rely on which gives regulators excessive power to change their minds at any time.

We are not being anti-STOs here and do not wish to undermine the ‘financial revolution’ that STOs might bring in their truest form. But apart from the various problems that we have stated above, our research of STOs tells us that this financial invention is currently far from what the Security Token proponents want it to be!

At Blockdata we have studied over 118 STOs to determine if Security Tokens have accomplished what they were invented for? Are they actually better? More trustworthy? More legit?

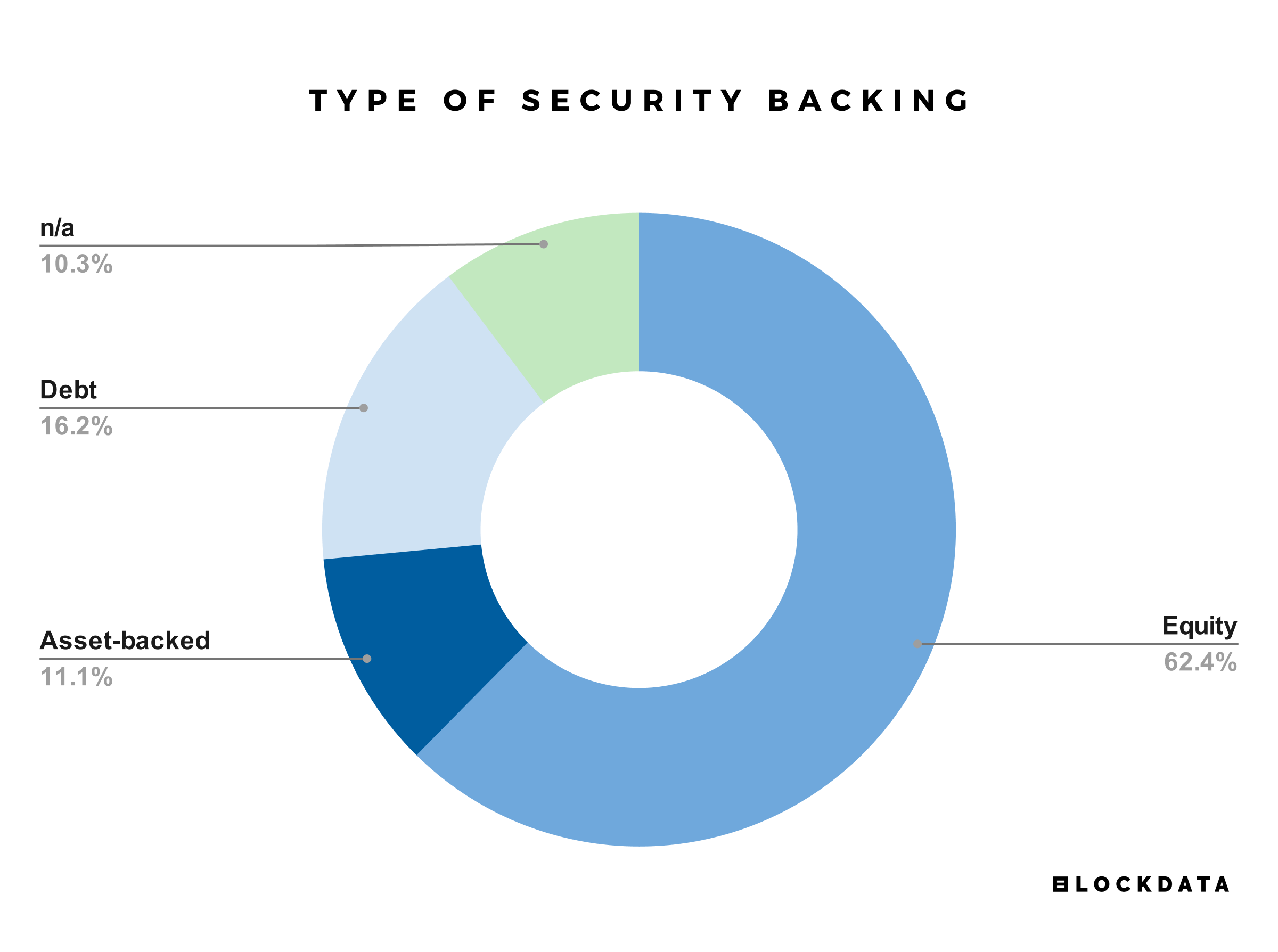

Before we break out the truth about STOs, let us understand the underlying assets. A part of our research has focused on the security backing behind STOs to truly understand the current wave in the crypto market.

Types of Securities

- Equity securities: We all have heard the word ‘equity’ everywhere from news to general conversations of ownership and it actually means the same you imagine it to. Equity refers to stocks and a share of ownership in a company held by a person/entity. The people who hold equity are known as shareholders and these equity securities usually generate regular earnings for them in the form of dividends.

- Debt securities: These securities involve borrowed money and the selling of a security and include a fixed amount (that must be repaid), a specified rate of interest, and a maturity date (the date when the total amount of the security must be paid by). Debt securities are issued by an individual, company, or government and sold to another party for a certain amount, with a promise of repayment plus interest.

- Derivatives: These are the securities with value based on an underlying asset that is then purchased and repaid, with the price, interest, and maturity date all specified at the time of the initial transaction. Derivatives are used for various purposes, including hedging and getting access to additional assets or markets.

In our research, most of the STOs, i.e., 62.4% were backed by Equity Securities while more than 16% were backed by Debt securities and about 11% were asset-backed STO. However, for 10.3% of the STOs in our study, we were unable to trace the actual asset backing them! These firms simply announced the STO but failed to outline a map regarding the type of security underlying the tokens.

What is The Favored Token Standard in The Security Token Offerings?

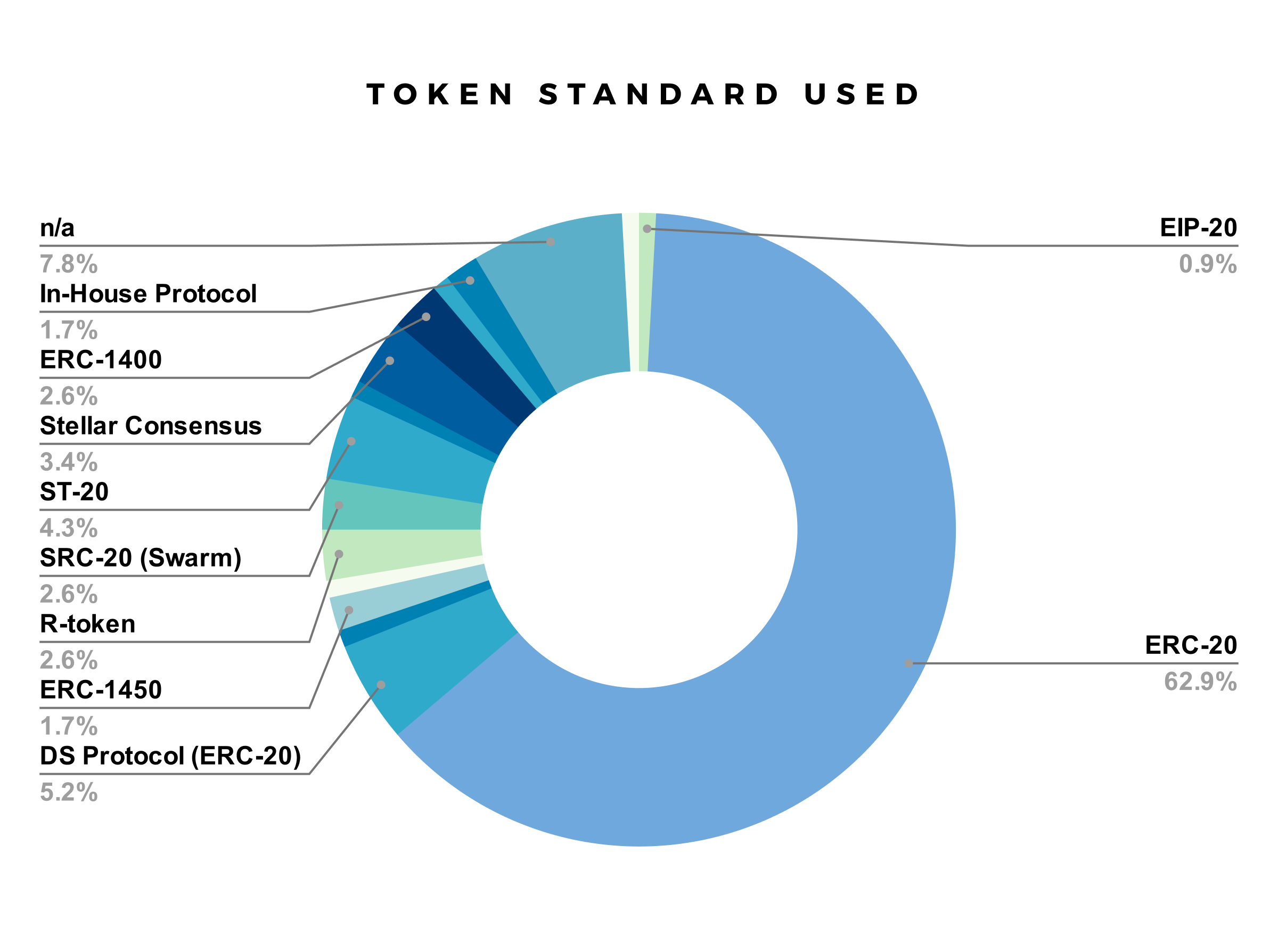

From our above discussion, we gathered the fact that equity tokens are the most favored STO type. But when it comes to the token standard used, we observed that the most popular vehicle for STO’s has been the ERC-20 token standard on the Ethereum platform, holding over 62% of the market share. ERC-20 is not just a piece of code, software, or technology rather, it is guidelines that facilitate the integration of various currencies on the Ethereum platform. One of the reasons behind the wide acceptance of ERC-20 standards can be attributed to its simplicity and continuous evaluation.

Also, a large number of developers have adopted the ERC-20 standard, giving companies a pool of talented developers who helped them implement ideas by the creation of ERC-20 compliant tokens. But the most crucial aspect behind such capitalization of ERC-20 token standards is the compatibility that these tokens provide. By creating an ERC-20 compliant STO on Ethereum developers ensure that the new token provides immediate interoperability with all other tokens on the Ethereum blockchain. The ERC-20 protocol creates a bridge so that all ERC-20 tokens can easily be interchanged with other ERC-20 tokens, thus are the most favored in the market.

STOs Boom in 2018, Both in Figures and Funding

In our analysis, one of the first things we observed was the relative boom of STOs after 2017, especially 2018. More than 50% of the 118 projects we researched were established in 2018. This information has been verified in a report published by Pricewaterhouse Coopers (PWC) in collaboration with Crypto Valley, in 2019. The report states that in 2018 a collective of 1,132 Initial Coin Offerings (ICO) and Security Token Offerings (STOs) were successfully completed, more than double the number in 2017 (532). The funds raised by these projects differ in the same magnitude as the boom of projects, in the respective years. For instance, two STOs that took place during 2017, raised a total of roughly $22 million, while 28 security token offerings raised $442 million collectively during 2018.

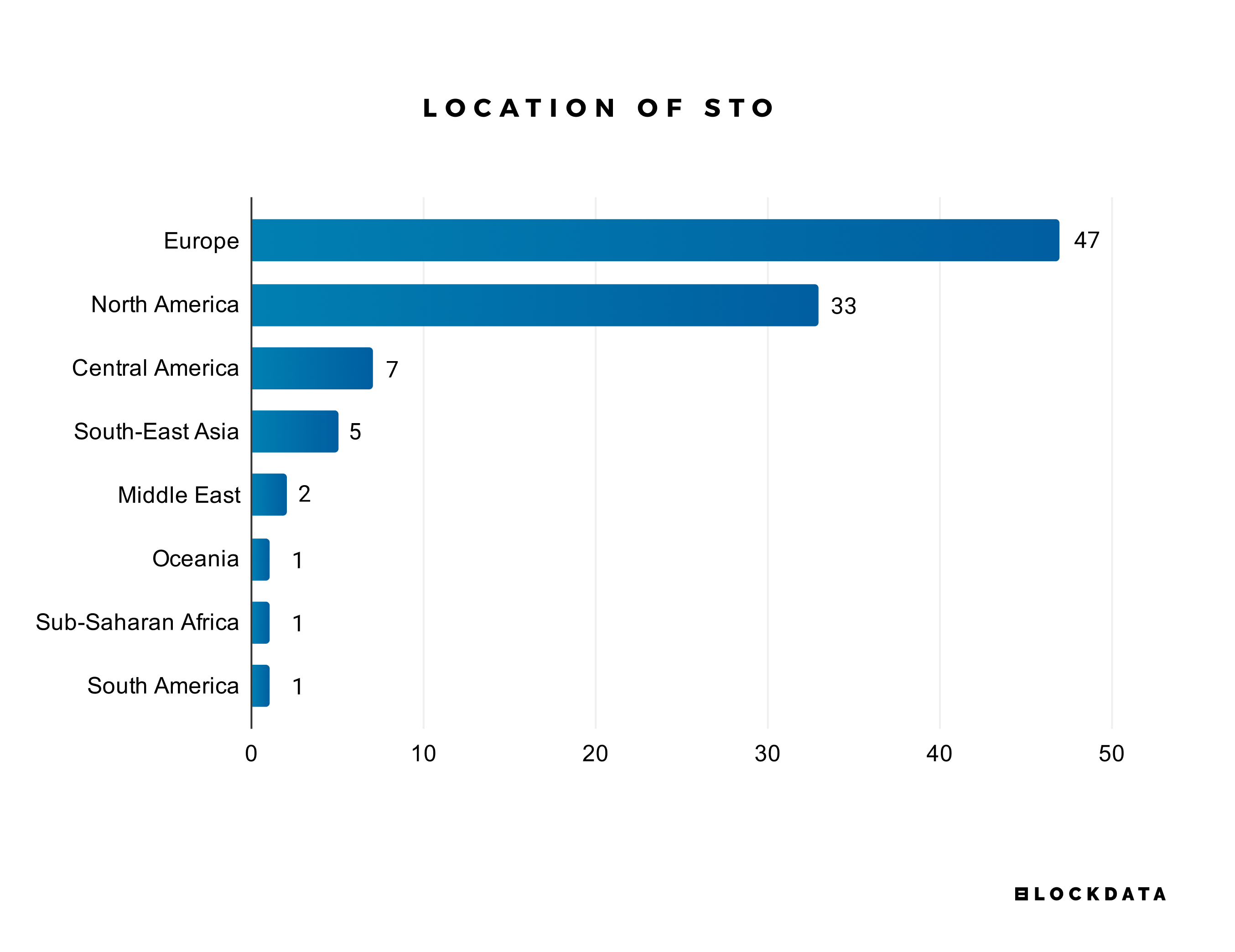

We saw that STO projects were mainly concentrated in Europe and North America. Together Europe and North America hosted about 70% of the total projects and lead the STO fundraising innovation. But when it comes to the volume of funds raised the trend reflected is not the same as we observe in the number of projects. Although Europe has the most STO projects, yet according to our research the Security Token Offerings in the United States have raised the most funds. ( Well, there have been few instances where STOs have not disclosed true figures of funding they received or have exaggerated these figures. All this has made it very difficult to come up with an accurate chart but we have tried to keep the figures as authentic as possible. )

*The above statistics were gathered at a best-effort across multiple data sources on STOs, therefore there may be possible discrepancies

Let Us Get To The Point…

Many insiders in the Blockchain and Crypto market call STO ‘everyman’s IPO’, as they believe that security tokens give everyone the chance to invest in the asset of their choice. Well, theoretically security token represents an electronically wrapped stake or share in a private interest or company, with the potential to extend to assets such as real estate, trusts, LLC, fine art, and so on. But have these STO funding rounds necessarily proved to be a better secure form of funding as opposed to the highly controversial ICOs?

How Transparent have the Projects been?

The whole purpose of having STOs is that they are “a more mature and regulated form” that “combine many good features of ICOs” including “low entry barriers for investors” and “traditional venture capital [and] private equity fundraising characteristics.” But our research showed us that a fairly large number of STOs (40 projects out of 118) have not disclosed how much money they have raised, nor have they publicized date of closure of the STO sales. This has left many investors and other involved people pondering what actually happened? A number of projects (about 11–12) have completely gone off the radar. Some of these projects do not have any social media presence for one and in some cases even two years! The more blunderous fact is that some of these STOs don’t even have a working website for the project.

Though the Security Token Offerings are supposed to be regulated and approved by some regulatory body — like U.S. Securities & Exchange Commission (SEC). But we found that a large number of STOs are still awaiting licenses by regulators, many of which have not transpired.

So Where Have STOs Finally Reached?

STOs started with a great idea of bringing more transparency and maturity to the sinking ICO market. But the security token market clearly is in a holding pattern for now, with most ideas making only to the whitepapers not actually getting inculcated into the product. We ventured throughout the lifespan of STOs and found how Equity tokens are favorite among STOs. We also saw how ERC-20 protocol is a real star among developers as all token issuers utilize ethereum in some form or another and the interoperability that these tokens provide with all other tokens on the Ethereum blockchain.

We also discussed that few early adopters are putting an experimental toe in the water, but it will take a lot more for STOs to fulfill their potential and promise to “decentralize finance.” Also, the adoption of STOs faces severe setbacks as many STOs do not have the best publicly available data (some even manipulate their data), making the general public and investors suspect the entire industry! There is no doubt that STOs are the future of fundraising especially as more progress is being made to merge the crypto and regulatory worlds, but this would take some time.

The absence of clear global regulations has been the major force holding STOs down as regulatory frameworks are still in their early stage and require a lot of work to find common standards for this form of fundraising. Once we have a set of specific regulations for security tokens, we would witness a lot more companies pursuing fundraising via STOs. As we make advancements in automated compliance and reduced issuance & servicing costs, digital securities will eventually find their space and true potential in the private markets that are currently seen with traditional private security markets.

Image by Gerd Altmann from Pixabay

More Related Articles:

A new wave of Security Token Offerings: digitizing alternative investments

You Might also Like