How emerging economies can lead the crypto revolution in commercial banking and enjoy an economic renaissance based on sound money

In a recent post Coindesk´s Nic Carter has made a very good case for bitcoin banking. While I share his views on the future that bitcoin will play in revolutionizing the legacy banking sector, I would like to see this issue from a slightly different perspective, that of the emerging economies. The definition of emerging economies is somewhat residual. It includes all those markets/economies which do not make it into the small club of the fully developed economies such as Europe, USA and Japan, to which nowadays China and Russia also belong. Regardless of the definition, emerging economies have in common a relative weakness of their currencies and the risk of sudden capital flights together with a less mature banking and credit system.

This is one of the major factors that hinders local investment and economical development.

The partial dollarization of these economies is a common aspect which at least mitigates the disastrous effects of hyperinflations or double-digit inflations suffered by local populations such as in Venezuela, Argentina or Turkey. The efficacy of capital controls will be in the future greatly diminished by the increasingly global access to cryptocurrencies. Emerging economies, therefore, will be on an accelerating path towards currency substitution for both cryptocurrencies and crypto-fiat currencies (i.e. stablecoins) — such as bitcoin or Tether/USDt, true USD or USDC — which are easily available and which will tend to gradually replace national currencies.

Counterintuitively perhaps, favouring a seamless integration and exchange between the local currency and foreign stablecoins while promoting a bitcoin centred banking system — rather than a US dollar centred one — is the solution that emerging economies need to immunize their markets from currency substitution, strengthen their banking systems and drive investments into the local economy.

The economical and geopolitical risks of the dollarization are very well known. How then a bitcoin centered economy can function while maintaining at the same time the local currency and its full exchangeability with both bitcoin and other national currencies and stablecoins?

The Lost art of commercial banking

In 1974 E.C Harwood — the American autodidact economist who founded in 1933 the American Institute of Economic Research and predicted both the 1929 Great Depression and steered his clients into gold investments anticipating the 1970s inflation — wrote on the “Lost art of commercial banking”. At the time — following Nixon´s 1971 infamous default on the US dollar and the breaking of the peg between gold and the US currency — the issue of money debasement was very much the talk of the moment.

E.C. Harwood pointed out that the period between the end of 1800 and 1914 pre-WWI, “represented the peak of development for Western civilization in monetary matters. It facilitated commerce and made possible long-term accounting records that were meaningful rather than fictitious. Not only commerce between nations but also the great increase of useful capital was encouraged by the growth of savings institutions, life insurance, and pension funds”.

It is widely acknowledged that this period likely marked the farthest advance achieved by the human race in the evolutionary development of a money-credit system that could serve modern industrial society. It is also a fact that at the time gold was the common international monetary base for all the leading industrial nations of the world and many others.

But Harwood was not a gold standard radical. He was a pragmatic, full of common sense, not an ideologist. He knew the monetary history and proposed practical solutions to the very well known problems of fiat money debasement at a time of growing globalization and trade.

Indeed, he also criticized the more radical position of the proponents of the 100% reserve gold standard “who would restrict the purchasing media in use to gold and perhaps silver coins or paper currency and to checking accounts directly representing these. They would go back to medieval times before the earliest beginnings of sound commercial banking. How they would cope with the flood of products to be marketed in a modern industrial civilization they do not suggest. Others among the gold-standard advocates offer a simplistic solution, raising the “price” of gold and restoring convertibility of currencies to gold. They seem not to realize that a huge volume of inflationary purchasing media exists and is polluting the money supplies of the world just as would multiple billions of counterfeit currency.”

In fact, not even the gold standard did by itself solve the problems of money debasement unless one applied what he defined “the basic principle of sound commercial banking”, the lost art of commercial banking. So what is this lost art?

The proper functioning of a commercial banking system is vital for the development of capitalistic economies. Its two primary functions are savings and lending, which revolve around making a profit between the interest rate paid on savings and that charged on the loans. But banks can lend either by drawing from the deposits/savings they collected or by creating new money. Harwood posits that the discriminating factor is to create new money only when such money goes into productive investments, which is when this money increases the quantity of goods and services in circulation (i.e a company builds a plant to manufacture cars) and not when this money finances consumer spending or any other non-productive investment (i.e an individual gets a loan to buy that car). In the first case, the banker can create new money because this is non-inflationary. In the second case, the purchase shall be rather financed by drawing from savings/deposits because creating new money — not offset by an increased amount of productive goods — would be inflationary.

Despite the gold standard being effective at the time, banking crises like that of the “Wildcat” banks or the Scottish banks happened whenever banks neglected to apply this basic principle of sound commercial banking and went on a money-printing frenzy. It was the free banking era after all and banks went bust frequently.

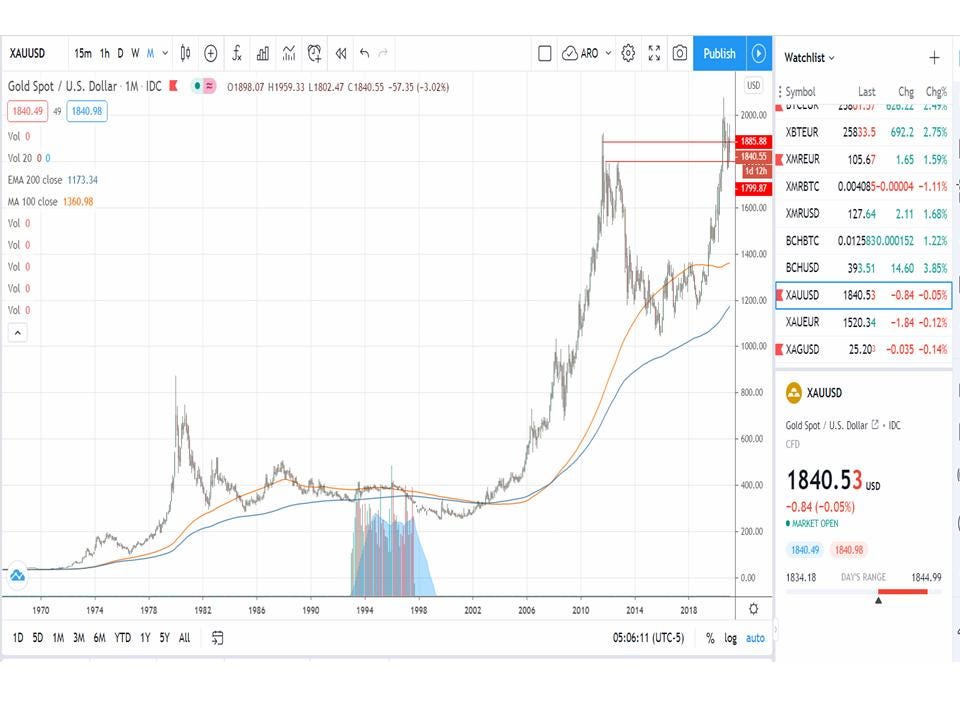

Today this does not happen simply because there is no anchorage between fiat money and a real asset like gold. But the effects of massive debasement are the same, except that they are watered down in time and not immediately apparent due to central banks interventions, manipulations and bailouts. Just look at this chart of gold vs. the US dollar to see the inflationary loss of purchasing power since the gold/dollar peg was removed in 1971 at US$35. Today you need US$ 1830 to buy one ounce of gold. That´s a 52x increase in 50 years.

The opportunity for emerging economies: a bitcoin centered commercial banking system

Now let´s fast forward to 2021 to see how E.C. Harwoods´ responsible commercial banking could be practised today .

The first consideration is that it is unlikely that we are going back to a gold standard of sorts. Or at least not like it was before. For a number of reasons, our economies and societies need today a different kind of hard asset/sound money on top of which a new financial system can be built. And gold does not fit this use case for a number of reasons, among which those three are the most important: (i) gold audit is subjective. Auditing a gold reserve implies trusting the auditor. It is a subjective valuation, not an objective one. (ii) gold is difficult to move around and it is complicated to withdraw and expensive to custody. Those are workable issues for central and bullion banks but they are major obstacles for smaller commercial banks and their clients. (iii) it is impossible to keep track of gold claims. Gold is rehypothecated multiple times in a fractional paper system and it cannot be ascertained how many claims/IOUs are existing on every ounce of physical gold. Some sources say over 100. Some say even more. Basically, the hyper financialization of paper gold makes it worthless as collateral unless you are prepared to hold it physically. If you don´t hold it, you don´t own it. Full stop.

Certainly gold still plays an important function in the international monetary system at the level of governments and central banks. And it will be likely used in what some call the “monetary reset” or a new Bretton Woods, where world governments and central banks decide to re-monetize gold at a price multiple times higher than today´s price to balance out their massive debts and shore up their fast inflating fiat currencies.

Below that level though, a new hard asset/sound money is needed to perform the reserve function in a modern digital commercial banking system. An asset that can be easily deposited, withdrawn, custodied and 100% reliably and objectively audited.

And that asset cannot be other than bitcoin.

The reasons why bitcoin is digital gold and much more, I have explained in a number of articles before such as here and here. I have also made the case here for central banks in smaller countries and developing economies to hold bitcoin rather than gold as a monetary reserve.

The fact that bitcoin is 100% auditable for Proof of Reserve and it has zero cost of carry and can be easily self-custodied and withdrawn to a personal wallet, make it the perfect modern reserve asset and collateral upon which a solid banking infrastructure can be built to make E.C. Harwood virtuous commercial banking reborn.

For one it will force commercial banks to create fiat money only within certain strict parameters without engaging in monetary exuberance because everyone can see transparently and in real-time on the blockchain the amount of new crypto-fiat currency created by the bank and contrast it with the amount of bitcoin held by the bank as a reserve. Second, if the bank goes overboard with crypto-fiat creation, the depositors can withdraw the bitcoins lent to the bank thereby increasing the risk of a bank run. Banks therefore will have the incentive to remain virtuous — within accepted parameters — if they want to remain solvent. There will be no bailouts. The market will be free to price the risks of each bank individually. There will be fully reserved banks which will pay lower interest rates on deposits and fractional reserve banks which will pay higher rates because they will be perceived as more risky.

If you think that I am a just fantasizing, you are wrong. This art of crypto banking is already here, and it is here to stay.

BlockFi founder Zac Prince says “we deliver these banking products, because we’re operating in a crypto first world, at a global and digital scale that wasn’t possible in a traditional banking context. … If we can build this new infrastructure starting from a blockchain and crypto first mind set, still bringing capital from that old world… we can deliver these products against bitcoin, that’s what we get really excited about.”

Translated, with BlockFi you can borrow or lend bitcoins and crypto-fiat dollars. BlockFi taps into traditional cheap dollar credit liquidity pools, swaps fiat for stablecoin dollars (say USDt) and lends it to customers in emerging economies for a higher yield while holding bitcoin as a collateral. They apply strict loan/collateral ratios and liquidate the collateral in case the ratio goes under a certain safety level. The borrower of stablecoin dollars is happy because he can borrow in a stronger currency and at cheaper rates than in the local currency.

Since companies like BlockFi or Compound Finance will firstly target needing customers in emerging economies, the real risk is for the local banking sector to be sidestepped and for the local economy to become crypto-dollarized (via the use of dollar denominated stablecoins). This will have long term undesirable consequences for emerging economies, both geopolitical and economical.

Therefore political and business leaders in such countries should be quick to realize that there is a short window of opportunity to jump into the bitcoin wagon and reshape the local banking sector around a bitcoin centric model rather than a US dollar centric model. At least — in addition to being sound money — bitcoin is both no one´s and everyone´s money and it does not carry geopolitical bias nor risk.

Emerging economies have also the advantage that the local banking system has not yet achieved the full maturity of the US or Europe, which makes the first much more flexible and reactive in adapting to sudden changes vs the latter.

But moving towards the described bitcoin standard in commercial banking is not only a task for the local banking sector. It is a transition process which involves the whole society and needs smart and courageous political leaders and regulators quick enough to grasp the dimension of the opportunity they are facing. If they do, emerging economies can lead this revolution and in 5 to 10 years find themselves in a position of great advantage towards both direct competitors and the developed economies.

A framework to jump start crypto investments and attract crypto capital and human talents

Emerging economies need to develop a competitive framework to jump start the sector and activate a virtuous cycle:

(a) adopt crypto-friendly regulations, mainly dealing with the recognition and the legal status of digitally tokenized assets (such as stablecoins and tokenized securities). The regulatory frameworks implemented by Liechtenstein, Switzerland and US State of Wyoming are good examples (*).

(b) implement an agile crypto bank charter to regulate mainly the issue and the custody of crypto assets, like the one implemented in Wyoming for the SPDIs (Special Purpose Dep. Institutions). AvantiBank was recently granted the charter of crypto bank in Wyoming to custody crypto-assets and to issue crypto-fiat dollars. It is important to note that the US OCC has recently issued an opinion letter which allows US banks to use blockchain infrastructure and existing stablecoins or issue their own. This — if confirmed by coherent governmental policies — might be a radical paradigm change which might trigger a global shift towards crypto banking.

This is an important point that regulators and politicians in emerging economies should carefully consider: the US regulator proposes the easiest and fastest of all the solutions, just plug and play into the Bitcoin blockchain to build a new banking infrastructure. Very smart.

(c ) incentivize the local licensing of crypto exchanges.

(d) adopt a CBDC which shall be 100% interoperable with cryptocurrencies in order to allow a frictionless exchange with bitcoin and stablecoins. A fintech based digital currency — not interoperable with cryptocurrencies — will not achieve the objectives that I have described. Clearly, it does not have to be decentralized nor permissionless like Bitcoin. It is perfectly fine that it is fully centralized to perform the same functions of the fiat currency, but the most important thing is that its monetary supply should be fully auditable on the blockchain, just like stablecoins. Indeed its architecture can easily mimic that of similar stablecoins.

(e) grant incentives to attract both crypto capital/investors and talented human capital. Tax incentives are very important. Money flows where it is treated better. But also human capital relocates where business opportunities and living standards are better or at least where better prospects are offered. Citizenship offered for investment or after a few years of permanence are also sought after. There are plenty of very talented individuals and investors in the crypto sector who are ready to leave Europe or the US to relocate where their money is treated better but also where basic freedoms are truly enforced and the environment for crypto investments is more friendly. It is a fast-growing global movement. At a time in which Europe and the US are rapidly becoming oligarchic run, corrupted to the core, “police states” and high taxes will be introduced to expropriate the leftover wealth of the once productive middle class (not the super-rich of course), emerging economies in South America and Asia can offer safe heaven to crypto capitals and human talents. Small, but politically stable countries like Uruguay (also known as the Switzerland of South America), Costa Rica or Singapore could reap huge dividends from such smart policies.

The bitcoin reset

The lost art of commercial banking described by E.C. Harwood is in essence the foundation of industrial capitalism. Paradoxically, this is exactly what — according to American economist M. Hudson — communist China is doing right now:

“While the US does not gain wealth by investing in means of production but in financial ways, China gains wealth the old-fashioned way, by producing it. And whether you call this, industrial capitalism or state capitalism or state socialism or Marxism, it basically follows the same logic of real economics, the real economy, not the financial overhead. So, you have China operating as a real economy, increasing its production, becoming the workshop of the world as England used to be…”

Fundamentally this is industrial capitalism vs financial capitalism.

“The idea of capitalism in the 19th century… was to get rid of the landlord class. It was to get rid of the rentier class. It was to get rid of the banking class essentially…”

“[Today Americans] say that public investment is socialism. Well, it’s not socialism. It’s industrial capitalism. It’s industrialization, that’s basic economics. The idea of what, and how an economy works is so twisted academically that it’s the antithesis of what Adam Smith, John Stewart Mill and Marx all talked about. For them, a free-market economy was an economy free of rentiers. But now [Americans wrongly assume that] a free-market economy is free for the rentiers, for the landlords and for the banks to make a killing. America has concentrated the planning and resource allocation into Wall Street. And that’s the sort of central planning that is much more corrosive than any government planning, could be.”

This sums up pretty well what fully developed western economies have become: neo-feudal economies, neo-rentier societies, very far from the industrial capitalistic model which made us prosper and lead the world from 1800 until the 1970s. Today China — a country theoretically governed according to communist ideology — has become the true follower of the industrial capitalistic doctrine. And this tells you how the world will shape up geopolitically in the future. The financialization of the economy — initiated in the US and now followed even in Europe — is the terminal disease of western developed nations.

As Unchained Capital´s Parker Lewis puts it, financialization is the “direct result of misaligned monetary incentives, and bitcoin reintroduces the proper incentives to promote savings. More directly, the devaluation of monetary savings has been the principal driver of financialization, full stop. If monetary debasement induced financialization, it should be logical that a return to a sound monetary standard would have the opposite effect.”

Of course there will be dire consequences for the western legacy financial system. The ruling elites will continue to kick the can down the road to preserve the status quo as long as possible. But eventually what is unsustainable will not be sustained and the whole system will need to reset around the only two real monetary assets which bear no counterparty risk, bitcoin and gold.

Conclusion

Definancialization, the end of financial repression and the aberration of negative interest rates, a return to a capitalistic productive society based on sound money, will be all the positive consequences of the system reset. Better still, a new economic renaissance is looming based on hard money and sound banking architectures and principles which are not dictated from above but are the result of the action of free market forces and well-aligned incentives. Emerging economies should smartly position themselves at the centre of the new bitcoin standard. They can be at the forefront of a new economic renaissance which might mimic the successes of the tiny but powerful and wealthy Italian Maritime Republics which have led the world´s economical and cultural development from the end of the middle ages through the renaissance.

They have absolutely nothing to lose and all to gain. Like with bitcoin, this is an asymmetrical bet with unlimited upside potential for emerging economies.

(*) Together with colleagues and fellows at Thinkblocktank.org we have helped governments shape innovative crypto-friendly policies and legislations both at EU level and nationally in Switzerland, Liechtenstein, Malta and Luxembourg.

Andrea Bianconi is an international business lawyer with over two decades experience, a scholar of Austrian Economics, monetary history and geopolitics, a believer in the future of Bitcoin and Blockchain based technologies, a consultant to the sector and a speaker/panellist at conferences and events. Founder and CFO of the Luxembourg based www.thinkblocktank.org, a member of the untitled-inc and an active contributor to the Berlin blockchainhub.net, and the German Blockchain Bundesverband Bundesblock.

© www.bianconiandrea.com — 2020

Disclaimer: All opinion pieces published on The Tokenizer are expressions of the writer’s own opinion, and The Tokenizer or the team of The Tokenizer or Norfico ApS cannot be held responsible for thoughts and opinions expressed in opinion pieces published on The Tokenizer. The content on The Tokenizer is based upon or derived from information generally believed to be reliable although no representation is made that it is accurate or complete and The Tokenizer and Norfico ApS accept no liability with the regards to the readers’ reliance on it.

More Articles by Andrea Bianconi:

And the Covid-vaccine winner is… the blockchain

Could blockchain have prevented the 2020 US elections´ fiasco?

Bitcoin goes parabolic, and it’s not the price!

Image by PublicDomainPictures from Pixabay

You Might also Like