Securitize Acquires Onramp Invest, Extending Tokenized Alts to RIAs Managing $40B in AUM for First Time

Securitize, the leader in expanding investor and business access to tokenized alternative assets, today announced its acquisition of digital asset wealth platform Onramp Invest.

As a result of this acquisition, and for the first time, RIAs will instantly be able to offer their clients investments in top performing alternative asset classes such as private equity, private credit, secondaries, real estate, and more, through the same Onramp Invest dashboard they are already familiar with, increasing and diversifying the investments they are able to manage with the ease of their existing reporting systems. By giving RIAs direct access to Securitize’s alternative investment portfolio, they will be able to offer their clients institutional share classes from top alternative asset managers, lower minimum investments, lower fees, and access to liquidity.

Onramp Invest is the premier advanced digital asset wealth platform for forward-thinking financial professionals. Bringing together everything financial advisors need to safely and intelligently invest in digital assets for their clients, Onramp Invest integrates seamlessly into existing RIA tech stacks like Orion, Advyzon, Wealthbox, AssetBook, among others, and offers leading market research through their academy and various innovative partners in the space. Onramp’s platform serves a community of RIAs across the U.S. representing over $40B in cumulative AUM, as well as recognized asset managers and index providers in the digital asset space like WisdomTree, CoinDesk, Global X, Valkyrie Invest, and more.

Most business value is created through private market alternative investments – that is, investments which are not traditional stocks and bonds listed on public exchanges. As a result of this acquisition, RIAs will now be able to offer their clients access to attractive, liquid alternative investment classes, including:

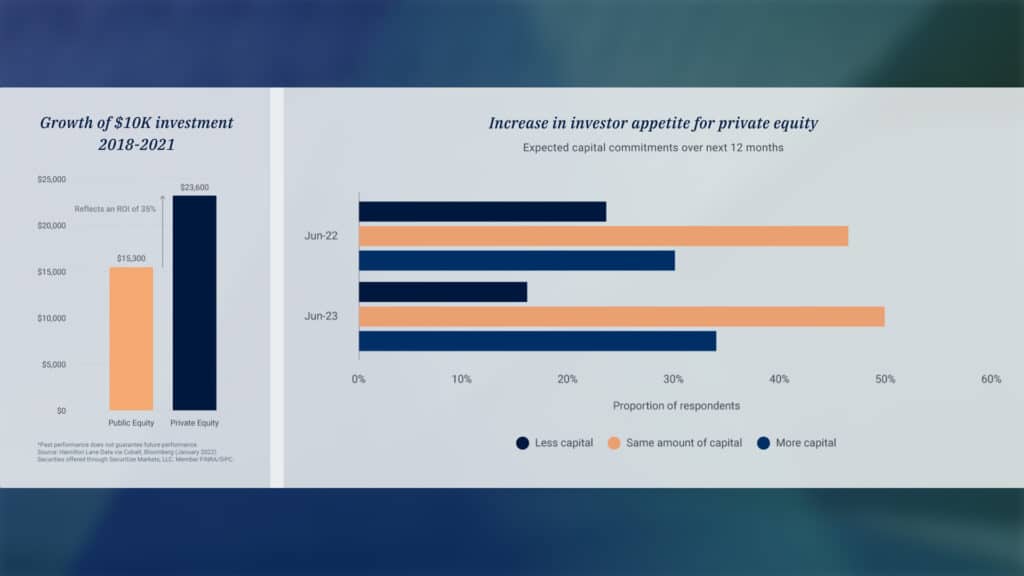

- Private Equity: One of the most exclusive asset classes historically, private equity provides exposure to funds composed of companies that are not publicly traded, and which investors expect to grow significantly over the next year.

- Private Credit: One of the most in-demand asset classes right now, private credit consists of loans or debt investments extended by non-bank lenders, which in the second quarter alone captured $71.2 billion in capital from investors.

- Secondaries: Buying and selling of existing, pre-established stakes in private companies or funds, which as a sector is showing signs of a closer agreement between buyers and sellers—with the median bid-ask spread on new indications of interest declining to the lowest percentage in a year.

“Our acquisition of Onramp is another big step forward in expanding investor access to top-performing alternative assets and in democratizing private capital markets. Onramp already offered RIAs easy access to digital assets, so it is a very natural extension to offer them tokenized alternative assets to complement their portfolios,” said Securitize CEO Carlos Domingo. “Most wealth is generated in private market alternative assets and bringing Securitize and Onramp together enables registered investment advisors to give their clients access to that wealth generation.”

“We started Onramp with the goal of breaking down barriers for advisors to access meaningful investment opportunities for their clients, and there’s no better way to continue that mission than working with Securitize,” said Eric Ervin, Founder and CEO of Onramp Invest. “More advisors would choose alternatives for their clients because the benefits are clear, but challenges like illiquidity and restricted access were previously significant problems to overcome. Securitize solves for this through offering lower minimums, lower fees, and potential for exit liquidity through secondary markets. Tokenization will be a major player in the investment space, and it’s imperative that all financial professionals are able to embrace this change.”

The acquisition follows a partnership Securitize and Onramp announced in March through which its RIA members could access private equity feeder funds Securitize offers with investment giants KKR and Hamilton Lane, and the news last month that Securitize had begun issuing tokenized securities in Europe.

Securitize connects investors seeking to access the wealth generated in the private markets with businesses seeking to raise capital, with shares securely recorded on leading blockchains such as Ethereum, Avalanche, Polygon, and Algorand.

Looking forward, Onramp is expected to continue operating as a subsidiary of Securitize and to integrate Securitize products into their existing offering over time. The transaction is anticipated to close in the next several days and the terms of the transaction were not disclosed.

About Securitize

Securitize is making private equity, venture capital, and other exclusive, real-world, private market assets accessible to a broader range of investors. With 1.2 million investors and 3,000 businesses already connected, Securitize is modernizing the relationship between companies and their investors by digitizing capital raising, investor onboarding, identity verification, and the issuance and trading of securities. Securitize, LLC is an SEC-registered stock transfer agent. Securitize Capital, LLC is an exempt reporting investment advisor. Securitize Markets, LLC runs the alternative trading system and is SEC-registered and a member of FINRA and SIPC.

About Onramp Invest

Onramp is a turn-key digital asset management platform that seamlessly connects traditional and digital asset financial infrastructures. Through Onramp, financial professionals can onboard clients to the digital asset investing ecosystem in minutes, both view held-away accounts and directly invest in digital assets, and access an expanding library of funds, models, indices, and portfolio management services.

Photo by Ryoji Iwata on Unsplash

Read other stories: Backed Brings Tokenized Real-World Assets to Six New Blockchains

Banco Galicia will use Agrotokens as collateral to offer credits to agricultural producers