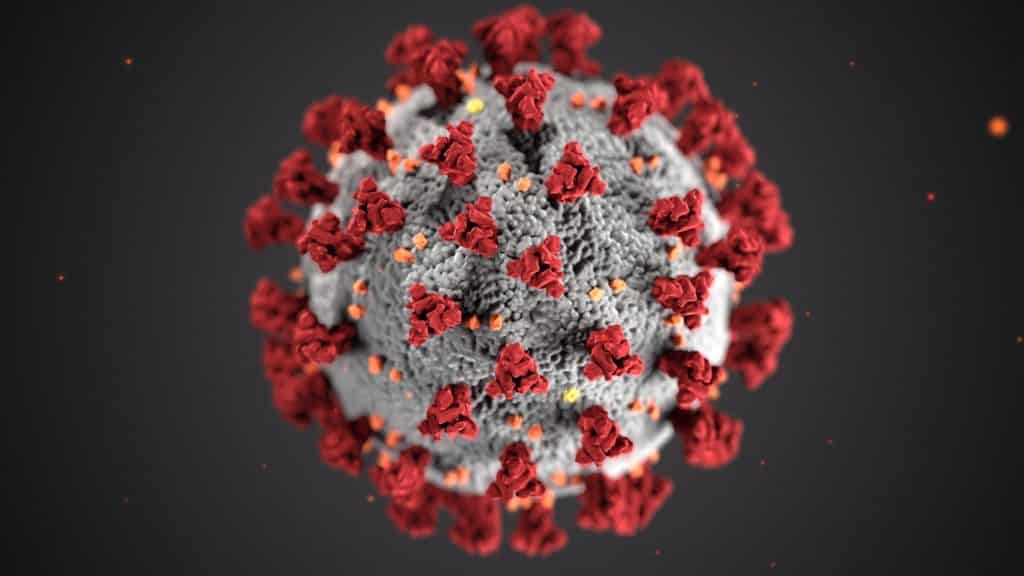

Could COVID-19 boost the tokenization industry?

– an interview with Dr Thomas Dünser, Director, Office for Financial Market Innovation, Government of Liechtenstein

How is the corona crisis affecting you and your professional activities in Liechtenstein?

We are mainly affected by travel and personal meeting restrictions.

What is your analysis of how the crisis may impact the emerging industry of security tokens and asset tokenization in the short and long term?

On the short term, I expect that the lockdown is slowing down the development of the token industry. The investors’ financial capabilities and risk appetite might be reduced, which will affect this development, both active companies and projects. However, in my opinion, the development towards tokenization really cannot be stopped. I rather assume that COVID-19 will lead to a boost for the tokenization industry in the medium and long term.

The negative economic consequences for the overall economy are now readily visible. The long-term damage depends heavily on how long (and how drastically) the lockdown must be continued and for how long international trade chains are restricted. The more jobs that are destroyed, and the more companies that go bankrupt, the greater the need will be to stimulate growth and rebuild the economy after the crisis.

The tokenization industry can and will make an important contribution to this by providing entrepreneurs with easy access to capital.

Does the crisis mean a setback for the development of the industry?

No, I don’t think so. It depends on the financial situation of the projects and running companies. If the crisis causes defaults, this is certainly a disaster for entrepreneurs, investors and employees. It also means a loss for the tokenization industry, because an element of the future ecosystem will be lost. And it is a broad-based ecosystem, with many players, that is key to its acceptance by a broader circle of investors.

But overall, the COVID-19 crisis will boost digitization, so the ecosystem will rather profit from this situation in the long term.

Do you see anything positive coming out of the corona crisis for the security token and tokenization industry?

Yes, as mentioned in the first question, I expect a boost of digitization due to the corona crisis. The tools of the tokenization industry are strongly needed after the end of the lockdown. But we also have to consider that tokenization can be used more than only for investment purpose. Tokenization can actually help to solve many of the problems we have recognized during this crisis: The distribution of financial aids, fraud prevention, theft of respiration protection masks, interruption of the value chain due to closed borders, etc. We know that we have a challenge, we know about a powerful solution with tokenization, and we know that the next a pandemic situation can always happen again. This is a good breeding ground for the future development of the tokenization industry.

Tokenization is part of the overall DeFi trend, and if you look at the current crisis from an overall perspective would you agree that something like the corona crisis where suddenly people are unable to meet up and act in the physical world only confirms that digitization is becoming increasingly important and so are next-generation digitization like decentralized finance solutions?

The corona crisis has shown some problems that could be solved with DeFi, like contactless payments. But the term Decentralized Finance seems to be too narrow for me: The application of the concept of decentralization on the whole economy, let us call this “decentralized economy” or “DeEco”, can actually solve the major problem we have seen in this crisis: The central distribution of goods that is mainly based on personal contact has proven as to be one major weak point of our society. “DeEco” can contribute to reducing the fragility of our society strongly. And tokenization is one important fundament of “DeEco”.

Do you have any advice for the industry about how to get the most out of the current situation?

Every crisis also shows a lot of opportunities. Be conscious and innovative!

Image by David Mark from Pixabay

More Articles:

You Might also Like