Entering Second-Generation Tokenization

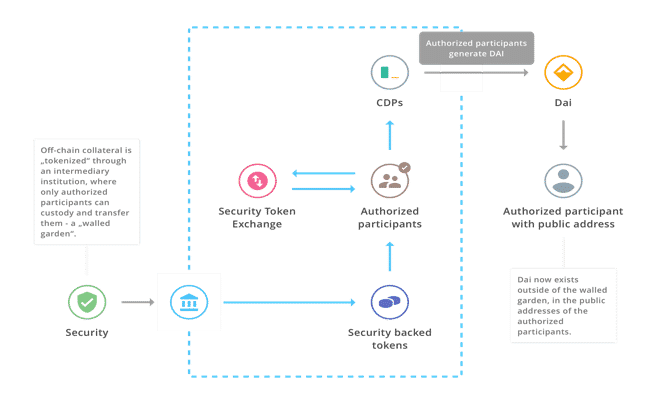

Later this year, The Maker Foundation expects to launch its multi-collateral platform, MCD, enabling both digital and non-digital real-world assets to be used as collateral for creating the stablecoin Dai.

Large scale tokenization of real-world assets helps The Maker Foundation realize the goal of making Dai available to everyone. And at the same time, holders of tokenized assets can increase the liquidity of their assets even further by using it as collateral in the Dai Credit System – introducing a new phase of second-generation tokenization.

Blockchain-based tokenization of many kinds of assets holds the potential of numerous advantages like increased liquidity, easier fractional ownership, rapid settlement, and more. And a rapidly increasing number of companies and platforms around the world are currently offering services for asset tokenization, which we, in the context of this article, will label ‘first-generation tokenization’.

Maker’s coming multi-collateral platform adds a fascinating and promising new chapter to the story of tokenization. Combining first-generation tokenization and the Maker multi collateral-backed stablecoin system allows us to enter a second-generation tokenization phase in which the potential of the tokenized assets will be further developed and utilised – and at the same time it will be possible to create the necessary setup for issuance of sufficient amounts of non-volatile cryptocurrencies to fuel the future token economy.

The Dai Credit System’s importance for tokenized assets

In the Dai Credit System, tokenized assets can be used as collateral in a CDP – Collateralized Debt Position[1]. This enables the owner of the tokenized asset to take out loans in Dai against the collateralized asset and use Dai within the token economy – just like a crypto counterpart to fiat currency – or to exchange Dai for USD, or to leverage the owners’ position and buy more assets to put into the CDP.

Currently, ether is the only collateral available in the Dai Credit System, but in a short while, we expect to see more asset classes accepted as collateral. Because assets like real estate or gold are far less volatile than cryptocurrencies, the Dai Credit System is expected to be much more stable and efficient for users as they will be able to take out more Dai against less volatile assets without jeopardising the security of the system.

In an interview with the CEO of Nomics, Clay Collins, in July 2018, Josh Stein, CEO of Harbor notes:

“I think it [tokenized securities and real estate] has the potential to become the foundation or the basis for Stablecoins. So today, for example, I’m a big fan of the MakerDAO project and some of the other Stablecoin projects that are out there. There is so much friction involved because the cryptocurrencies are so volatile, and there’s so much commerce that wants to be done in what is essentially fiat, and folks are looking for crypto fiat, and that’s what the Stablecoin projects are about.

The issue is, let’s take the MakerDAO for example, you pledge collateral, and in order to get Dai, you have to significantly over-collateralize that contract if you’re using cryptocurrencies precisely because they are so volatile. There is a confidence issue in the value there. And you are vulnerable to a classic run on the bank, a classic loss of confidence that’s catastrophic and causes the currency peg to break. But now imagine a world in which you have a bunch of tokenized securities. You have all these security tokens based on high-quality real estate. So, in other words, assets that are not volatile. Assets that are volatile 10% a year rather than 10% every 10 minutes. In that world, you can imagine folks using those security tokens, pledging them as collateral to produce Dai, and people really trusting these Stablecoins.”[2]

This means the asset owner is able to tokenize the asset and simply trade it on an exchange – which is the core of first-generation tokenization. But in addition, by combining tokenization and the Dai stablecoin system, the asset owner is now able to keep his or her asset and use it to open a CDP and draw Dai at a very low interest rate, which can be used for whatever the asset owner wants.

Furthermore, the asset owner still owns the collateralized assets in his CDP, and can free up the assets and get it back anytime just by paying back the loan in Dai. In the event that the asset goes up in value while being collateralized and held in the CDP, the owner not only gets a very cheap loan in Dai, he also gains a profit because he had his value tied as collateral. This is the core of the second-generation tokenization.

Stein is convinced that tokenization is going to be transformative for the crypto economy. He says in the interview mentioned above:

“So, now imagine a crypto economy powered by fiat currency that you can trust. What are the various things that you can do? When you have a blockchain-based ride-sharing solution. When you have a blockchain-based any other sort of service, look at Harbor’s potential services down the road distributing dividends to folks. Rather than doing that in cryptocurrencies, you could do that in a crypto Stablecoin that people know and trust, and that opens up the crypto economy and the services you can provide in a way that I think is truly transformative. So, tokenizing securities doesn’t just have transformative effects on private capital formation liquidity. I think it will have transformative effects on the crypto economy.”[3]

Asset tokenization’s importance for the Dai Credit System

As described, there is a mutual dependence between tokenization of assets and the further development of the multi-collateral Dai Credit System. For Maker and the Dai Credit System, strong development of tokenization of real-world assets is important for three reasons:

Stability – The stability of the system depends on the collateral in the system. Until now the system has managed to maintain its peg with only ether as collateral. In the long run, the best way to secure the platform’s stability is to have a diverse mix of as many asset types as possible for collateral. As important as the number of collateral types is, the Maker Community’s must have the ability to make a correct risk assessment of each of the asset types and to make sure to have the right spread of asset types.

Growth – All platforms need a critical mass of users to become successful. This goes for the Maker platform as well. The Maker platform is growing quickly, but the acceleration of tokenization of real-world assets and the link to stablecoins has the potential to hugely boost the growth of this platform in the coming years.

Supply of Dai – Dai can only be created through generation of Dai against collateral in a CDP. That is why the scalability of Dai is hugely dependent on the popularity of creating CDPs and generating Dai.

The stablecoin Dai is minted in a CDP against the collateral

in the CDP. This means that for Dai to reach critical mass, a lot of CDPs must be created on an ongoing basis – and a

lot of Dai must be generated against collateral to get enough Dai in

circulation. To secure long-term stability and security, cryptocurrencies as

collateral need to be supplemented with as many different types of off-chain tokenized asset types as

possible.

The Dai CDP interaction process

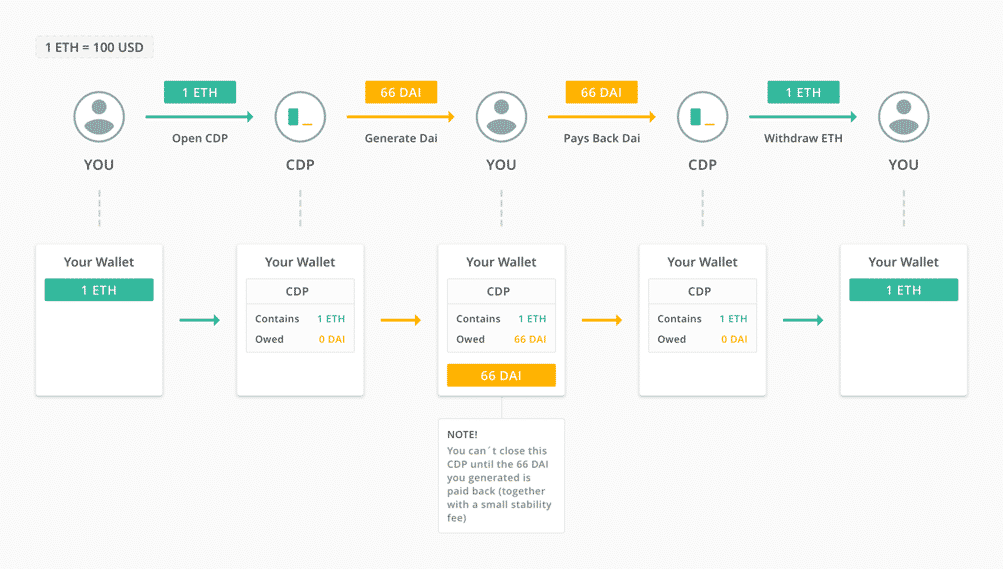

- Step 1: Creating the CDP and depositing collateral

To create a CDP, the user sends a transaction that transfers the amount and type of collateral that will be used to generate Dai to a smart contract in the decentralized MakerDAO system. At this point, the CDP is considered collateralized.

- Step 2: Generating Dai from the collateralized CDP

The CDP user then sends a transaction to retrieve the amount of Dai they want from the CDP, and in return the CDP accrues an equivalent amount of debt, locking them out of access to the collateral until the outstanding debt is paid.

- Step 3: Paying down the debt and Stability Fee

When the user wants to retrieve their collateral, they must pay down the debt in the CDP, plus the Stability Fee that continuously accrues on the debt over time. Once the user sends the requisite Dai to the CDP to pay down the debt and Stability Fee, the CDP becomes debt free.

- Step 4: Withdrawing collateral and closing the CDP

With the debt and Stability

Fee paid down, the CDP user can freely retrieve all or some of their collateral

back to their wallet by sending a transaction to Maker.[4]

This article is based on chapter 6 of The Tokenizer Informational Paper prepared for Maker. You can download the full paper here.

[1] Collateralized Debt Position (CDP): A smart contract whose users can generate a stable asset (Dai). The CDP user has posted collateral in excess of the value of the Dai generated in order to guarantee their debt position.

[2] https://blog.nomics.com/flippening/security-token-documentary/, Part 3 Transcript [17:30]

[3] https://blog.nomics.com/flippening/security-token-documentary/, Part 3 Transcript [19:00]

[4] https://makerdao.com/whitepaper/Dai-Whitepaper-Dec17-en.pdf p. 4