After a long winter, the optimism is back in the crypto world. Sure enough, I also share this widespread feeling…though for mostly different reasons.

By Andrea Bianconi

So What are the Real Reasons Behind the Recent Crypto Run?

Investors have pointed to the Chinese fearing capital controls and to a general flight to safety because of the global geopolitical tensions. Although both motives may well be (temporary) concurring reasons — which incidentally also increases the risk for short term speculative spikes and painful wash-outs — my optimism never faded in this long winter and it is much more long term based because it lies with fundamental factors.

Simply, it is the institutional money — increasingly attracted to the sector — which drives the growth and will continue to do so.

The long term planned allocation of institutional funds is enabled by new services being made available to the sector. And this is clearly a far more important and a long term bullish driver than the temporary/speculative flight to safety of the last month.

Institutional investors have increasingly positive sentiment

Fidelity Investments, one of the largest asset managers in the world, recently announced that it will start trading BTC for its institutional client base. They clearly see the potential. In a recent survey, 46% of their institutional client base expressed their willingness to invest in crypto. And this despite BTC was — at that time — down 80% from 2017 high. Surprising? Not really, institutional investors think long term and are less influenced by short term price fluctuations.

Goldman Sachs, despite outspoken critics, has quietly invested in crypto firm Circle. And Circle is now issuing a new stablecoin, the USDC.

New stablecoins are being created

Also JP Morgan announced its new JPMCoin. It is an important step. Stablecoins are fundamental to enable frictionless transitions from fiat funds to crypto-tokens. The sector cannot appeal to institutional money without trustworthy and well functioning stablecoins.

And the issue here is mainly subjective rather than technological. Can we trust the issuer of the stablecoin? Can we trust that funds are kept segregated? Can we trust that the coin is fully backed up with fiat?

The Tether (USDT) story is revelatory. Leaving personal opinions aside, the facts are that the latest official declarations by the company point to a back-up ratio of 74% of the coins issued, this despite the company had always maintained that the coins were fully backed-up by fiat funds 1:1.

With Tether´s credibility tattered, the JPMCoin — or Goldman´s Circle-USDCoin for the sake of it — are very much needed in order to channel investments into the sector.

STOs and STexchanges are coming

Slowly yes, but this is the key to open the door to investments from the VC sector, from the real estate sector and create regulated markets where tokenized securities can be traded.

The tokenization of bonds/debt is already a fact. But the tokenization of real assets and equities needs to overcome regulatory hurdles in most jurisdictions.

Still, a few countries are getting ready and the rest will — sooner or later — be obliged to follow. A new regulatory prospectus regime is also coming into force in the EU, which will facilitate investments flowing into the sector.

New custodial, clearing and settlement services for institutional investors are being set up.

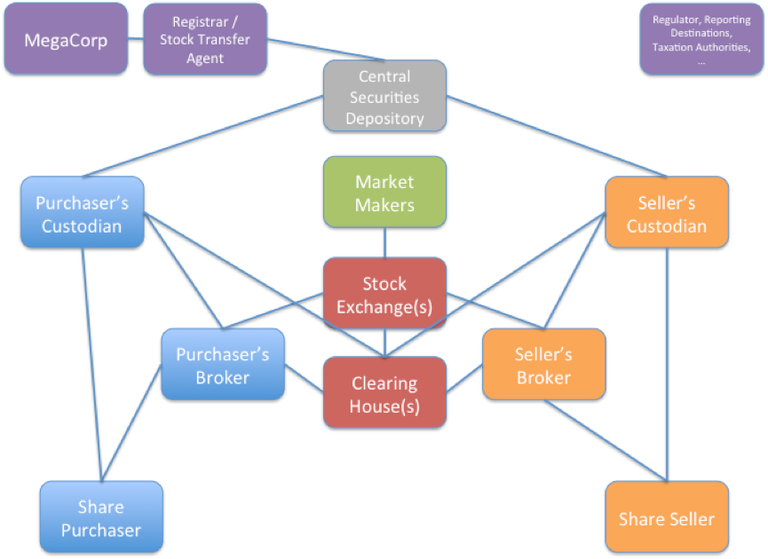

Self-custody, frictionless peer to peer transfer, easy clearing and nearly immediate settlement of crypto transactions are often touted as great benefits and advantages compared with the complexity of the custody, clearing and settlement chains of the legacy financial sector (see figure below).

I tend to agree…but only for us individuals.

The sector can grow exponentially only thanks to the trillions which will be invested by the legacy financial sector. And institutional money does need institutional grade custodial, clearing and settlement services to operate, the likes of what Nomura, JPMorgan, BNY and Northern Trust are interested into and Fidelity starts to offer or BitGo recently announced here.

Clearly, until events like the Quadriga CX can happen, institutional money will wait on sidelines.

Surely this means that some of the complexities of the legacy financial sector (see figure above) will be replicated also in the crypto-sector and that the likes of the DTCC and Clearstream or Euroclear will be needed, but there is no alternative way for institutional money to operate.

To illustrate, in the recently announced services by BitGo one recognises all the tracts of the legacy custodial, clearing and settlement services adapted to the crypto-sector:

– one party acts as trustee, custodian and settler for buyer and seller

– assets are held in trust in segregated accounts (in cold storage)

– firstly an off-chain settlement of the transaction is completed and then the on-chain reconciliation follows

– both parties must have accounts with the trustee to enable the frictionless clearing and settlement of the respective positions

Conclusions

Such new services address fundamental operational issues and risks for institutional investors. The only risk that cannot be taken out of the equation is the solvency risk of the custodian. But this is a risk that the legacy financial system is accustomed to and which will be dealt with more stringent regulations, capital requirements and insurances.

Does this mean that the too big to fail issue — which was one of the core motives for inventing the Bitcoin protocol — is going to become an issue also in the crypto-sector?

Possibly yes, but at least only for the big boys. Let them play the way they like. We individuals can continue playing the decentralized, peer to peer and self-custody game. But — most importantly and despite the daily critics — the big boys like the crypto-game, they want to be part of it and want to make it big so that they can make a lot of money with it.

As a consequence they will mobilize their trillions, they will invest heavily to engineer a suitable for them infrastructure to trade crypto-tokens and this investment wave will lift all boats. And this will be inevitably reflected also in the appreciation of BTC and all correlated cryptos. This process is ongoing and it is irreversible.

That is the real reason for being — long term — very, very bullish in the sector.

Andrea Bianconi is an international business lawyer with over two decades experience, a scholar of Austrian Economics, monetary history and geopolitics, a believer in the future of Bitcoin and Blockchain based technologies, a consultant to the sector and a speaker/panellist at conferences and events. Founder and CFO of the Luxembourg based www.thinkblocktank.org, a member of the untitled-inc and an active contributor to the Berlin blockchainhub.net, and the German Blockchain Bundesverband Bundesblock.

https://www.bianconiandrea.com/

https://www.linkedin.com/in/andrea-bianconi-blockchain-law/

https://medium.com/@andreabianconi

http://thinkblocktank.org/

http://www.untitled-inc.com

More Articles:

You Might also Like