How will Security Tokens Change Financing for Corporations?

Innovations such as distributed ledger technologies affect more and more the financing for corporations. Blockchain technology has the potential to disrupt classical financing and the traditional security business. So-called security tokens — recently, the hottest topic in the crypto world — will play a major role.

By Philipp Sandner, Jonas Groß, Christoph Impekoven, Christian Labetzsch

What are security tokens?

Security tokens are issued as Security Token Offerings (STOs) and are equipped with security-related features. With the help of security tokens, real assets can be converted into digital tokens. This process is called “tokenization”. In this manner, it is possible to transform tradable financial instruments such as stocks or profit-participation certificates into digital assets on the blockchain. In the future, this will happen in a dematerialized fashion without a certificate or commercial register entry.

Upon placement at the primary market, investors can easily come from anywhere in the world as long as Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) rules are followed. Besides, payments back to security holders such as dividend payments can be automatically processed via the underlying smart contracts. Thus, security tokens represent an improvement to classical securities as stocks or profit-participation certificates. Furthermore, STOs have the potential to challenge the traditional emission of equity via Initial Public Offerings (IPOs).

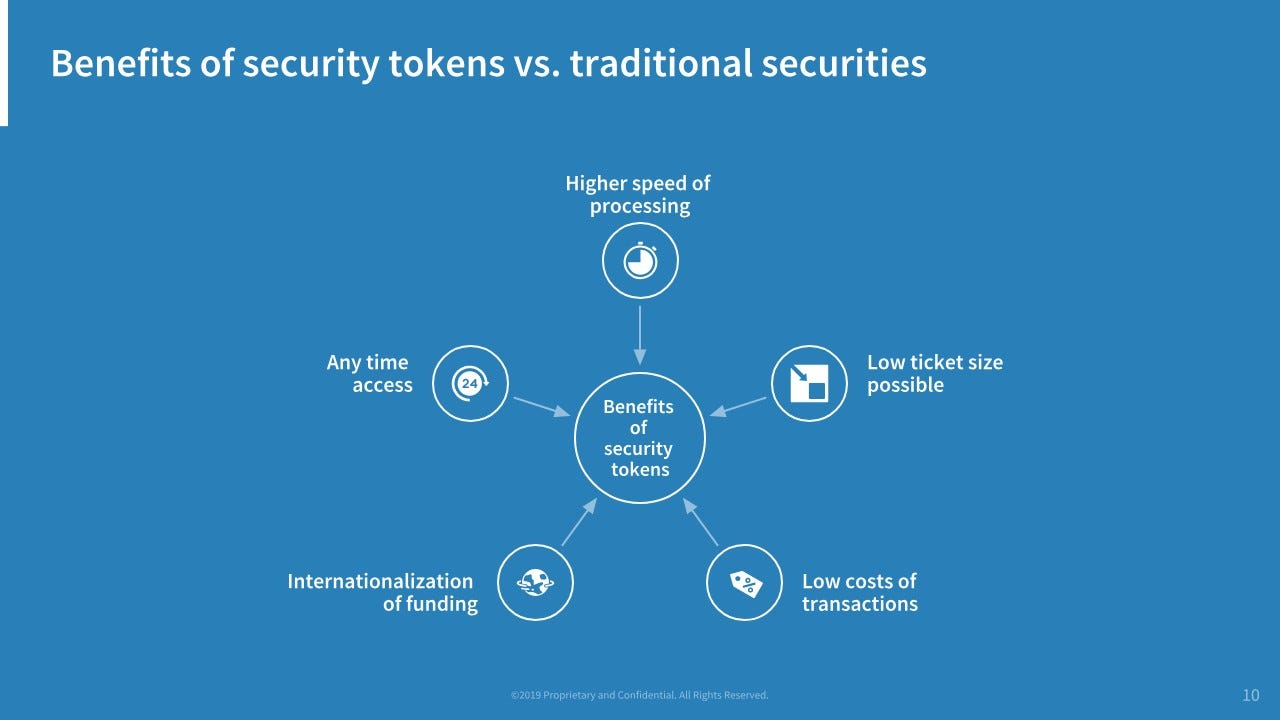

Benefits of security tokens

But what exactly are the advantages of security tokens compared to classical securities? Typically, small and medium-sized enterprises (SMEs) are not able to use stock issuances as a source of funding due to its high costs. However, thanks to STOs the issuing costs could be remarkably reduced. This is due to the fact, that expenses related to the realization of the issuance would become reluctant.

Moreover, digital assets could in the future be traded at any time — and very cost efficiently. This constitutes another significant advantage compared to the traditional security business. Furthermore, the collection of money could potentially become more international. Therefore, it would get easier for international investors to participate in the emission process.

STOs arose from the so-called Initial Coin Offerings (ICOs). In 2017 and 2018, more than 10bn USD have been invested in startups via ICOs. During this time, mainly utility tokens have been issued where the investor has received a claim on future products or services. However, also fraudulent ICOs attracted attention.

Now that the first ICO hype is over, regulatory bodies in many countries have taken action or are in the process of taking action. The main distinction between utility and security tokens is that security tokens are legally accepted capital market vehicles combined with payments on the blockchain. In 2019, this will probably be the Ethereum blockchain since it has a proven track record.

How to trade security tokens

So far, it was not possible for startups to issue and trade security tokens. However, in 2019 this situation has changed. Already at the beginning of this year, the first crypto exchanges have started to offer services related to security tokens (e.g. custody, listing, due diligence). Additionally, regulated stock exchanges as the Stuttgart Stock Exchange seek to begin the trading of security tokens later this year. Also, stock exchanges in Malta or Liechtenstein aim at offering STOs within the next few months.

Accordingly, in the nearer future, digital assets are expected to be issuable and tradable according to Maltese and Liechtenstein laws. It can be seen that STOs are supposed to offer a new form of financing. And the trend will continue: More exchanges have already announced to engage in security token-related services by the end of this year. Simultaneously, myriads of startups are recently planning their own STOs.

At the moment, plenty of interesting activities with regard to security tokens have been initiated in Europe. Examples are the projects Azhos and Eco Wave Coin. Azhos is a startup in the field of supply chain financing. In close cooperation with the medium-sized company Orbit Logistics, a blockchain-based “Proof of Existence“ of speciality chemicals in the warehouses of industrial concerns optimizes the liquidity of involved companies.

Another innovative project is the Tel Aviv-based company Eco Wave Power. The startup is engaged in the field of renewable energies by planning and developing worldwide wave energy projects. One facility already in operation, is a power plant on the coast of Gibraltar, which was subsidized by the EU European Regional Development Fund. With help of the security token Eco Wave Coin, which is issued according to Gibraltar law, other energy-related projects should be financed.

Open questions

However, a few challenges have to be kept in mind. Examples are the security prospectus, the design of the regulatory KYC requirements and also of the smart contracts. A technology platform is necessary, which enables a smooth onboarding process and supports plenty of jurisdictions. Digital providers for authentication are applied to ensure automatic processing as well as compliance with AML requirements. But if this is all done, ICOs — as STOs — can be in line with current capital market laws.

Conclusion

Fortunately, the first hype about blockchain and crypto currencies has vanished. Now, the focus lies on the productive development and usage of the blockchain technology for concrete use cases. So far, the blockchain technology has a diffusion of less than one percent. Nevertheless, the technology will gain full acceptance within the next 10–15 years with respect to various kinds of financial transactions.

Security tokens are an essential innovation to challenge the security emission and financing for startups. Due to an increasing number of exchanges, which offer security token-related services, the supply and the professionalization will climb continuously. In the upcoming weeks, one can observe how STOs will become reality.

Disclaimer

Frankfurt School Blockchain Center has consulted

Prof.

Jonas Groß is a research assistant of the Frankfurt School Blockchain Center (FSBC). His fields of interests are primarily security tokens. Besides, in the context of his

Christoph Impekoven and Christian Labetzsch are founders and managing directors of Blocksize Capital located in Frankfurt. You can contact them via email ([email protected]) or LinkedIn. Blocksize Capital is a Frankfurt-based service provider specializing in crypto assets established in 2018 by the experienced Fintech founders Christian Labetzsch and Christoph Impekoven. With its four-member management team, Blocksize Capital provides infrastructure for the bank and retail customers on the buy side as well as services in the primary market business for security tokens. Today, several institutional clients use the startup’s trading infrastructure, which is specifically designed for crypto assets.

More Articles:

Mauritius issues guidance notes on security tokens

Max Property Group Crowdfunds Crowdfunding Platform With Security Tokens