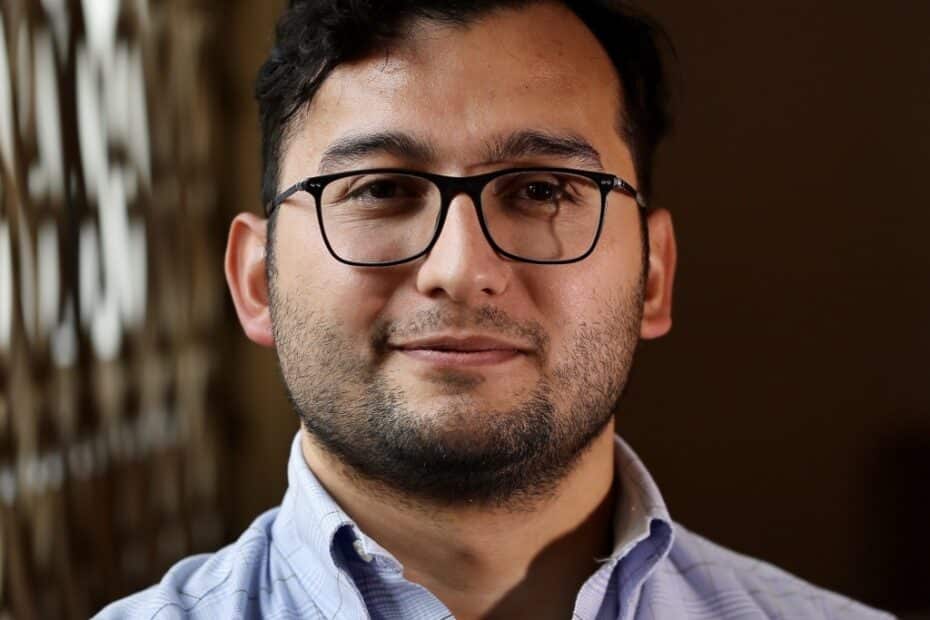

In this interview, Jose J. Perez Aguinaga, the Head of Digital Custody Services at SEBA Bank AG, explains what an NFT custody service is and why it is important for developing the NFT ecosystem.

Jonas Kasper Jensen (JKJ): What is SEBA Bank, and how do you integrate NFTs into your services?

Jose J. Perez Aguinaga (JJPA): SEBA bank is a digital asset-qualified custodian bank. We offer our customers multiple financial services and products, ranging from financial institutions and qualified investors to different enterprises and funds. We are a FINMA-regulated bank that is registered in Switzerland. SEBA can host 16 tokens, many of them on the Ethereum network, as well as nearly all G20 fiat currencies.

We recently launched a new NFT custody service. That means that clients can keep their NFTs within our bank service, and as a result, they can have a place to ensure that their NFTs are safe and not exposed to any other digital assets. Another benefit of hosting your NFTs within SEBA bank is that you will have direct contact with a relationship manager. If you need any help, either executing a trade or transferring or inheriting an NFT, a dedicated relationship manager can help you with any of these transactions.

JKJ: Can you explain how the custodian product works, for example, what kind of NFTs will you take into custody and who can use the service?

JJPA: Right now, we only provide custody for NFTs that we consider blue chip NFTs. That is NFT projects like Crypto Punks, Bored Apes, Azuki and CloneX. That doesn’t mean we will only host blue-chip NFTs in the future, but it’s a good first qualifier. Another point is that we cannot just take a customer’s NFT. We need to go through a process internally for compliance purposes, such as a KYC process. Because of our NFT mandate by FINMA, we also must ensure that the NFT has not been tainted by any funds that have come from misused or misappropriated sources. If the NFT manages to pass these steps, we do an internal business approval round. When all these steps have been completed, we proceed with the process to custody the NFT. Then, the bank gives the customer a wallet address. Right now, we only support the ERC-721 standard with an Ethereum address. When the customer has the address, then they can transfer the NFT.

SEBAs solution is made to secure that we have vetted the NFT in multiple ways because we want to make sure that the NFTs our clients are holding within the bank are as valuable in years to come as they are today, from a custody perspective, that is. something as valuable years down the road as it is today.

JKJ: Who are the clients that are using this service?

JJPA: We already have some clients. The most typical client is the ultra-high net worth individual that has acquired a range of NFTs, which have grown to the point that they are no longer comfortable holding in a hardware wallet or their proprietary solution. Within SEBA, we are, of course, advocates of self-custody when it makes sense. Still, for some amounts of money and particularly underlying assets that have considerable value, clients feel more at ease when another entity, in this case, a regulated custodian, takes care of the assets. So, the first use case for our custody solution is that we have been approached by high-net-worth individuals and crypto-native persons who are very qualified and technical and know the technology very well. Still, they want to avoid holding the burden of self-custody with a seven or eight-figures NFT collection under their belt.

We have been approached by a mix of funds and individuals wanting to create an index fund that either track NFTs or wants to put together a collection of NFTs and offer it as a product. On top of that, because we are a qualified investor, we can hold the custody of the assets on behalf of a fund or any other legal institution as long as they pass through our compliance and regulatory processes. If the funds are accepted, then the clients can generate derivatives and structure products on top of that.

And finally, we have seen family offices relying on us for support and guidance. They are often entering the market for the first time, and they want to have a position in the market of alternative investments because they’re always looking to diversify their portfolio to have some exposure.

JKJ: Why is it relevant for SEBA to offer an NFT custody service to your customers?

JJPA: NFTs are interesting to us because of two reasons. First, we want exposure to the general community of artists, creators, and builders in different capacities. We are strong believers in the web3 ecosystem. We don’t want to be only seen as a quote-unquote boring bank, but instead, we want to be spearheading the discussion on the crypto asset ecosystem.

We can provide a range of security services and confidence to our clients, which is what we want to bring to the ecosystem. We want to show that we are aware that there are still many challenges in the web3 ecosystem and that we are here to push the conversation forward and provide a layer of confidence with a reliable source of custody and financial assistance for web3. So, the first reason to create an NFT custody solution is exposure. We also want to expand our business model.

We see that there are exciting avenues for business in the NFT ecosystem. Right now, we only offer custody of NFTs. But we have the ambition that there will be other services that we will be able to offer in the future. In the future, I can envision that the bank itself may launch loans against an NFT, which could be a unique product that hasn’t been seen in the market yet. For us, it’s important to be eager participants involved early and not only spectators.

JKJ: As a bank, you are closely related to the regulated environment. Do you have any thoughts on the regulation of NFTs?

JJPA: I think the very unfortunate reality is, as of today, the NFT ecosystem is still exposed to multiple bad actors that are trying to exploit the technology. This includes using NFTs for money laundering, using Twitter to do quick NFT pump-and-dump schemes and doing rug pulls. I also think it is expected that, based on the nature of some NFT projects, some of them will fall into the realm of securities. I think many NFT projects are using the technology to do a kind of ICO 2.0. The SEC and other regulatory organisations are paying a lot of attention to this. We often underestimate how well regulators and auditors within the industry understand the space. At least within Switzerland, many agents and government officials are well-informed. I think all these projects will eventually face a stonewall as they cannot operate with proper KYC and AML. At the same time, if a project falls into the category of being a security and is just looking to achieve that category, that should not be a problem in the future if they comply with the conditions required to issue a security.

Read other stories: Dartroom and Shufl selects Alty to deliver chat functions of their NFT marketplaces

Obilum Art, Spain’s first curated digital art platform, is born